Tungsten Waste and Scrap Market Sees Rapid Sell-Off - September 17, 2025

- Details

- Category: Tungsten's News

- Published on Wednesday, 17 September 2025 16:46

Analysis of Latest Tungsten Market from Chinatungsten Online

The tungsten market is operating under pressure, with a relatively relaxed supply-demand balance.

Tungsten raw material prices are showing a slow downward trend, reflecting a rational trading mentality among market participants based on the natural correction of supply and demand. Tungsten scrap prices have fallen significantly, driven by panic cashing out by holders and price pressure from consignees. Overall, there is a certain misalignment between buyers and sellers, resulting in limited trading enthusiasm and cautious, demand-driven negotiations.

In the tungsten concentrate market, supply is temporarily easing, while demand has not seen significant growth, leading to a cooling of overall market sentiment.

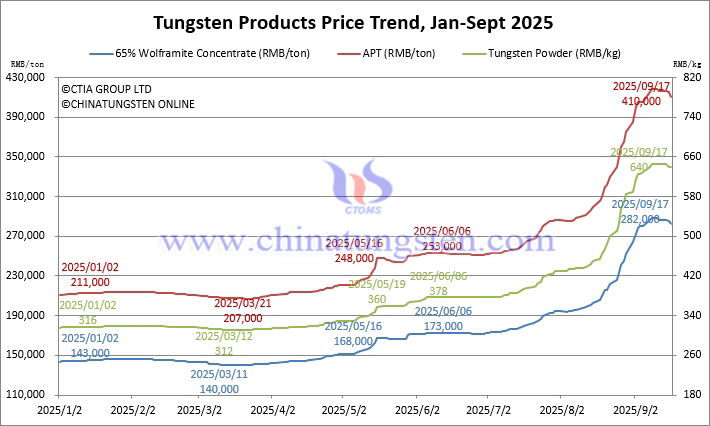

The price of 65% wolframite concentrate was reported at RMB 282,000/ton, down 2.1% from its peak and up 97.2% from the beginning of the year.

The price of 65% scheelite concentrate was reported at RMB 281,000/ton, down 2.1% from its peak and up 97.9% from the beginning of the year.

In the ammonium paratungstate (APT) market, transactions were primarily executed in long-term contracts, with limited single-digit trading. Due to the easing of costs, market room for negotiation has expanded.

Domestic APT prices were reported at RMB 410,000/ton, down 1.9% from their peak and up 94.3% from the beginning of the year.

European APT prices were reported at USD 550-645/mtu (equivalent to RMB 347,000-407,000/ton), up 81.1% from the beginning of the year.

In the tungsten powder market, the industry chain deadlock remains unresolved, market trading activity is lacking, suppliers are temporarily stabilizing their prices, and downstream end-users are purchasing slowly, resulting in a stagnant market.

Tungsten powder prices were reported at RMB 640/kg, down 0.8% from their peak and up 102.5% from the beginning of the year.

Tungsten carbide powder prices were reported at RMB 625/kg, down 0.8% from their peak and up 101% from the beginning of the year.

In the ferrotungsten market, overall prices remained stable, with some high prices declining as raw materials prices fell.

70 ferrotungsten prices were reported at RMB 408,000/ton, down 0.5% from their peak and up 89.8% from the beginning of the year.

The European ferrotungsten price is USD 82-83.1/kg W (equivalent to RMB 409,000-414,000/ton), up 87.6% from the beginning of the year.

The tungsten waste and scrap market are generally under pressure from both sentiment and fundamentals, with a strong short-term bearish outlook. Some recyclers have temporarily suspended purchases due to funding pressures and risk aversion.

The price of scrap tungsten bars is RMB 400/kg, down 10.1% from its peak and up 81.8% from the beginning of the year.

The price of scrap tungsten drill bits is RMB 390/kg, down 14.3% from its peak and up 71.1% from the beginning of the year.

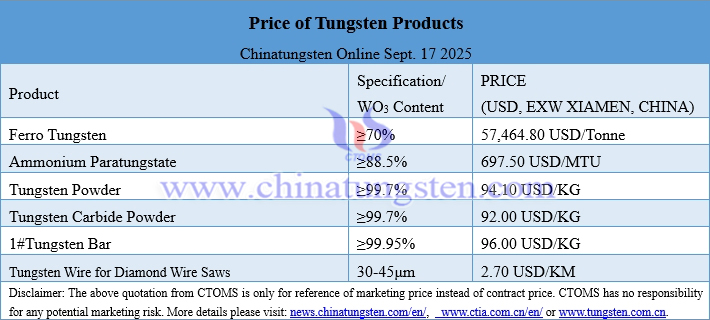

Prices of Tungsten Products on September 17, 2025

Tungsten Price Trend from January to September 17, 2025

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com