Tungsten Market Confidence Wavers - September 15, 2025

- Details

- Category: Tungsten's News

- Published on Monday, 15 September 2025 17:22

Analysis of Latest Tungsten Market from Chinatungsten Online

On Monday, the domestic tungsten raw material market was dominated by a wait-and-see approach to price stability, while the tungsten scrap market was relatively weak. Market sentiment diverged further, overall confidence was shaken, and high-price purchasing appetite further weakened. International tungsten prices remained firm due to unresolved supply chain issues.

The tungsten concentrate market showed a slight easing in supply, driven both by the gradual resumption of production at some mines and by increased profit-taking by traders. However, prior to the official release of annual mining targets, market expectations of tight resource supply remained dominant, and market adjustments were expected to be limited.

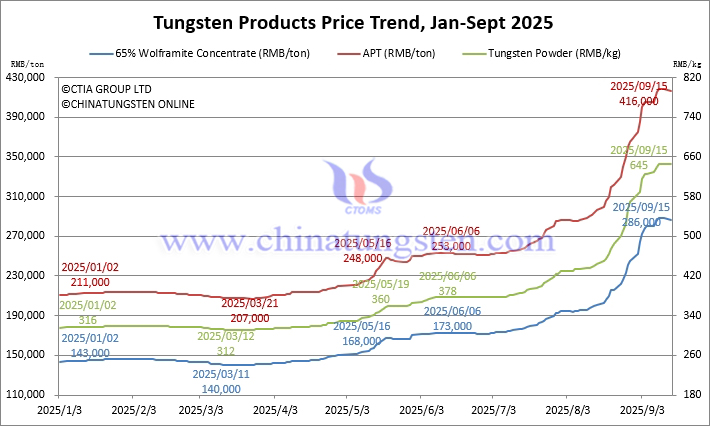

The price of 65% wolframite concentrate was reported at RMB 286,000/ton, a 100% increase from the beginning of the year.

The price of 65% scheelite concentrate was reported at RMB 285,000/ton, a 100.7% increase from the beginning of the year.

The ammonium paratungstate (APT) market continued its sideways trend, with cost support and downstream demand pressures balancing. Trading activity was low, and most traders remained on the sidelines.

Domestic APT prices are reported at RMB 416,000/ton, up 97.2% from the beginning of the year.

European APT prices are reported at USD 550-645/mtu (equivalent to RMB 347,000-407,000/ton), up 81.1% from the beginning of the year.

In the tungsten powder market, market confidence continues to diverge due to the dual pressures of high costs and cautious demand. Transactions are mostly conducted on a case-by-case basis, resulting in a stagnant market.

Tungsten powder prices are reported at RMB 645/kg, up 104.1% from the beginning of the year.

Tungsten carbide powder prices are reported at RMB 630/kg, up 102.6% from the beginning of the year.

The ferrotungsten market is generally stable. During the current phase of industry chain competition, market sentiment remains cautious, with neither supply nor demand sides showing significant initiative.

70 ferrotungsten prices are reported at RMB 410,000/ton, up 90.7% from the beginning of the year.

European ferrotungsten prices are reported at USD 82-83.10/kg W (RMB 409,000-414,000/ton), up 87.6% from the beginning of the year.

The scrap tungsten market is relatively weak. With the cooling of speculative sentiment and some holders taking profits, a sell-off has occurred, leading to a rapid price correction and shifting the bargaining power to buyers.

The price of scrap tungsten bars is reported at RMB 430/kg, up 95.5% from the beginning of the year.

The price of scrap tungsten drill bits is reported at RMB 420/kg, down 7.7% from its high.

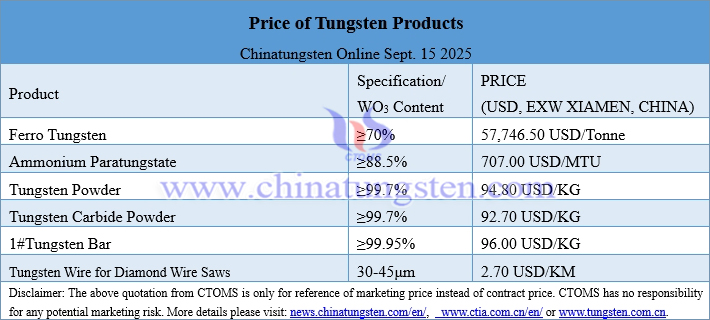

Prices of Tungsten Products on September 15, 2025

Tungsten Price Trend from January to September 15, 2025

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com