Erbium Oxide Prices - November 11, 2024

- Details

- Category: Tungsten's News

- Published on Monday, 11 November 2024 17:54

At the beginning of the week, the domestic rare earth market continued to operate steadily.

However, under the influence of various uncertainties, price negotiations between buyers and sellers have been intense, with most transactions focused on essential needs. This has resulted in difficulties in updating product prices and limited transaction volumes.

Currently, the prices for praseodymium-neodymium oxide, gadolinium oxide, and erbium oxide are holding steady at around 424,000 yuan per ton, 177,000 yuan per ton, and 305,000 yuan per ton, respectively.

Key Influencing Factors:

According to China Tungsten Online, the main factors influencing the volatility of rare earth prices include:

Geopolitical Risks: Significant external geopolitical risks have led to restricted imports of rare earth products into China. Customs data shows that in the first three quarters of 2024, China imported a total of 102,490 tons of various rare earth products, with imports from Myanmar accounting for 38.7%, a 24.0% year-on-year decrease.

U.S. Election and Domestic Policy: The conclusion of the U.S. election and the continued release of favorable domestic policies have boosted confidence in the market’s outlook.

Supply-Demand Imbalance: The ongoing issue of oversupply in the rare earth market continues to suppress price increases, making it difficult for product prices to rise or fall significantly.

Industry News:

According to reports from Baotou Rare Earth High-tech Zone, Baotou Jinli Permanent Magnet has expanded its production capacity. On top of its Phase 1 project, which produces 8,000 tons of high-performance rare earth permanent magnets annually, the company has invested in Phase 2, which will produce 12,000 tons of high-performance rare earth permanent magnets annually. Currently, the two-phase project has a total production capacity of 20,000 tons of rough material annually, making Baotou Jinli Permanent Magnet the largest sintered neodymium-iron-boron factory in the world by single production capacity. The workshops for machining, packaging, and surface treatment are in the process of equipment installation and debugging, and auxiliary facilities are nearing completion. Once fully operational, the project is expected to achieve an annual output value of 5 billion yuan, with an average output value of 25 million yuan per hectare.

These developments suggest a steady progression in China’s rare earth industry, though the market continues to face pricing challenges due to oversupply and geopolitical factors.

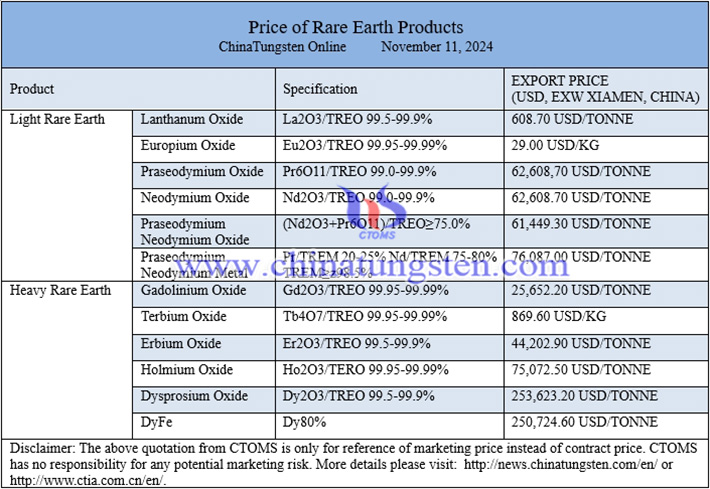

Prices of rare earth products on November 15, 2024

Picture of praseodymium oxide

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com