Impacts of Russia-Ukraine Conflict on Tungsten Market & Price (I)

- Details

- Category: Tungsten's News

- Published on Tuesday, 29 March 2022 09:59

IMPACTS OF RUSSIA-UKRAINE CONFLICT ON TUNGSTEN MARKET & PRICE

PART I OF X

Brief Introduction to the Conflict between Russia & Ukraine and the Military Use of Tungsten

1. Russia Ukraine Conflict

1.1 The Black Swan Nature of Russia Ukraine Conflict and Sanctions

Not long ago, when the new year 2022 was coming, many research institutions, experts and professional scholars around the world predicted the "Black Swan" event in 2022, most of which focused on the adjustment of China-US relations and bilateral economic, trade, scientific and technological control measures, or the possibility of extreme weather,

epidemic and other aspects; Of course, with regard to military and regional conflicts, some people believe that East Asia and the Taiwan Strait may be one of the hot spots. No matter whether the author of this article agrees with their views or not, after reading these research articles, I have benefited a lot, and I am very grateful for their research and contribution!

However, for the analysis of these predictable risks that occur frequently, have traces to follow and have logic in recent years, I think such predictable risks and events should actually be called "grey rhinoceros" events. The real "black swan" is often infrequent and difficult to predict, such as the recent conflict between Russia and Ukraine, which has attracted great international attention.

Since February 24, 2022, Russia has "invaded" Ukraine and launched what they call a war of self-defense, while the United States, the European Union and their allies have launched an “Economic War” of various sanctions against Russia. Not only is the conflict between Russia and Ukraine an outright Black Swan incident, but only the measures of sanctions against Russia by the United States and Europe, such as the implementation of the bank's expulsion from the SWIFT payment system, also have the nature of an indiscriminate black swan; Even Switzerland, a permanent neutral country, has joined the ranks of sanctions, which shows that the conflict between Russia and Ukraine is unprecedented and rarely heard of.

The Russian Ukrainian conflict is undoubtedly the first "black swan" to be remembered by history and fly high in 2022. It not only disrupts the global stock market and commodity market, intensifies the risk of global inflation and supply chain interruption, but also may accelerate the disintegration of the "one super multi power" international order since the end of the cold war. It is true that the Russian Ukrainian issue involves not only the military strength struggle between the two countries or multiple global interest subjects, but also the multi-faceted struggle between the political ecology and global political pattern at home and abroad, the all-round resource coordination ability of various countries and regions, economic strength and mobility of various subjects.

As a counter measure, at Putin's order, the Russian government immediately pulled out the "unfriendly list" of about 50 countries and regions, including EU Member States (27 countries such as Germany, France, Italy, Spain, the Netherlands and Poland), the United States, the world's largest economy, and San Marino, a small country with a population of only 30000. The vast majority of them are European and American countries and regions, and the Five Eye Alliance is naturally included; There are about 50 countries and regions in Asia, and only four of them are listed in Japan, South Korea, Singapore and Chinese Taiwan. According to the decree signed by Putin, Russian citizens, companies, the state itself, its regional and municipal governments who have foreign exchange obligations to foreign creditors in the list of unfriendly countries and regions can pay their debts in rubles. In order to fulfill its obligations, the debtor has the right to apply to the Bank of Russia to open a class C account in the name of foreign creditors or nominees to pay off relevant debts.

In particular, Taiwan, which legally belongs to China, has always been a follower of the United States, and its personality inevitably makes it one of them! Therefore, like the United States and European countries, China should also be regarded as one of the countries sanctioned by Russia!

Recently, when the conflict between Russia and Ukraine is approaching a month, Russian President Vladimir Putin's counter-measures against the west, listed the list of countries that are not friendly to Russia, and asked these countries and regions to only pay the price of importing Russian energy in Rubles. Such Putin style counter-measures are also full of unprecedented arrogance, and are enough to amaze and confuse politicians and financiers all over the world!

1.2 Oil and Gas Boom and "Demon Nickel" Rampant under Sanctions

Since the war between Russia and Ukraine, European and American stock markets have continued to fall sharply, and NASDAQ has fallen into a bear market. In fact, the stock markets of many countries and regions have fallen into a bear market. "For global investors, this battle is like fighting with their money." However, if we look at the three principles of Russia's withdrawal, "Ukraine stops military operations", "Ukrainian neutrality is incorporated into the constitution" and "recognize that Crimea is Russian territory and the two separate regions in eastern Ukraine are independent", we will know that this war, even if it will not last for a long time, will be difficult to end in the short term, and the global political economy will be difficult to calm in the short term, even if the war ends in the future, We can also foresee whether it will have a significant impact on the world economic pattern and development in the next decade or decades.

The various measures taken by the United States and Russia on sanctions and anti sanctions have resulted in the rapid rise of international oil prices and the continuous decline of the Russian ruble. It can be seen that the United States has a great impact on Russian oil, natural gas and other energy sources, which account for about 8% of its liquid fuel imports. After the shale gas revolution in the United States, the main buyers of Russian oil and gas are the European Union and China. Therefore, the rising energy prices mainly affect the import dependent countries and regions such as the European Union and China. After 2007-2008 and 2011-2014, the international oil price has entered the era of high oil price of more than US $100 per barrel for the third time. Experts estimate that the international oil price is close to reaching and may remain high in the second quarter of 2022. Unless the war ends as soon as possible, it is difficult to fall sharply and judge whether it will jump to another high level.

Since the superposition of high oil prices and the epidemic, countries have launched and continuously increased monetary easing policies, which is bound to push up commodity prices and inflation. At the same time, the study and judgment of the global economy and bulk commodities should not only focus on the Russian Ukrainian war and the Federal Reserve and other monetary policies, but also consider the havoc of Omicron in Japan, South Korea, Europe and the United States, and the continuous friction in economic and trade relations among the world's major economies; For China, we should consider the trend of the relationship between Japan- South Korea, China- South Korea,and China- Japan after the South Korean election and its impact on the economy of East Asia and even the whole Asian economy.

The rise in commodity prices in recent years is mainly due to the mismatch between supply and demand, the fragile supply chain and the loose monetary policy generally adopted by all countries; As for bulk commodities such as aluminum, nickel and wheat, Russia's export volume plays an important role, accounting for 4.2%, 5.3% and 5% of global output respectively. However, we must be soberly aware that affected by the conflict between Russia and Ukraine, prices may rise far more than oil, natural gas, metal aluminum, wheat, corn and other commodities.

Nickel is a kind of non-ferrous metal plate. Nickel is an important industrial metal, which is widely used in iron and steel, machinery, construction, aviation, transportation, chemical industry and other industries. Major commodity exchanges such as the London Stock Exchange and the last stock exchange have nickel futures. The usual trend of nickel futures is irregular. There is no obvious market logic and theoretical basis for the sharp rise and fall of nickel futures. The name "Demon Nickel" given to it by people in the market has its origin, but it comes from nowhere.

Russian nickel supply accounted for 40% of the global circulation. The supply concerns, logistics chain disconnection, financial sanctions and other factors caused by the conflict between Russia and Ukraine, coupled with the capital predators in the market trying to take the opportunity to carry out a strong epic short squeeze on Chinese related enterprises with short speculation, LED to a sharp rise in nickel prices all the way. The domestic nickel price quickly climbed to 200000 yuan / ton, and then jumped again. Shanghai nickel closed on March 9 and rose at the price limit of 267700. Originally, under the scenario of tight nickel supply and back to the original market, the nickel price was too strong, and the transportation belonged to the normal range. Then, due to the low inventory of Lun nickel and Shanghai nickel, the demand for new energy was strong, and the long air war was in full swing, Russia and Ukraine were suddenly superimposed, resulting in structural shortage contradictions and psychological panic, resulting in the emergence of "demons". This may be just one of many black swans, or it may be just a preview of a major economic event, but in any case, its butterfly effect will appear soon.

1.3 Observe the Future Trend of Tungsten Price from the Market Situation of Nickel

How does the conflict between Russia and Ukraine affect the tungsten products industry? For the tungsten industry, we have to seriously consider such issues. Modern war is not only the destruction of human life, but also the massive consumption and destruction of all kinds of materials. Therefore, the war must be accompanied by a substantial increase in the demand for all kinds of materials, especially strategic related materials and resources. In addition to the direct military demand, the related industries driven by it will also increase. Tungsten products are such a resource.

How does the conflict between Russia and Ukraine affect the tungsten products industry? For the tungsten industry, we have to seriously consider such issues. Modern war is not only the destruction of human life, but also the massive consumption and destruction of all kinds of materials. Therefore, the war must be accompanied by a substantial increase in the demand for all kinds of materials, especially strategic related materials and resources. In addition to the direct military demand, the related industries driven by it will also increase. Tungsten products are such a resource.

As tungsten products are a small commodity, many economists and experts will not notice it, but we believe that tungsten products may be greatly and long-term affected by the Russian Ukrainian conflict. Why do we say so? It is not difficult to draw a conclusion as long as we look at the importance of tungsten products, their main producing countries, their position in the supply chain and their position in the Russian Ukrainian conflict.

Based on the above analysis and taking the lesson of "demon nickel", this paper intends to discuss the importance of tungsten products in military and people's livelihood, the distribution of large countries of tungsten resources reserves and main production and supply countries, the situation of tungsten resources in Russia, the influencing factors of tungsten resources market and price, the feasibility and future prospect of China's tungsten products futures, national regulation This paper analyzes the impact of the conflict between Russia and Ukraine on China's tungsten products industry and the future development trend, and puts forward some foolish opinions. The content of this article is like the perspective of a frog at the bottom of a well,I sincerely hope that all experts, scholars and colleagues of tungsten industry will give me more advice and/or suggestions!

2. Tungsten Resource and Its Importance

2.1 Tungsten and Its Characteristics

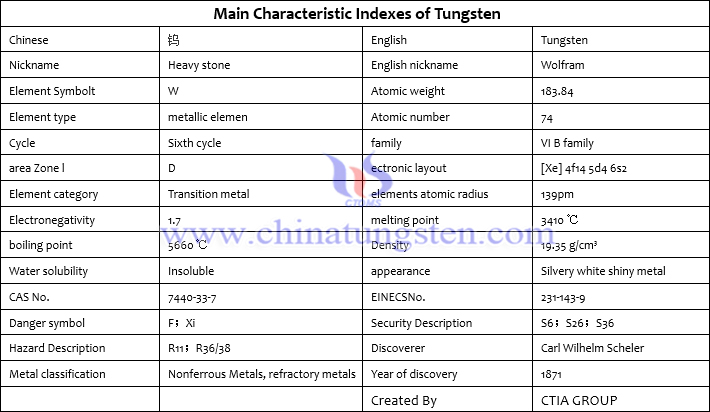

Tungsten, whose chemical element symbol W comes from Wolfram in English, has an atomic number of 74 in the periodic table and is a metal of VIB group. The density of tungsten is 19.35g/cm3, which is very close to that of gold; Tungsten has a melting point of 3422 ℃ and a boiling point of 5927 ℃, which is the highest among almost all metal elements, so it is classified as a refractory metal among non-ferrous metals. Tungsten is a rare metal with silver white metallic luster, but its shape is very similar to the silver gray of steel in ferrous metals. The chemical properties of tungsten are very stable. It does not react with air and water at room temperature, and does not react with hydrochloric acid, sulfuric acid, nitric acid and hydrofluoric acid of any concentration.

Tungsten is a rare refractory metal. Due to its high melting point, high hardness, high density, good conductivity, good ductility and small expansion coefficient, tungsten has excellent physical, chemical, mechanical and machining properties. All kinds of tungsten products are widely used in the fields of national economy, national defense industry, aerospace, medical electronics and other fields, and become an indispensable important raw material and functional material in modern social production, The strategic position is very prominent. In the modern industrial system, not only tungsten chemicals, such as tungsten oxide and tungsten chloride, are very important raw materials for powder metallurgy and chemical industry, but also indispensable raw materials for metal manufacturing and petroleum smelting catalysis; Moreover, tungsten metal products, high-density gold and cemented carbide products, tungsten copper, tungsten silver and other tungsten alloys and tungsten rare earth doped materials are one of the most important functional materials in the application of modern industrial machining, information technology, photoelectric technology and national defense high-tech. For more information and data on the metallic element tungsten, please visit the website: www.tungsten.com.cn

2.2 Main ProductS Categories of Tungsten

2.2.1 Tungsten Ore and Tungsten Concentrate

......

More information is available at www.chinatungsten.com

2.2.2 Tungsten Oxide, Sulfide and Other Tungsten Compounds

......

For everyting details about yellow and blue tungsten oxide and trixode, please visit www.tungsten-oxide.com

2.2.3 Tungsten Metal Products

......

More information is available at www.tungsten-heater.com.cn

2.2.4 High Specific Gravity (High Density) Tungsten Heavy Alloy Products

......

www.tungsten-alloy.com is a website built by China Tungsten Online in the late 1990s, which mainly introduces the tungsten alloy products it manufactures. It is also the most authoritative, comprehensive and well-known website in the field of tungsten alloy. You can visit this website to get more comprehensive treatment of products and their uses.

2.2.5 Tungsten Cemented Carbide

3. Main Application of Tungsten

4. Application of Tungsten in Military

4.1 Military Use of Tungsten Products as Raw Materials

4.2 Cemented Carbide as Cutting Tools for Military

......

The first part of this paper is only the author's analysis and judgment of the price trend of tungsten products in 2022, including the conflict between Russia and Ukraine and the military use of tungsten. In the context of the Russian Ukrainian conflict at the beginning of 2022, we believe that Europe and the United States continue to increase sanctions against Russia. Although the Russian Ukrainian negotiations are beginning to dawn, the sequelae of the conflict and the aftereffect of sanctions will continue to appear, and will continue to affect the global political and economic pattern and the market trend and price trend of major commodities in 2022. Strategic metals such as tungsten, molybdenum and rare earth are the same as many bulk commodities related to the national economy and the people's livelihood, Under the counter cyclical background of the booming counter trend of the national defense industry, the consumption demand of its important strategic raw materials tungsten and rare earth is bound to increase.

(THE REMAINING PART I TO X WILL BE CONTINUED)

This article is published on the official account of WeChat on March 20022, and is also listed at www.ctia.com.cn and news.chinatungsten.com.

SUMMARY

Different from the experience of tungsten products market in the past few decades, we judge that the price of tungsten products will continue to rise in 2022, but the main factor is not traditional market factors. Therefore, we will start from the global resource distribution and resource competition of tungsten products, the increasing pressure on the production cost of tungsten products, monetary and financial policies of all countries in the world, inflation and many other factors, In particular, we will comprehensively analyze the main factors and possibilities of the rise and fall of tungsten product prices in 2022, and we will also discuss the feasibility and risks of China's Tungsten product futures; Since it is related to Russia, finally, we will briefly analyze the suspected fraud such as the so-called sky high price "Russian tungsten gold bar" that has appeared from time to time in recent decades.

Read/download the full report:

'Impacts of Russia-Ukraine Conflict on Tungsten Market & Price (I)'

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com