Molybdenum Market Update - March 25, 2025

- Details

- Category: Tungsten's News

- Published on Tuesday, 25 March 2025 19:28

Molybdenum market update on March 25, 2025

The domestic molybdenum market has shown an overall trend of stabilizing and halting its decline, with the interplay of bullish and bearish factors gradually shifting the consumer market from a buyer's market to a seller's market. This shift is mainly reflected in two key aspects: first, the supply of low-priced goods has tightened, and the phenomenon of low-price dumping in the market has decreased; second, market trading volume has increased, with a noticeable rise in transaction activity.

In the molybdenum concentrate market, the trading atmosphere has been moderate, with a recent increase in downstream inquiries injecting some vitality into the market. Additionally, molybdenum concentrate prices had previously undergone a downward cycle, during which suppliers' profit margins were squeezed. Based on cost considerations and expectations for future market trends, suppliers' willingness to sell at reduced prices has significantly decreased, thereby driving a price recovery.

In the ferromolybdenum market, conditions have gradually improved, with slight increases in steel procurement volumes and prices, coupled with stronger support from production costs, significantly boosting the confidence of intermediate smelting enterprises to raise prices. In the molybdenum chemical and product market, product prices have shown no significant fluctuations. Although the selling price of molybdenum raw materials has recently increased, the limited extent of the increase and the inability of terminal customer demand to grow effectively have led to a strong wait-and-see sentiment among holders, who mostly adopt a price stabilization strategy when quoting.

According to data from the China Iron and Steel Association, in mid-March, the social inventory of five major steel categories across 21 cities totaled 10.85 million tons, a decrease of 370,000 tons or 3.3% from the previous period, marking a shift from inventory growth to decline. Compared to the beginning of the year, it increased by 4.26 million tons, up 64.6%; compared to the same period last year, it decreased by 3.19 million tons, down 22.7%. During the same period, the social inventory of the five major steel categories all declined to varying degrees on a month-on-month basis, with hot-rolled coil seeing the largest reduction in volume and medium-thick plate showing the largest percentage drop. Year-on-year, all categories saw declines, with rebar recording the largest reduction in volume and wire rod showing the largest percentage decrease.

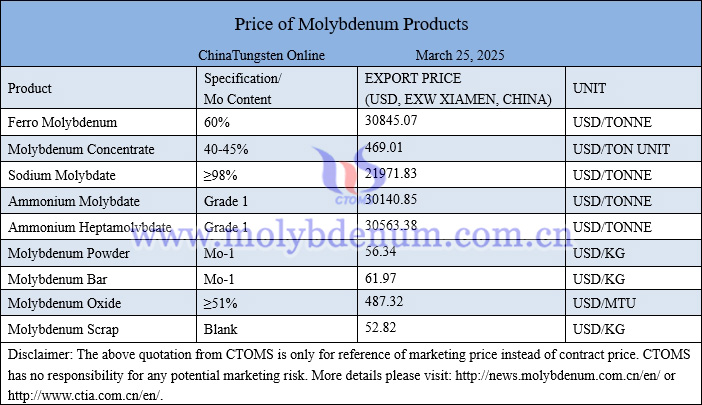

Price of molybdenum products on March 25, 2025

Molybdenum electrode picture

Follow our WeChat to know the latest tungsten price, information and market analysis.

| Molybdenum Supplier: Chinatungsten Online www.molybdenum.com.cn | Tel.: 86 592 5129595/5129696 Email:sales@chinatungsten.com |

| Tungsten News & Prices: Chinatungsten Online news.chinatungsten.com | Molybdenum News & Molybdenum Price: news.molybdenum.com.cn |

sales@chinatungsten.com

sales@chinatungsten.com