Gadolinium Oxide Price - April 12, 2023

- Details

- Category: Tungsten's News

- Published on Wednesday, 12 April 2023 16:14

The overall decline in the Chinese rare earth market is mainly due to the imbalance between the supply and demand of rare earth raw materials, that is, the limited consumption capacity of downstream users.

In this case, the supply of rare earth raw materials such as praseodymium, neodymium, dysprosium, and terbium is slightly increased. Currently, the prices of praseodymium neodymium oxide, gadolinium oxide and terbium oxide have dropped to around RMB 510,000/ton, RMB 274,000/ton and RMB 9,900/kg respectively.

According to Chinatungsten Online, the main reasons for the weak demand in the rare earth market are: the year-on-year increase in rare earth mining and separation indicators in the first half of this year, a slight decline in the listing price of rare earths in the north in April, and an increase in imports of ion-type minerals from Myanmar. All have weakened consumers' confidence in the future market of rare earths to a certain extent.

However, as the weather warms up, the development of downstream rare earth industries such as infrastructure, new energy vehicles and photovoltaics is accelerating, and supported by production costs, it has also largely boosted confidence in the rare earth market.

In terms of news: According to data from the Passenger Federation, from January to March 2023, a total of 1.319 million new energy vehicles were retailed, a year-on-year increase of 15%. In addition, according to the China Photovoltaic Association, domestic photovoltaic installed capacity in January-February 2023 will be 20.37GW, a year-on-year increase of 87.6%, which is close to the cumulative installed capacity in January-May 2022.

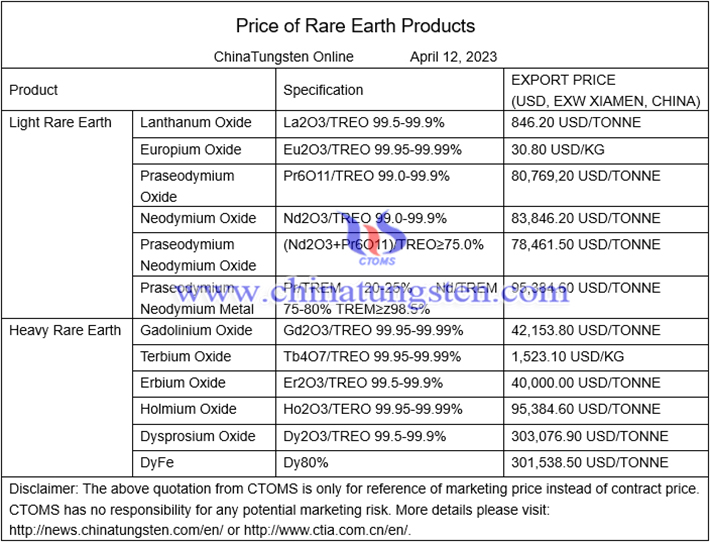

Prices of rare earth products on April 12, 2023

Picture of europium oxide

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com