Risk Alert for China's Tungsten Industry Amid Escalating China-US Trade Friction

- Details

- Category: Tungsten's News

- Published on Tuesday, 15 April 2025 19:01

In today's deeply interconnected global supply chain, the escalating China-US trade friction is having a profound impact on the critical minerals sector. China, which holds the world's largest tungsten reserves (52.17% of the global total) and production (81.48% of the global total), is facing unprecedented policy and market challenges in its tungsten industry.

1. Complete Blockade of US Tungsten Products' Access to China

According to the announcement by the Customs Tariff Commission of the State Council on April 11, 2025, starting from April 12, the additional tariffs on imported goods originating from the United States will be adjusted to 125%. This adjustment directly declares the economic death of US tungsten products in the Chinese market—under the current tariff level, US goods exported to China have lost their price competitiveness.

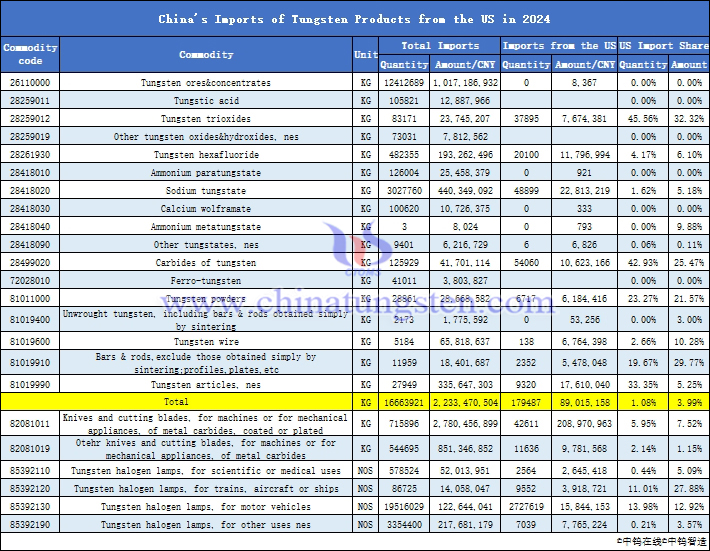

From the perspective of trade structure, according to data from China Tungsten Online, in 2024, China's imports of tungsten products from the US (excluding cemented carbide tools and tungsten halogen lamps) accounted for only 1.08% of total imports (179.49 tons) and 3.99% of the total import value (89.0152 million yuan). The dependency is very small, and China can completely fill the gap by turning to other suppliers or increasing domestic production.

It is worth noting that with the blockade of US tungsten products' access to China, its technologically advantageous areas, such as high-end alloy tools, are forced to give up market space. Chinese tungsten companies, such as Xiamen Tungsten Industry, are expected to seize the opportunity, leveraging their resource reserves, technological accumulation, and domestic market advantages to capture market share and accelerate domestic substitution.

2. China's Tungsten Export Controls May Enter a "Nuclear Option" State

A more severe challenge comes from the export side. To counter the unreasonable tariff measures of the United States, the Ministry of Commerce has strengthened the export review of critical minerals and their processed products through the identification of "dual-use items." This includes implementing export controls on tungsten, molybdenum, and other related items starting from February 4, and on some medium and heavy rare earth-related items starting from April 4. These countermeasures have significantly impacted the US military, electronics, new energy, and other industries.

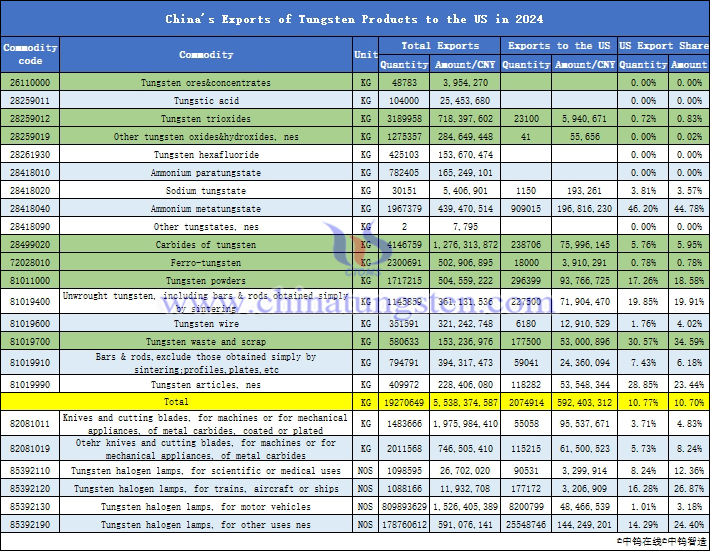

As the China-US trade friction continues to escalate, the possibility of further narrowing export channels to the US cannot be ruled out. In 2024, China's exports of tungsten products to the US amounted to 2,074.91 tons, accounting for 10.77% of China's total tungsten product exports, with an export value of 592 million yuan, representing 10.70% of China's total tungsten product export value. If exports to the US face a complete embargo, it will directly impact more than 10% of the overseas market for related export-oriented tungsten enterprises.

3. Chinese Tungsten Enterprises Need to Respond Prudently

In the face of the risk of "two-way decoupling," the tungsten industry is urged to pay close attention and operate related businesses prudently. Moreover, as a resource-rich country with a complete industrial chain advantage from mining to deep processing, Chinese tungsten enterprises should see the strategic opportunities in the crisis. Through technological innovation, market restructuring, and policy coordination, they can completely turn external pressure into a catalyst for industrial upgrading. In the field of critical minerals such as tungsten, molybdenum, and rare earths, China has both the confidence to say "no" and the ability to create new situations in the game.

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com