Domestic Molybdenum Market - November 11, 2024

- Details

- Category: Tungsten's News

- Published on Monday, 11 November 2024 17:50

At the beginning of the week, the domestic molybdenum market continued to display a stalemate, with neither a clear upward nor downward trend.

Under the complex and volatile global economic conditions, the supply and demand balance remains relatively steady. As a result, the atmosphere among traders is somewhat stuck, with suppliers reluctant to lower prices and buyers pushing hard for price reductions. This has led to a slow pace of market orders.

Currently, the focus for industry participants is on the number of bids and pricing in the steel mill tenders for ferro-molybdenum. Recently, steel companies involved in the bidding for ferro-molybdenum include Pangang, Erzhong Equipment, Shijiazhuang Steel, CITIC Pacific, and Xinxing Ductile Iron. As of now, prices for molybdenum concentrate, ferro-molybdenum, and sodium molybdate are quoted at around 3,750 yuan per ton unit, 242,000 yuan per ton, and 169,000 yuan per ton, respectively.

Market Data:

According to customs data, in October 2024, China imported 536,000 tons of steel, a decrease of 3.2% month-on-month. The country imported 103.84 million tons of iron ore, a slight drop of 0.3% month-on-month. Steel exports, however, increased by 10.1% month-on-month, totaling 11.18 million tons. From January to October 2024, China imported 5.72 million tons of steel, a year-on-year decrease of 10.1%; iron ore imports totaled 102.25 million tons, an increase of 4.9%; and steel exports reached 91.89 million tons, a year-on-year increase of 23.3%.

These figures reflect a steady demand for steel and raw materials, though the slow decline in steel imports and a slight decrease in iron ore imports suggest some caution in the domestic market.

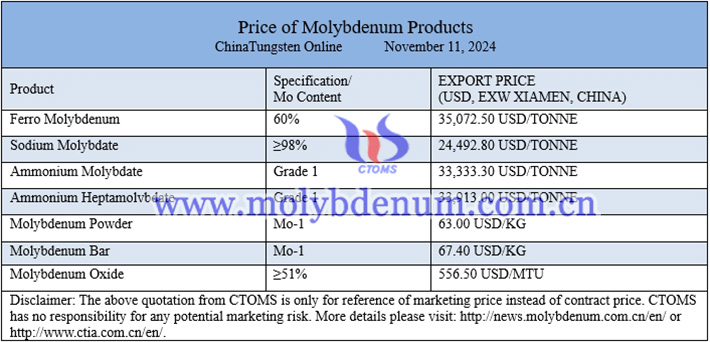

Prices of molybdenum products on November 11, 2024

Picture of TZC piercing plugs

Follow our WeChat to know the latest molybdenum price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com