Wolframite Concentrate Prices Firm, Scrap Tungsten Trends Vary

- Details

- Category: Tungsten's News

- Published on Thursday, 07 August 2025 15:52

Analysis of Latest Tungsten Market from Chinatungsten Online

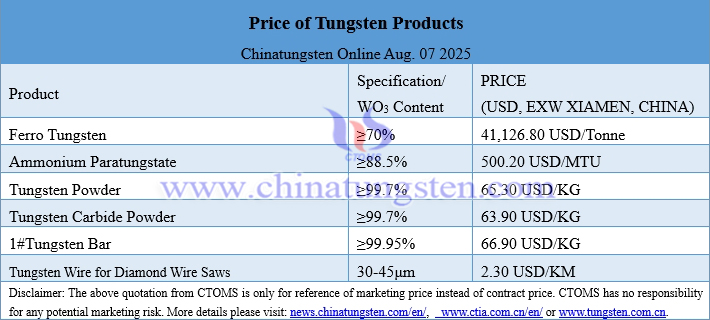

Tungsten prices saw a slight increase, with the upstream and downstream industry chains remaining in a stalemate. Sellers increased shipments but were generally unwilling to offer discounts, while buyers remained cautious, replenishing stocks based on demand.

Overall market activity increased, with prices fluctuating within a range. Market participants awaited future developments in the supply-demand impasse and macroeconomic news.

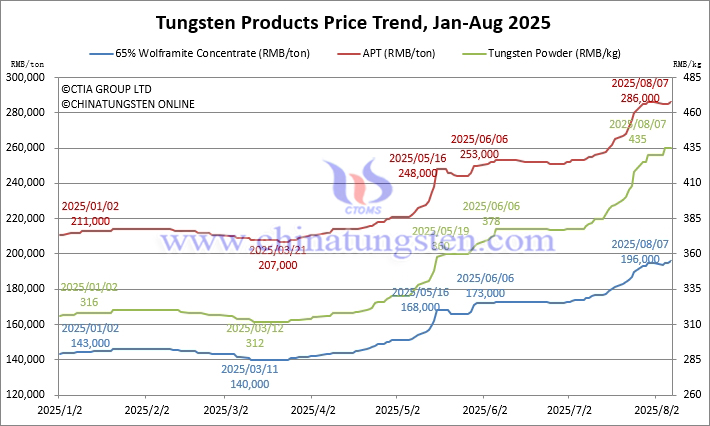

The price of 65% wolframite concentrate was quoted at RMB 196,000/ton. Limited cash-out activity was observed in the market. Combined with policy and seasonal factors, supply remained tight, and the market remained firm.

Ammonium paratungstate (APT) was quoted at RMB 286,000/ton. Market activity was limited by supply-demand dynamics and export controls, leading manufacturers to adopt a cautious wait-and-see approach.

Tungsten powder was quoted at RMB 435/kg, and tungsten carbide powder at RMB 425/kg. Cemented carbide manufacturers face significant cost pressures for tungsten and cobalt raw materials, maintaining cautious inventory management. Market activity is primarily driven by essential demand.

The price of 70% ferrotungsten is reported at RMB 292,000/ton. Market costs remain strong, and steel mills maintain their fundamental demand, maintaining a stable overall market.

Sentiment in the scrap tungsten market is divided, with some merchants holding onto their stock in anticipation of price increases, while others are more motivated to sell their stock for cash, resulting in a slight downward shift in actual market bargaining levels.

Prices of Tungsten Products on August 7, 2025

Tungsten Price Trend from January to August 7, 2025

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com