Northern Rare Earth Q1 2025 Net Profit Exceeds 400 Million Yuan

- Details

- Category: Rare Earth News

- Published on Thursday, 08 May 2025 15:04

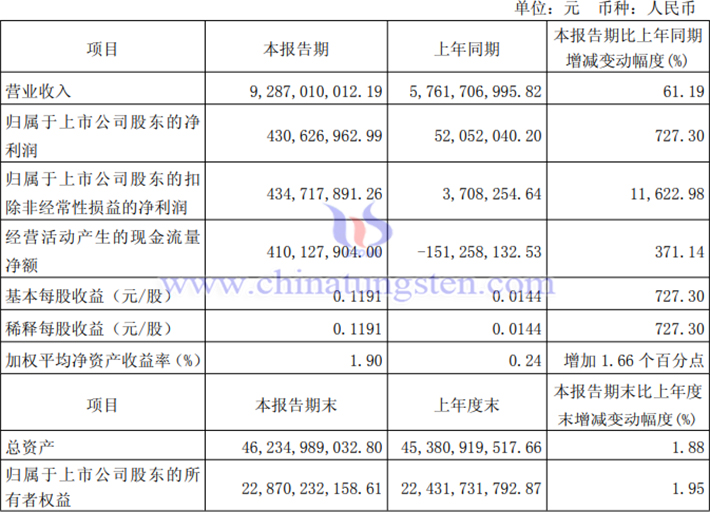

In Q1 2025, Northern Rare Earth reported revenue of 9.287 billion yuan, up 61.19% year-on-year; net profit attributable to shareholders was 431 million yuan, up 727.30% year-on-year; non-recurring profit-adjusted net profit was 435 million yuan, up 11,622.98% year-on-year; basic earnings per share were 0.12 yuan, up 727.30% year-on-year; net cash flow from operating activities was 410 million yuan, up 371.14% year-on-year; total assets at the end of the period were 46.235 billion yuan, up 1.88% year-on-year; and net assets attributable to shareholders were 22.87 billion yuan, up 1.95% year-on-year.

The significant year-on-year performance increase in Q1 2025 was mainly due to higher average prices of key rare earth products, particularly praseodymium-neodymium products, lower raw material costs, and increased gross profit. The company's products are pided into rare earth raw materials (including rare earth salts, oxides, and metals, serving as raw materials for downstream functional and new materials production), rare earth functional materials (such as magnetic, polishing, hydrogen storage, and catalytic materials), and rare earth terminal application products.

According to CTIA GROUP LTD, from January to March 2025, most rare earth product prices in China rose both month-on-month and year-on-year: praseodymium oxide averaged 447,579 yuan/ton, up 4.50% month-on-month and 12.40% year-on-year; neodymium oxide averaged 440,719 yuan/ton, up 3.63% month-on-month and 11.73% year-on-year; praseodymium-neodymium oxide averaged 430,158 yuan/ton, up 2.98% month-on-month and 11.97% year-on-year; and praseodymium-neodymium metal averaged 529,491 yuan/ton, up 2.55% month-on-month and 11.28% year-on-year.

Northern Rare Earth’s controlling shareholder, Baogang Group, holds exclusive mining rights to the Bayan Obo mine, the world’s largest iron and rare earth symbiotic mine. After Baogang Shares produces iron concentrate from Bayan Obo ore, it focuses on green resource utilization by concentrating tailings into rare earth concentrate, supplying Northern Rare Earth with a stable raw material source. In Q1 2025, the transaction price for rare earth concentrate between the two parties was adjusted to 18,618 yuan/ton (dry basis, REO=50%, excluding tax), up 4.7% month-on-month but down 10.22% year-on-year; for every 1% increase or decrease in REO, the tax-excluded price adjusts by 372.36 yuan/ton, also up 4.7% month-on-month but down 10.22% year-on-year.

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com