Global Tungsten Reserves Rose by Nearly 5% in 2024

- Details

- Category: Tungsten's News

- Published on Thursday, 20 February 2025 19:43

Recently, the United States Geological Survey (USGS) released the global tungsten production and reserves in 2024, as well as the situation of the U.S. tungsten industry. The following is the relevant content compiled by China Tungsten Online.

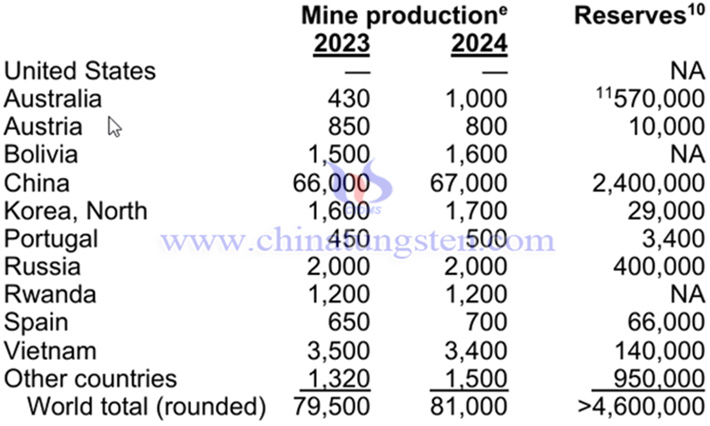

Global tungsten reserves and production in 2024

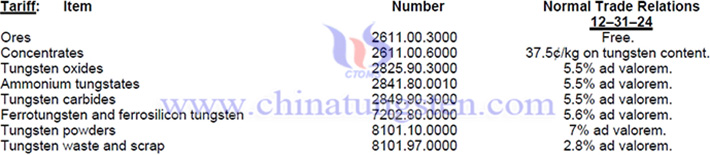

World tungsten supply was dominated by Chinese production and exports. Tungsten concentrate production outside China was estimated to have increased in 2024 but remained around 20% of total world production, owing in part to the addition of two new operations in Australia. A project in the Republic of Korea was nearing production; additional projects outside of China were awaiting funding for further development. Scrap continued to be an important source of raw material for the tungsten industry. Tungsten consumption is strongly influenced by economic conditions and industrial activity. China continued to be the world’s leading tungsten consumer. In September, the United States Trade Representative announced a section 301 tariff increase of 25% on imports of tungsten carbides, concentrates, oxides, powders, and tungstates from China. According to Argus Media Group, global tungsten consumption was estimated to have increased slightly from that in 2023.

In 2024, the global tungsten reserves will be about 4.6 million tons, a year-on-year increase of 4.55%. Among them, China has the highest tungsten reserves, which are 2.4 million tons, accounting for 52.17% of the global total reserves.

In 2024, the global tungsten production will be about 81,000 tons, a year-on-year decrease of 1.89%. Among them, China has the highest tungsten production, which is 67,000 tons, a year-on-year increase of 1.52%, accounting for 81.48% of the global total production.

World tungsten resources are geographically widespread. China ranked first in the world in terms of tungsten resources and reserves and had some of the largest deposits. Significant tungsten resources have been identified on every continent except Antarctica.

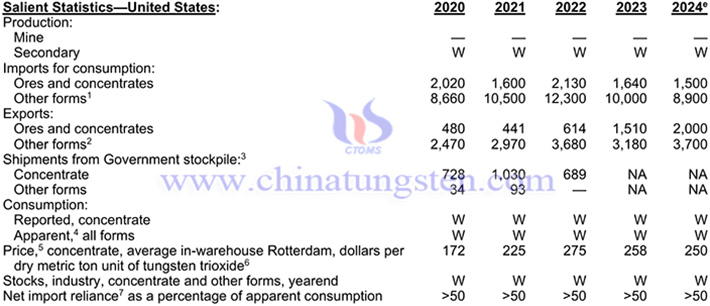

U.S. Tungsten Industry in 2024

Tungsten has not been mined commercially in the United States since 2015. There were seven U.S. companies that have the capability to convert tungsten concentrates, ammonium paratungstate (APT), tungsten oxide, and (or) scrap to tungsten metal powder, tungsten carbide powder, and (or) tungsten chemicals. An estimated 60% of the tungsten consumed in the United States was used in cemented carbide parts for cutting and wear-resistant applications, primarily in the construction, metalworking, mining, and oil- and gas-drilling industries. The remainder was used to make various alloys and specialty steels; electrodes, filaments, wires, and other components for electrical, electronic, heating, lighting, and welding applications; and chemicals for various applications.

In 2024, the United States is expected to import 1,500 tons of tungsten ore and concentrate, a year-on-year decrease of 8.54%; it is expected to import 8,900 tons of other tungsten products, a year-on-year decrease of 11.00%; it is expected to export 2,000 tons of tungsten ore and concentrate, a year-on-year increase of 10.42%; it is expected to export 3,300 tons of other tungsten products, a year-on-year decrease of 32.45%; it is expected that the inventory of tungsten ore and other tungsten products from the government is not counted; the price of tungsten concentrate denominated in WO3/KT is expected to be US$250, a year-on-year decrease of 3.10%. Note: Other tungsten products include tungstate, ferrotungsten, tungsten carbide, tungsten powder, unwrought tungsten, wrought tungsten forms, and tungsten scrap.

Import Sources (2020–23): Ores, concentrates, and other forms: China , 27%; Germany, 14%; Bolivia, 8%; Vietnam, 8%; and other, 43%.

source: USGS

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com