Molybdenum Market - July 25, 2025

- Details

- Category: Tungsten's News

- Published on Friday, 25 July 2025 15:20

Molybdenum market update on July 25, 2025

This week, domestic molybdenum market exhibited a pattern of initial suppression followed by a rebound. At the beginning of the week, the market entered an adjustment phase after a rapid price increase, compounded by declining steel mill tender prices and low downstream procurement inquiry activity, prompting suppliers to slightly lower quotations to facilitate transactions.

Toward the weekend, influenced by major molybdenum mining companies raising their molybdenum concentrate sales prices, other suppliers’ confidence in price increases strengthened. Additionally, a sudden accident at a copper-molybdenum mine in Inner Mongolia raised market concerns about molybdenum supply stability, collectively driving molybdenum prices to halt their decline and rebound.

This week, molybdenum prices reached a new annual peak, with molybdenum concentrate prices rising to approximately 4,080 yuan per ton-unit, an increase of 60 yuan and a rise of 1.49% from the previous high; ferromolybdenum prices rose to around 265,000 yuan per ton, an increase of 9,000 yuan and a rise of 3.52% from the previous high; molybdenum oxide prices increased to about 4,210 yuan per ton-unit, an increase of 60 yuan and a rise of 1.45% from the previous high; and ammonium heptamolybdate prices rose to approximately 254,000 yuan per ton, an increase of 6,000 yuan and a rise of 2.42% from the previous high.

According to CTIA GROUP LTD statistics, this week, molybdenum concentrate prices increased by approximately 80 yuan per ton-unit, a rise of 2.00%; ferromolybdenum prices increased by approximately 11,000 yuan per ton, a rise of 4.33%; molybdenum oxide prices increased by approximately 80 yuan per ton-unit, a rise of 1.94%; sodium molybdate prices increased by approximately 4,000 yuan per ton, a rise of 2.17%; ammonium heptamolybdate prices increased by approximately 2,000 yuan per ton, a rise of 0.81%; and molybdenum powder prices increased by approximately 7 yuan per kilogram, a rise of 1.56%. This indicates that the price increases for molybdenum products this week outweighed the decreases.

In terms of news, data from the China Iron and Steel Association shows that in mid-July 2025, the steel inventory of key statistical steel enterprises reached 15.66 million tons, increased by 580,000 tons from the previous ten-day period, a growth of 3.9%; increased by -3.29 million tons compared to the beginning of the year, a growth of 26.6%; decreased by -550,000 tons compared to the same ten-day period last month, a decline of -3.4%; decreased by 640,000 tons compared to the same period last year, a decline of 3.9%; and decreased by 10,000 tons compared to the same period two years ago, a decline of 0.1%. By region, steel inventories in Northeast China increased by 210,000 tons, East China increased by 200,000 tons, Northwest China increased by 20,000 tons, Central-South China increased by 270,000 tons, North China decreased by 50,000 tons, and Southwest China decreased by 60,000 tons.

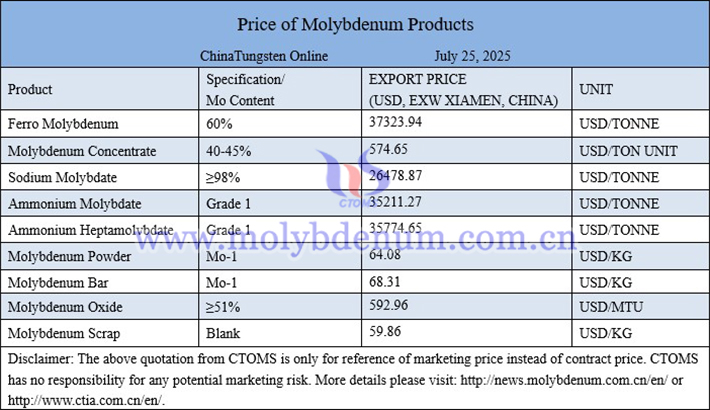

Price of molybdenum products on July 25, 2025

Molybdenum copper sheet picture

Follow our WeChat to know the latest tungsten price, information and market analysis.

| Molybdenum Supplier: Chinatungsten Online www.molybdenum.com.cn | Tel.: 86 592 5129595/5129696 Email:sales@chinatungsten.com |

| Tungsten News & Prices: Chinatungsten Online news.chinatungsten.com | Molybdenum News & Molybdenum Price: news.molybdenum.com.cn |

sales@chinatungsten.com

sales@chinatungsten.com