Is It Normal for Tungsten Prices to Remain High?

- Details

- Category: Tungsten's News

- Published on Thursday, 24 July 2025 15:09

Analysis of Latest Tungsten Market from Chinatungsten Online

▏ Current Situation of Tungsten Price:

The price of tungsten raw materials continues to rise. Due to the reluctance to sell and the high price of tungsten ore, the overall tungsten market maintains an upward trend driven by costs. The price of tungsten waste and scrap fluctuates, some of which maintain a strong attitude, and some traders cash in profits, and the market price difference has widened.

As of press time,

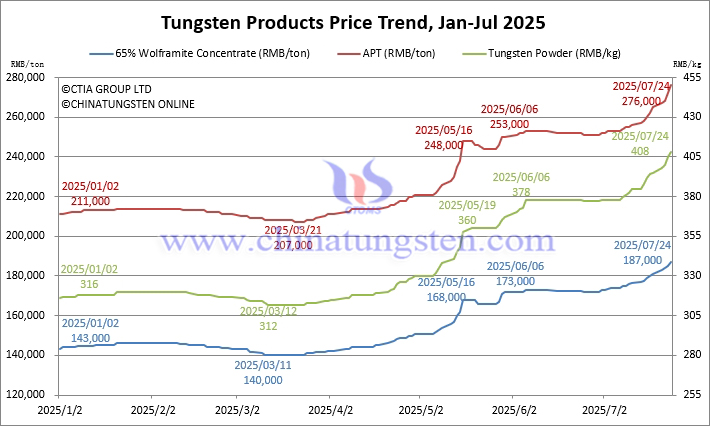

65% black tungsten concentrate is quoted at RMB 187,000/ton, up 30.8% from the beginning of the year.

65% scheelite concentrate is quoted at RMB 186,000/ton, up 31.0% from the beginning of the year.

Ammonium paratungstate (APT) is quoted at RMB 276,000/ton, up 30.8% from the beginning of the year.

Tungsten powder is quoted at RMB 408/kg, up 29.1% from the beginning of the year.

Tungsten carbide powder is quoted at RMB 398/kg, up 28.0% from the beginning of the year.

70 ferrotungsten is quoted at RMB 278,000/ton, up 29.3% from the beginning of the year.

The price of scrap tungsten rods is RMB 315/kg, up 43.2% from the beginning of the year.

▏Is It Normal for Tungsten Prices to Remain High?

The sharp rise in tungsten prices this year is the result of multiple factors such as supply and demand game, policy regulation, geopolitical factors, and market sentiment. Although the rapid increase in raw material prices has caused operating pressure on tungsten smelting and cemented carbide companies in the short term, in the long run it is in line with its value as China's advantageous strategic resources and important key minerals. However, due to the relatively lagging acceptance of consumers, the cost transmission mechanism of the tungsten industry chain needs to be further unblocked. Therefore, we believe that the current high tungsten prices are normal, mainly for the following reasons:

(1) Recently, China has frequently taken actions to target involutionary competition. On July 1, the Sixth Meeting of the Central Financial and Economic Commission emphasized the need to govern low-price disorderly competition among enterprises in accordance with laws and regulations; on July 16, the State Council Executive Meeting heard a report on the regulation of the competition order in the new energy vehicle industry; on July 18, the Ministry of Industry and Information Technology and other departments held a symposium on the new energy vehicle industry to deploy further regulation of the competition order in the new energy vehicle industry; on the same day, the State Administration for Industry and Commerce interviewed food delivery platform companies to further regulate promotional activities and rationally participate in competition.

(2) Under the current macroeconomic situation, it is understandable that China's tungsten industry chain, which is dominated by several state-owned enterprises, will release certain products and market space to ensure the stable operation of the industry chain in the early stage of high prices. However, if the market is impacted by large-scale sales, the market will be unbalanced and out of control, which will not be worth the loss and will violate the current national policies. Therefore, the stable operation of the tungsten market at a high level has strong macroeconomic policy support.

(3) On the other hand, in the international market structure, China has just opened up the export license of tungsten products to Europe and the United States to a certain extent. It is the time when export enterprises and international market customers are fiercely competing with each other on the execution of previous contracts and future market pricing. If the price goes down, Chinese export enterprises will face extremely unfavorable bargaining disadvantages. Therefore, maintaining stability is also a top priority.

(4) Furthermore, the tungsten product market is a volume-price exchange, and the two-way flow is goods and funds. We believe that the current larger tungsten resource holders, especially the major listed companies, do not lack funds and financing capabilities and channels, and the profits of upstream tungsten resources after the price increase are sufficient to make up for the financing costs. Therefore, the market's momentum for obtaining liquidity by exchanging price for volume is not strong. At present, there is a partial callback of scrap tungsten to recover funds, which shows that the scrap market is mainly operated by small and scattered entities with relatively weak financial capabilities.

How will the tungsten market develop in the future? We are waiting for you in the comment area. Please leave your comments. We will fully adopt constructive views in the subsequent WeChat public account content.

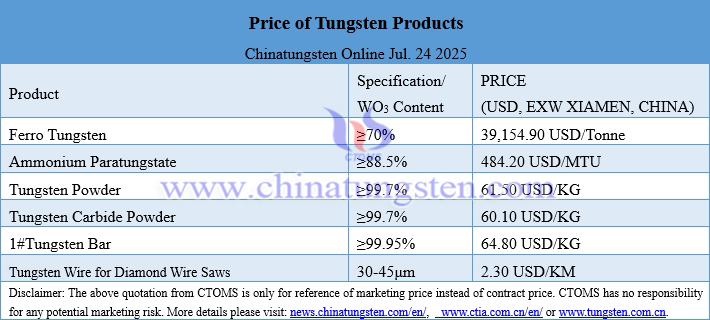

Prices of Tungsten Products on July 24, 2025

Tungsten Price Trend from January to July 24, 2025

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com