Prices of Rare Earth Oxides Still Falling

- Details

- Category: Rare Earth News

- Published on Wednesday, 13 March 2013 08:45

- Written by Yuri

- Hits: 2440

Lanthanum oxide finished as the week’s biggest mover in this week after dropping 6.4 percent. The past week saw cerium oxide close after a 6 percent decline.

The price of praseodymium neodymium oxide, however, rose 1.7 percent after falling 3.2 percent during the previous week.

Praseodymium oxide fell 1.3 percent over the past week. Dysprosium oxide remained unchanged for the week. Europium oxide prices held steady from the previous week.

The week finished with no movement for neodymium oxide. Rare earth carbonate remained essentially flat from the previous week. Samarium oxide traded sideways last week. Terbium metal remained unchanged for the week.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Heavy And Light Rare Earth Prices May Appear Differentiation

- Details

- Category: Rare Earth News

- Published on Tuesday, 12 March 2013 16:46

- Written by jiang

- Hits: 2679

In tumbled trend of rare earth prices throughout 2012, during the state and enterprises to take a premium Shouchu discontinued insured and other measures were not rare earth prices can significantly rising trend. According to publicly available data, in 2012 about 40% year-on-year decline in the annual average price of rare earth, close to being "cut." Dysprosium oxide and terbium oxide average market price of the more significant reduction in the price declines of 40% and 46.6%. However, the export of of lanthanide products and cerium but contrarian rose year-on-year growth of 41% and 84% respectively, the price decline is also smaller. Can be seen, the larger decline in export prices of heavy rare earth elements such as dysprosium, terbium, and the light rare earth exports impact on a smaller scale.

The still general consulting metallurgical industry analysts pointed out that the fourth quarter of 2011, so far scarce rare earth prices by illegal private mines and overseas mining heavy volume, was a the shock downward trend, but the southern ionic rare earth minerals for our unique, rich in heavy The rare earth elements, there are obvious advantages compared to overseas rare earth mine in the reserves and grade. So the next few years is expected the heavy rare earth prices will gradually rise, light rare earths by the heavy volume of overseas mines will maintain low volatility. Heavy rare earth prices rise, mainly due to the following:

First, the heavy rare earth reserves are very limited. Based on USGS data show: the world's total rare earth reserves of 110 million tons, the Chinese reserves accounted for 50% of the approximately 55 million tons, which only 3% of China's reserves of about 165 million tons of proven reserves of southern China's rare earth ionic, therefore, rare earth ionic annual output of 50,000 tons of dollars static reserve-production ratio of less than 37 years, and this the main varieties of the ore in gold. The heavy rare earth is only part of the rare earth ionic, so more scarce. According to the agency is expected in the next world, more than 80% -90% of the heavy rare earth demand will continue from China to meet.

Second, will accelerate the reduction of the heavy rare earth stocks. The main reason for the decline of heavy rare earth prices in the near future is that pre some countries, as foreseen in the heavy rare earth scarcity to import large quantities of the formation of the stock, while the economic crisis lead to downstream companies cut a short-term oversupply situation, so the heavy rare earth. As the economy rebounds, the downstream enterprises will accelerate the consumption of existing inventory of heavy rare earth new demand will rapidly increase.

Third, the Southern rare earth industry will accelerate the integration. Another reason is that the Southern small mines stealing stealing and selling heavy rare earth prices. Currently, relevant departments have formulated relevant industrial policies, to increase the punishment for the rare earth indiscriminate digging of private behavior, Southern Rare Earth resources in the province are encouraged to promote the industry consolidation. Industry consolidation is complete, the efforts to control production and prices for the heavy rare earth will be greatly enhanced.

Other hand, according to the agency expects that by 2015, lanthanum, cerium, praseodymium, neodymium and four light rare earth ore production in China of the world's total output than will decline from 94% in 2010 to 61% in 2015. Moreover, the future of the four light rare earth ore production will increase every year. This will greatly ease the contradiction between supply and demand of the light rare earths, so future prices will be difficult to improve.

Tungsten Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Rare Earth Market Traded Weaker

- Details

- Category: Rare Earth News

- Published on Monday, 11 March 2013 17:55

- Written by jiang

- Hits: 2505

Monday rare earth market is still deserted, traders slightly mobilize quotes, concentrated in the lanthanum, cerium, gadolinium. Most cargo operators who offer more stable.

Market quote a higher degree is still concentrated in the oxide, gadolinium oxide, praseodymium, neodymium, addition some traders Alerts cheap gadolinia, market inquiries and turnover of other oxides are weak. Insiders reflect gadolinium oxide is a tax 140,000 yuan / ton, there are many traders very price including tax 150,000 yuan / ton. Praseodymium neodymium oxide market tax price is still $ 31-32 million / ton, excluding tax 26.3-26.5 yuan / ton. The lanthanum cerium-based oxide prices are still down 39 lanthanum oxide tax 3.6-3.8 yuan / ton, 395 cerium oxide tax of 3.5-4 yuan / ton offer both. Lanthanum cerium metal offer more stable, Baotou traders tax offer 60,000 yuan / ton, the Ganzhou traders offer slightly higher.

Rare Earth Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Rare Element Reports Additional Drilling Results High in Critical Rare Earth Elements

- Details

- Category: Rare Earth News

- Published on Tuesday, 12 March 2013 08:57

- Written by Yuri

- Hits: 2693

Rare Element Resources Ltd. is pleased to announce rare earth element (REE) assay results from the final core holes completed during the 2012 drilling program at the Company’s 100% owned Bear Lodge property, located in northeastern Wyoming, USA. The drilling results confirm that the Bear Lodge deposits contain high grades of total rare earth oxide (TREO), including high abundances of combined Critical Rare Earth Oxides (CREOs).

Dr. James Clark, Vice President of Exploration for Rare Element Resources, states “Assay results are now in from all of the development and exploration core holes drilled during our 2012 program. We are extremely pleased with the results as most recent drill results confirm and further expand the quality and continuity of the Bull Hill REE deposit and the Whitetail Ridge resource area. We expect to significantly increase the Measured and Indicated resources in those deposits in preparation for the upcoming definitive Feasibility Study (dFS). Further, the results confirm the zones of HREE-enrichment (Eu, Tb, Dy, and Y) at Whitetail Ridge and Carbon and illustrate the significance of this world class source of CREOs.”

Critical Rare Earth Oxides (CREO)

Critical rare earth elements (CREEs) are those with the highest value, and for which the strongest future growth is projected. We refer here to the oxides of Nd, Pr, Eu, Tb, Dy, and Y as Critical Rare Earth Oxides (CREO). In 2011, the Company identified significant HREEs (Eu, Tb, Dy, and Y) in leached FMR (F (FeOx)-M (MnOx)-R (REE minerals)) and oxide-carbonate dikes at the Whitetail Ridge resource area, and at the East Taylor and Carbon target areas (see news releases dated 4 August and 27 October 2011, and 10 December 2012). The current set of assay results from the Whitetail Ridge resource area and Carbon target confirm those important observations. Examination of aggregate significant intercepts from past drill results and the current set of drill assay results indicate that there is a district-wide zonation in which the strongest TREO enrichment occurs within a central zone focused on the Bull Hill and Bull Hill Northwest deposits, while the strongest HREE (Eu, Tb, Dy and Y) enrichment is found in mineralization peripheral to the central zone and focused at the Whitetail Ridge deposit, and at the Carbon and Taylor REE target areas (Table 1 and Figure 2). The peripheral enrichment zone is ascribed to a late-stage, low-temperature hydrothermal event.

Objectives of the 2012 Drill Program

The objectives of the 2012 drilling program were to expand and upgrade the district’s resource categories at the Bull Hill and Whitetail Ridge oxide deposits, and to further delineate the HREE (Eu, Tb, Dy, and Y) enrichment at the Whitetail Ridge resource area and Carbon target area. The drill results emphasize a Bear Lodge district-wide REE zonation, with a central zone of strong TREO enrichment that gives way to a peripheral zone with significant TREO and strong Eu, Tb, Dy, and Y enrichment.

The assay results from 35 core holes are announced in this release and include assays from 15 core holes at the Bull Hill REE deposit, 18 holes from the Whitetail Ridge resource area, and 2 holes from the Carbon REE target area.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Rare Earth Market

- Details

- Category: Rare Earth News

- Published on Monday, 11 March 2013 15:56

- Written by Yuri

- Hits: 1504

Exact statistics are difficult to come by in the rare earths field, partly because there is no official statistics agency, partly because they rely on Chinese sources where smuggling occurs, and partly because the end uses are so disparate. The Industrial Mineral Corporation of Australia (IMCOA) are widely respected and gave some updated numbers in a November 2012 presentation.

The anticipated rare earth supply for 2012 was estimated at 112,500 tonnes of rare earth oxide against production of 106,000 tonnes. Global production of heavy rare earths at 7,000 tonnes was 40% below the estimated 10,000 tonnes demand with almost all of this being produced in China. Global demand is expected to increase to 160,000 tonnes by 2016 and to 220,000 tonnes in 2020. Demand for heavy rare earths is expected to increase 45% but supply expected to remain static at 7,000 tonnes.

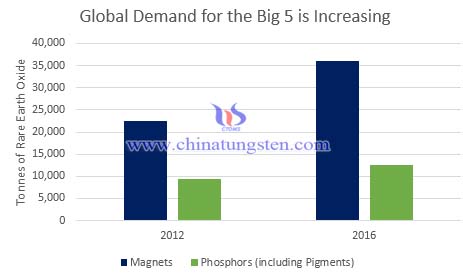

The five elements which drive the economics of rare earth production (what Frontier calls the “Big 5” are neodymium, praseodymium, dysprosium, terbium and europium. The two demand sectors which consume the majority of these elements’ production are magnets and phosphors. IMCOA sees demand for these increasing rapidly, which will help to support their prices while other elements – such as lanthanum and cerium – may be in oversupply.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com