Rare Earth Concentrate Output in the United States Increased by More Than 8% in 2024

- Details

- Category: Rare Earth News

- Published on Monday, 24 February 2025 18:36

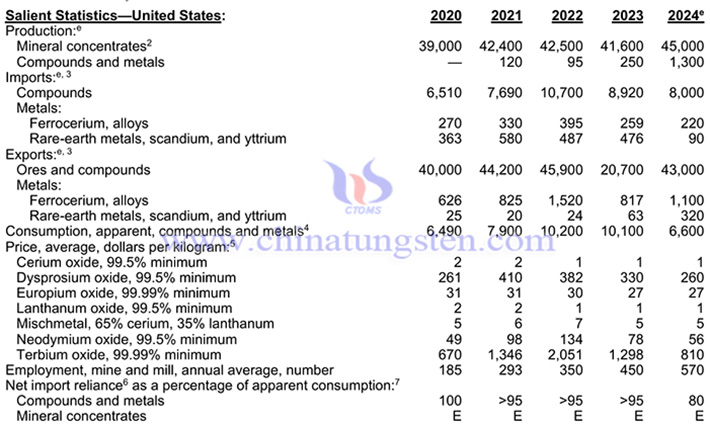

According to data from the United States Geological Survey (USGS), in 2024, the United States' rare earth concentrate production is expected to be 45,000 tons, an increase of about 8.17% year-on-year; the production of rare earth compounds and metals is expected to be 1,300 tons, an increase of about 420% year-on-year; the import volume of rare earth compounds is expected to be 8,000 tons, a decrease of about 10.31% year-on-year; the import volume of ferrocerium and alloys is expected to be 220 tons, a decrease of about 15.06% year-on-year; the import volume of rare earth metals, scandium and yttrium is expected to be 90 tons, a decrease of about 81.09% year-on-year; the export volume of rare earth ores and compounds is expected to be 43,000 tons, an increase of about 107.73% year-on-year; the export volume of ferrocerium and alloys is expected to be 1,100 tons, an increase of about 34.64% year-on-year; the export volume of rare earth metals, scandium and yttrium is expected to be 320 tons, an increase of about 407.94% year-on-year; the apparent consumption of rare earth compounds and metals is expected to be 6,600 tons, a decrease of about 34.65% year-on-year.

By the end of 2024, the rare earth reserves in the United States will be about 1.9 million tons, an increase of about 5.56% year-on-year, accounting for 2.11% of the world's total reserves (90 million tons). The rare earth resources in the United States are mainly distributed in California, Alaska and other places. Among them, the Mountain Pass Mine in California is an important rare earth mine in the Western Hemisphere. In terms of industry, the United States is currently mainly mining the Mountain Pass Mine, but the processing system is incomplete, and it relies more on shipping the mined ore to China and other countries for processing. Rare earths are mainly used in high-tech industries and defense fields. Given their importance, the United States attaches great importance to them.

According to China Tungsten Online, during the period of 2020-2023, the United States has a significant degree of dependence on China in the import of rare earth compounds and metals. China has become the largest supplier to the United States, accounting for 70% of the US import market share. With rich reserves, mature mining and refining technology and a complete industrial chain, it has been exporting to the United States stably for a long-term, and has a prominent dominant position in the global rare earth industry. Malaysia ranks second with a share of 13%. Taking advantage of its own rare earth processing advantages, it processes rare earth concentrates and chemical intermediates sourced from Australia, China and other regions and then exports the processed products to the United States. In recent years, it has cooperated closely with the United States and consolidated its position in the US market. Although Japan has small rare earth reserves, it has a developed industry and rich experience in trade and processing. It obtains raw materials from Australia, China and other places and processes them, meeting the US demand for specific rare earth products, accounting for 6% of the US import market share. Estonia accounts for 5%. Relying on its own large-scale rare earth processing industry, using raw materials from Australia, China and other places, and relying on geographical advantages and industrial characteristics, it meets the persified demand of the US market for rare earth products. The remaining countries and regions account for a total of 6%. Although the inpidual supply accounts for a low proportion, they provide the United States with persified options from different angles, and constitute an important supplement to the source of rare earth imports for the United States.

These aspects of the US rare earth industry are closely related to the global rare earth situation. Here are the global rare earth reserve and production data in 2024. In 2023, the global rare earth reserves were about 110 million tons. In 2024, the global rare earth reserves will be about 90 million tons, a year-on-year decrease of about 18.18%; among them, China has the highest rare earth reserves, which are 44 million tons, accounting for 48.89% of the global total reserves. In 2024, the global rare earth production will be about 390,000 tons, an increase of about 3.72% year-on-year; among them, China's rare earth production is the highest, at 270,000 tons, accounting for 69.23% of the global total production.

- Rare Earth Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com