Tungsten and Cobalt Raw Materials Drive Up Tungsten Cemented Carbide Prices

- Details

- Category: Tungsten's News

- Published on Wednesday, 16 April 2025 15:30

Analysis of latest tungsten market from Chinatungsten Online

The tungsten market remains in a stalemate, primarily influenced by rising raw material prices and insufficient acceptance from the consumption side. The supply-demand contradiction is still prominent, with limited trading activity. Industry players are focusing on the recovery pace of downstream manufacturing, global supply chain stability, and policy regulation impacts.

The price of 65% black tungsten concentrate is reported at RMB 144,000/ton, maintaining high-level consolidation. However, the market shows a situation of "difficult low-price procurement and insufficient high-price acceptance," with intensified bargaining between supply and demand sides, limited room for price negotiation, and average market liquidity.

Ammonium paratungstate (APT) prices are reported at RMB 214,000/ton, with a firm cost-driven atmosphere. Some companies have raised ex-factory prices to alleviate profit compression. However, demand-side feedback reflects sluggish sentiment, with market transactions mostly limited to small, just-in-time orders. Export business has seen reduced order volumes and extended order cycles due to dual-use item reviews. Divergent bullish and bearish expectations in the market have led to noticeable price negotiation tug-of-war.

Tungsten powder prices are reported at RMB 318/kg, and tungsten carbide powder at RMB 313/kg. Cost pressures have prompted some manufacturers to slightly increase quotations. However, downstream end-user demand progress is limited, with slow growth in new orders. The market cautiously replenishes inventory as needed, with prices moving in line with market trends and insufficient trading initiative.

Since April, tungsten cemented carbide prices have seen a collective upward adjustment, mainly driven by rising tungsten and cobalt raw material prices, which have increased production costs for alloy companies. However, downstream end-users generally show low acceptance of upstream cost pass-through, adopting cautious, just-in-time procurement strategies. Amid the U.S. tariff storm, industry players are operating cautiously, with actual trading remaining stagnant.

Cobalt powder prices remain stable at RMB 268/kg. The international market maintains high prices due to supply chain risks, but domestic cobalt inventories are currently sufficient, with limited short-term supply pressure. Coupled with the risk of substitutability in downstream demand, the market shows low willingness to trade at high prices, resulting in hindered cobalt market trends and reduced recent activity.

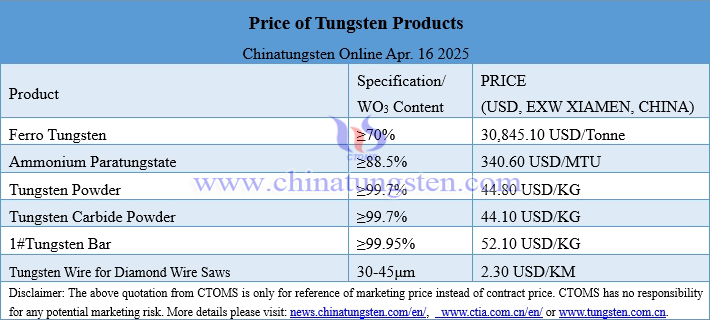

Prices of tungsten products on April 16, 2025

Picture of tungsten cemented carbide rods

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com