Macro Overview of the Tungsten, Molybdenum, and Rare Earth Market

- Details

- Category: Tungsten's News

- Published on Sunday, 08 October 2023 15:10

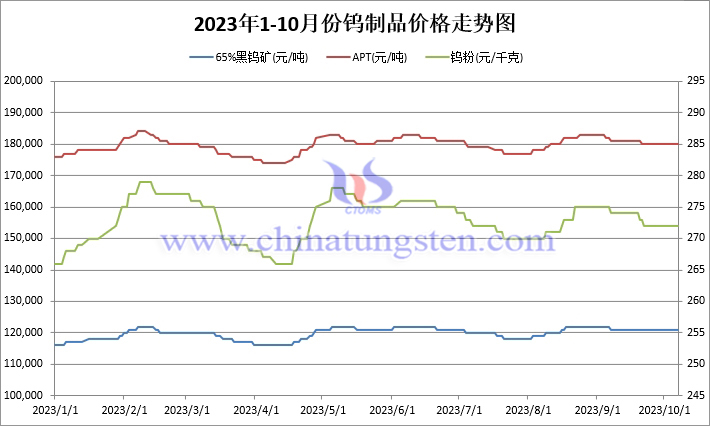

Analysis of latest tungsten market from Chinatungsten Online

Macro Overview of the Tungsten, Molybdenum, and Rare Earth Market During the Mid-Autumn Festival and National Day:

1.The U.S. interest rate hike will ultimately slow demand for tungsten, molybdenum, and rare earth products

In September, the U.S. non-farm payroll data showed an impressive increase of 336,000 jobs, far exceeding the market's expected 170,000. The yield on the 10-year U.S. Treasury bond reached 4.848%, while the 30-year bond yield surpassed 5%, marking its highest level since 2007. The U.S. dollar index has maintained levels above 106 in the morning, signaling heightened expectations of a U.S. interest rate hike. This is expected to accelerate capital inflow into the U.S. and may likely lead to a financial crisis within the next six months to a year, which has already put many emerging market countries, especially those in Central and South America, under severe financial stress. The U.S. dollar is widely recognized as the anchor for risk-free asset pricing, causing short-term commodities priced in U.S. dollars, such as oil, silver, and gold, to face increased downward pressure. Crude oil prices dropped from $95 to $82 per barrel, and gold saw a rare nine consecutive days of decline.

On the other hand, as a major producer and exporter of tungsten, molybdenum, and rare earths, China's commodities are ultimately priced in U.S. dollars. The strengthening of the U.S. dollar and the relative depreciation of the Chinese yuan favor the profitability of export products. However, negative market factors have significantly offset the positive effects of exchange rates. Demand from European and American markets, especially Germany, the UK, and France, has decreased. Additionally, there is an increasing trend in the use of recycled materials, reducing the demand for primary raw materials.

2.Commodity Sales Difficulties and Contraction in Hard Alloy Oil and Gas Development and Steel Production

In the bulk metal materials sector, the steel market has been affected by the sluggish demand in the real estate sector. Among the top 50 steel companies, 34 have seen a decline in revenue, and 36 have experienced a decline in profits, with more companies facing losses. Direct supply from steel mills has reached 17%, and it is expected to exceed 50% in the future. Intermediate steel trading is challenging, and many steel traders in Guangdong, Jiangxi, and Jiangsu have gone bankrupt. To worsen the situation, countries like Mexico, Brazil, Argentina, and India have imposed tariffs of over 25% on Chinese steel products.

3.Impact of Japan's Economic Recovery on the Tungsten, Molybdenum, and Rare Earth Industries

Looking globally, the Japanese Cabinet recently announced that Japan's domestic GDP for the second quarter of the year (April to June) grew by 1.5% compared to the previous quarter, translating to an annualized growth rate of 6.0%. This growth significantly exceeded market expectations. On October 6th, during the Asian market session, the USD/JPY exchange rate dropped to a low of 148.34, precisely touching the 20-day moving average support. Therefore, we need to closely monitor the devaluation of the yen in traditional tungsten, molybdenum, and rare earth-consuming countries like Japan, along with signs of manufacturing returning, rising employment rates, and economic recovery. At the same time, China's industries should be aware of the impact of Vietnam's tungsten and rare earth mining and significant lithium discoveries in the United States on the entire industry.

4.Short-term Forecast for the Tungsten, Molybdenum, and Rare Earth Market

Based on the current uneven political and economic changes in China and the United States, the 10th-anniversary summit of China's Belt and Road Initiative is yet to take place in October, and the U.S. OPEC meeting in November has not confirmed its attendance. The uncertainty surrounding whether the U.S. will raise interest rates and the ongoing dispute over the Speaker of the House are yet to be resolved. Taiwan's presidential election at the end of 2023 and the upcoming U.S. presidential election in 2024 will add to the uncertainty. Tungsten, molybdenum, rare earth, and other products will face a complex market situation driven by both market demand and geopolitical factors. In the short term, the trend is bearish, and prices are more likely to fall than rise, making it unwise to go long or hoard goods.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com