Tungsten Prices Stable Amid Cost Support and Weak Demand

- Details

- Category: Tungsten's News

- Published on Monday, 17 March 2025 18:44

Analysis of latest tungsten market from Chinatungsten Online

On Monday, the tungsten prices remained stable, but the market inquiry and transaction atmosphere are still under pressure. The sluggish demand side has led to slow inventory digestion in the mid-to-downstream sectors of the industry chain; however, with rigid cost support from the mining end, there is limited room for the price to continue declining.

Recently, the tungsten market has exhibited cautious sentiment, with trading primarily driven by demand. Prices are holding steady, as market participants await updates on long-term contract news from companies.

The price of 65% black tungsten concentrate remains at $19,718.3/ton. Resources at the mining end are limited, downstream demand is mainly for replenishment, market liquidity is constrained, and the market remains in a stalemate.

The price of ammonium paratungstate (APT) fluctuates around $329.4/mtu. Negative oscillations from the demand side persist, keeping the market relatively sluggish, with the transaction center remaining weak.

Tungsten powder is priced at $43.9/kg, while tungsten carbide powder is reported at $43.2/kg. Market feedback on orders is unfavorable, and companies show low enthusiasm for transactions, resulting in a stable market with a wait-and-see attitude.

The price of 70% ferro tungsten stands at approximately $30,422.5/ton, with market fluctuations tied to the performance of raw tungsten ore and steel mill demand. Recently, there has been significant bargaining in the market, though transactions remain largely stable.

The price of tungsten waste and scrap is weak yet stable, with considerable bargaining due to a lack of demand highlights, and the overall market continues to operate under pressure.

On the macroeconomic front, data from the central bank indicates that the broad money supply (M2) balance grew by 7% year-on-year at the end of February. The increment in total social financing rose by an additional 1.32 trillion yuan compared to the previous year, and RMB loans increased by 5.87 trillion yuan. This suggests that monetary policy continues to support the real economy, with sectors such as infrastructure and manufacturing potentially receiving increased credit allocation. As a key industrial raw material, tungsten’s demand is closely tied to industrial investment. If capital inflows drive industrial capacity expansion or technological upgrades, this could provide some short-term support for tungsten demand. However, the narrow money (M1) growth rate is only 0.1% year-on-year, reflecting low activity in corporate current funds, which may limit the potential for explosive short-term demand growth. Overall, the tungsten market is likely to maintain a balanced supply and demand pattern, with prices possibly experiencing mild fluctuations in response to marginal improvements in industrial investment. Continued observation of credit fund flows and the pace of global economic recovery is necessary.

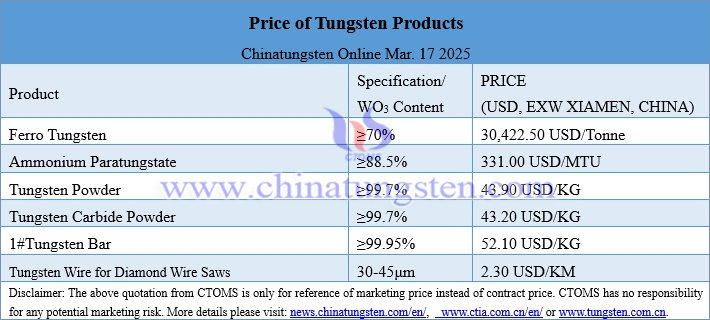

Prices of tungsten products on March 17, 2025

Picture of tungsten alloy rings

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com