Erbium Oxide Price - September 20, 2023

- Details

- Category: Tungsten's News

- Published on Wednesday, 20 September 2023 17:41

China rare earth prices remain stable in some areas with minor fluctuations.

For example, gadolinium oxide has seen a decrease of about 8,000 yuan per ton, while dysprosium oxide has increased by approximately 20,000 yuan per ton. Meanwhile, praseodymium-neodymium oxide and erbium oxide have temporarily stabilized at 527,000 yuan per ton and 325,000 yuan per ton, respectively.

Looking at the supply side, although some rare earth manufacturers have slowed down production due to increased production costs, stricter environmental protection policies, and the current low raw material prices, they still struggle to offset the damage caused by the limited downstream demand, resulting in a relatively high supply of spot market materials.

From the demand side, due to relatively tight liquidity and low short-term bullish expectations for the rare earth market, downstream users have primarily maintained just-in-time purchasing.

In terms of news, data from the National Energy Administration shows that as of the end of August, the cumulative installed generating capacity in the country is approximately 2.76 billion kilowatts, a year-on-year increase of 11.9%. This includes wind power capacity of about 400 million kilowatts, a year-on-year increase of 14.8%. From January to August, the average utilization of generating equipment nationwide was 2,423 hours, a decrease of 76 hours compared to the same period last year. Hydropower utilization was 1,984 hours, a decrease of 469 hours compared to the same period last year. From January to August, the total investment in power projects by major power generation companies in the country reached 470.3 billion yuan, a year-on-year increase of 46.6%. This includes 114.9 billion yuan in wind power investment, a year-on-year increase of 38.7%.

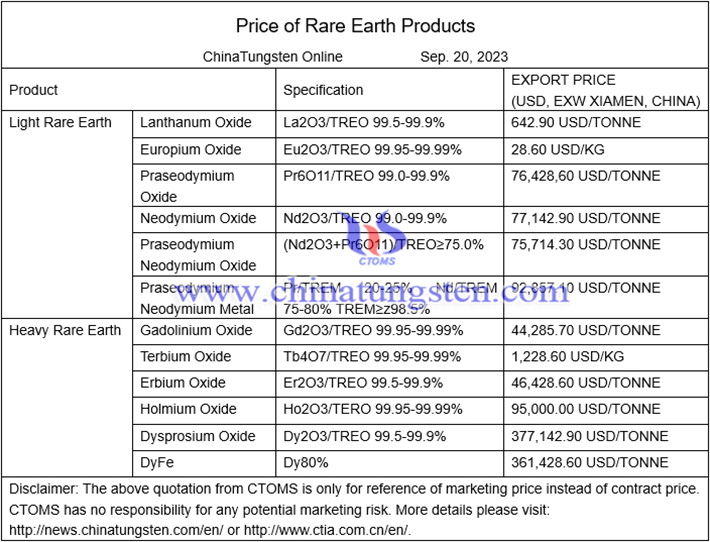

Prices of rare earth products on September 20, 2023

Picture of europium oxide

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com