Surging 30%, Tungsten Ore Price Reaches RMB 190,000!

- Details

- Category: Tungsten's News

- Published on Friday, 25 July 2025 16:29

Analysis of Latest Tungsten Market from Chinatungsten Online

Tungsten prices rose strongly this week.

The main support for the market comes from the continued tight supply of tungsten concentrate, due to the summer weather characteristics and natural conditions in the mining area, policy regulation and market sentiment, international geopolitical and economic environment, and sudden regional conflicts. Cost pressure is transmitted to the middle and downstream industrial chain step by step. The price of major tungsten raw materials rose by about 5% week-on-week, and cemented carbide companies were forced to issue price increase letters again. However, the acceptance of downstream end users is limited, the gap in raw material supply is difficult to fill, and demand is also weak, and the market transaction is sluggish.

As of press time,

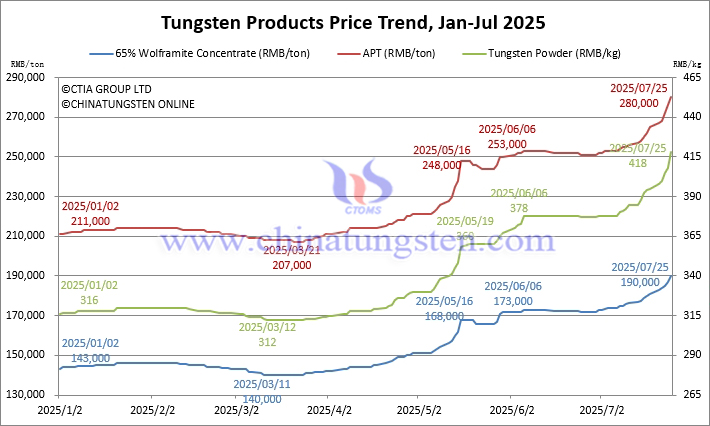

65% wolframite concentrate is quoted at RMB 190,000/ton, up 5.0% week-on-week and 32.9% from the beginning of the year.

65% scheelite concentrate is quoted at RMB 189,000/ton, up 5.0% week-on-week and 33.1% from the beginning of the year.

Tungsten ore holders are reluctant to sell, pushing prices to new highs.

Ammonium paratungstate (APT) is quoted at RMB 280,000/ton, up 5.7% week-on-week and 32.7% from the beginning of the year.

The European APT price is USD 460-485/ton (equivalent to RMB 292,000-308,000/ton), which is flat week-on-week and up 43.2% from the beginning of the year.

The profit margins of domestic tungsten smelting enterprises are under pressure, and the market is in a deadlock of "price without market".

Tungsten powder is quoted at RMB 418/kg, up 5.8% week-on-week and up 32.3% from the beginning of the year.

Tungsten carbide powder is quoted at RMB 408/kg, up 6.0% week-on-week and up 31.2% from the beginning of the year.

The tungsten powder market is in a game period of high cost and weak consumption, and trading is not smooth.

Since late March, the cost of tungsten raw materials has soared by more than 30%, and the price of cemented carbide products has been passively adjusted 2-4 times, with a cumulative increase of about 30%. Downstream users replenish inventory on demand, and market orders are cold.

70 ferrotungsten is quoted at RMB 285,000/ton, up 7.1% week-on-week and up 32.6% from the beginning of the year.

European ferrotungsten prices are reported at USD 54.5-59.6/kg W (equivalent to RMB 273,000-299,000/ton), up 7.6% week-on-week and 29.7% from the beginning of the year.

Tungsten raw material cost drive is strong, domestic "anti-involution" and large-scale infrastructure projects have boosted steel market sentiment, and ferrotungsten prices have strengthened.

Scrap tungsten rods are quoted at 320/kg, up 13.5% week-on-week and 45.5% from the beginning of the year.

The tungsten scrap market has a coexistence of bullish and profit-taking mentality, and resource release and liquidity have increased.

Prices of Tungsten Products on July 25, 2025

Tungsten Price Trend from January to July 25, 2025

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com