Tungsten Prices Keep Hitting New Highs: Exercise Caution

- Details

- Category: Tungsten's News

- Published on Friday, 30 May 2025 16:14

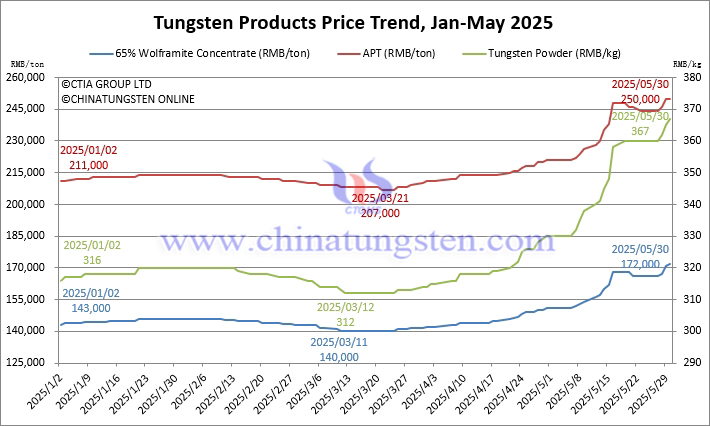

In May 2025, the Chinese tungsten market experienced an overall upward trend, with tungsten concentrate and ammonium paratungstate (APT) prices repeatedly reaching new historical highs.

According to a survey by Chinatungsten Online, as of May 30, the market price for 65% black tungsten concentrate was 172,000 RMB per standard ton, up 20.3% from the beginning of the year. The average price for May was 162,600 RMB per standard ton, reflecting an 11.68% increase month-on-month and a 6.34% increase year-on-year. APT was quoted at 250,000 RMB per ton, an 18.5% rise from the start of the year, with an average May price of 239,000 RMB per ton, up 11.02% month-on-month and 5.48% year-on-year.

Given the current high-price pressure in the tungsten market, Chinatungsten Online, in conjunction with several industry experts' analyses of market sentiment and various perspectives on future supply and demand, presents the following insights for your reference and welcomes your feedback.

I. Reasons for the Rise in Tungsten Prices

Chinatungsten Online believes that the sharp rise in tungsten product prices in May was mainly due to the market's unexpected profit sentiment based on the strategic reconstruction of tungsten resources and the rediscovery of relative value. The driving force of basic demand is limited, mainly reflected in the following aspects:

1.1 Resource development and supply contraction

Due to the decline in the grade of mining resources, the quality of recycled raw materials is limited; the quota for raw ore mining has been reduced and environmental protection supervision has been strengthened; and the competition for key minerals or basic raw materials among international and domestic market players has intensified.

1.2 Emerging Demand in the Short and Long Term

In recent years, new demand for tungsten products, exemplified by photovoltaic tungsten wire, has emerged in various fields such as renewable energy batteries, smart buildings, electronic information, low-altitude economy, deep-sea exploration, and nuclear fusion. This new demand has not only expanded the application areas of tungsten products but also transformed the tungsten industry ecosystem, thereby increasing the value and price of tungsten raw materials.

1.3 Speculative Sentiment and Holding for Higher Prices

The closed loop of any industry chain requires corresponding capital and credit support. The sharp rise in tungsten product prices in the short term necessitates an equal proportion of new capital to sustain it. Therefore, it can be inferred that the recent surge in tungsten prices is partly driven by speculative capital, leading to a strong sentiment among holders to withhold supply and wait for higher prices. The high international tungsten prices, as a habitual reference point, provide a pricing benchmark for the strategic value of tungsten resources.

II. Risk Warning for the Tungsten Market

The tide rises and falls, it's natural! The law of the market is always switching between high and low, but some are man-made, and most are planned and guided by the invisible hand of the market. For the tungsten products that have risen by more than 20% in two months, with an average increase of about 0.5% per working day, can we learn from the words of the stock god and kindly remind us: sell when the market is greedy, and buy when the market is sluggish. Because we believe that there are major explicit risks in the current market as follows:

2.1 Imbalances in Domestic and International Supply and Demand

The gap in foreign demand will gradually be filled by new mineral production capacity and high recovery and high purification capabilities outside China. Traditional domestic demand is suppressed by the macro-economy, and major related industries are still in a downward trend. The demand growth trend in emerging fields is not as fast as the upward slope of prices, and may even follow a downward curve.

2.2 Exchange Rate and Export Revenue Challenges

The restriction on China's tungsten product exports immediately caused a sharp rise in the price of tungsten products in the international market, which shows that the global demand for tungsten resources is heavily dependent on my country, and also shows the degree of dependence of my country's major tungsten product processing companies on the international tungsten market. As a result, the export business volume with higher and more stable profits was restricted, and foreign exchange income decreased. In addition, the RMB appreciated significantly during the same period, from around 7.3 to a high of 7.17, forming a scissors gap with the reduction in US dollar income. Corporate profits are currently at this scissors mouth.

2.3 Stricter Policy and Regulatory Scrutiny

China has stepped up its export control efforts. For any export order, not only must the information be clearly stated, but also the final customer and final use must be thoroughly checked to protect my country's advantageous resources and assume international non-proliferation obligations. This move can limit and precisely control the flow of resources, precisely control the direction of resource flows, and jointly promote the rise of resource prices, achieving three goals at one stroke.

2.4 Speculative Psychology and Cost Burdens Reaching Limits

If the rising prices in the short term cannot be smoothly transmitted to the end of the industrial chain, or the end is controlled and cut off as mentioned above, the price and cost transmission mechanism will be broken, the transmission pipeline will be limited, and the downstream bearing capacity and the psychological limit of the intermediate holders will be close to the critical point.

2.5 Emerging Substitutes and New Applications

New technologies and materials may create "black swan" events in the industry. For example, the potential of photovoltaic tungsten wire, heavily invested in by tungsten and photovoltaic companies in recent years, has been affected by the contraction of the photovoltaic industry, with prices halving. The current market structure of the photovoltaic industry may face significant disruption from the development of alternative materials.

III. Countermeasure Suggestions from Chinatungsten Online

Unfounded profits bring fleeting joy, while lack of insight leads to entrapment. Our analysis of market risks suggests that the current tungsten market is in a period of intense conflict between "emotion-driven" and "reality-verified" forces. Intermediate producers are struggling, facing difficulties in securing upstream resources and hesitancy in accepting high-priced downstream orders. The rapid short-term rise in tungsten raw material prices is supported solely by supply-side factors, lacking solid fundamental demand, and the hunger marketing-style price increase lacks sustainability and fit with the reasonable consumption basis, which will aggravate the tear between the pricing logic of upstream resource scarcity and the psychological sustainability of downstream demand.

On the occasion of the Dragon Boat Festival, Chinatungsten Online offers the following reminders:

3.1 Exercise Caution and Rationality

Recognize the speculative nature and risk accumulation behind the current rapid price increases. Avoid blindly chasing highs; instead, gradually release resources to realize profits and secure gains.

3.2 Establish Risk Management Mechanisms

Companies should maintain reasonable inventories of raw materials and finished products based on production and sales needs, avoiding excessive hoarding or large-scale short-term selling. Establish stable supply relationships and flexible pricing mechanisms with suppliers.

3.3 Facilitate Downstream Price Transmission

Move away from fast-consumption marketing models and short-term gimmicks. Focus on quality and build long-term, mutually beneficial relationships with customers. Establish a "long-term contract + transparent costs + dynamic pricing" model with long-term clients. Based on Chinatungsten Online's nearly 30 years of experience, price fluctuations can be determined by coefficients based on exchange rate fluctuations and raw material price changes at the time of contract execution. The RMB exchange rate can reference the People's Bank of China data on a specified date, and tungsten product prices can reference Chinatungsten Online's prices on a specified date. This creates a relatively fair pricing mechanism to jointly address market volatility and achieve stable production and sales cooperation.

3.4 Closely Monitor Policy and Market Dynamics

In an era of geopolitical tensions and fluctuating U.S. tariff policies, closely monitor domestic and international policy directions and market changes, including tungsten mining policies, export control adjustments, emerging sector demand shifts, and international political and economic situations. Adjust business strategies promptly and flexibly.

3.5 Follow the "chinatungsten" WeChat Official Account

We recommend that you, your clients, and friends follow the "chinatungsten" WeChat official account for free access to daily updated market prices and information, as well as objective and professional analyses.

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com