The Tungsten Market: Rising Costs, Tightening Supply, and Pressured Demand

- Details

- Category: Tungsten's News

- Published on Thursday, 15 August 2024 10:07

Analysis of latest tungsten market from Chinatungsten Online

Tungsten prices have remained stable, with the market fundamentals showing no significant changes.

The primary support for the market comes from adjustments in sentiment on the supply side, which has been somewhat transmitted downstream. However, traders remain uncertain, and the ongoing standoff between supply and demand has limited the momentum for a sustained price rebound, leading to cautious transactions based on need.

The price of 65% black tungsten concentrate is centered around $19,142.9/ton, reflecting firm market sentiment. The price of ammonium paratungstate (APT) is testing $322.8/mtu, though actual transactions face resistance. Tungsten powder prices are holding steady at $42,857.1/ton, while tungsten carbide powder prices are around $42,142.9/ton, with alloy companies cautiously replenishing stocks as needed. The price of 70% ferrotungsten remains at $29,571.4/ton, with market transactions driven primarily by just-in-time needs. The scrap tungsten market shows some price differences, with overall supply tightness supporting the market, though transactions remain limited.

On the cost side, there are expectations for future strengthening, including increased environmental costs such as tungsten slag treatment or high-salinity wastewater discharge requirements, rising food and energy prices due to frequent extreme weather events, and inflation in a loose monetary environment.

On the supply side, there is a clear trend toward tightening resources, mainly due to declining ore grades, increased resource concentration, expectations of strategic resource reserves, and the expansion of downstream capacities in tungsten chemicals, tungsten powders, and hard alloys, which will increase the consumption of raw tungsten ore, leading to tighter supply and higher prices. It should be noted that smelters and alloy companies may face more severe inventory pressures and cost inversion pressures. Additionally, attention should be paid to the development of overseas mines and the potential shift of production and demand overseas as China's labor cost advantage diminishes.

On the demand side, there are many uncertainties, particularly the complex and volatile international trade environment and extreme weather, which affect the global economic recovery and result in demand recovery lagging behind supply. Although domestic policies continue to provide positive support, which could help release potential terminal consumption in the future, the current off-season patterns and intense industry competition are suppressing consumer confidence and market stability. Furthermore, it is unclear whether the typical "golden September and silver October" demand recovery will materialize.

Prices of tungsten products on August 14, 2024

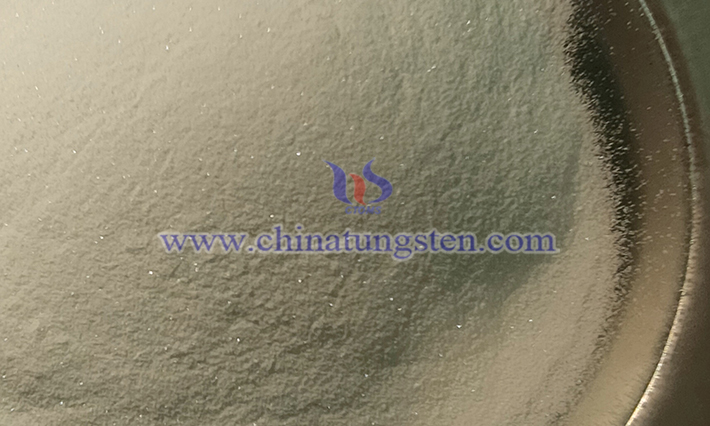

Picture of ammonium metatungstate

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com