Recent Developments in the Chinese Tungsten Markets: Prices, News, and Outlook

- Details

- Category: Tungsten's News

- Published on Sunday, 07 April 2024 09:42

Analysis of latest tungsten market from Chinatungsten Online

At the beginning of the week, Chinese tungsten market maintained a stable foundation supported by firm prices of tungsten raw materials. Recently, the announcement of long-term contract prices by tungsten enterprises and relatively positive macroeconomic news further supported the relatively high prices of tungsten products.

According to information from Chinatungsten Online, metals such as gold and copper, which have financial attributes, may see significant price increases in the medium to long term due to expectations of a decline in the US dollar and global inflation. As for tungsten and molybdenum, important key raw materials closely related to industrial production, whether they are on the verge of a significant price increase remains to be seen, and continued attention is warranted.

Recent news related to the tungsten and molybdenum market includes:

(1) Major tungsten companies announced upward adjustments to long-term contract prices: Xiamen Tungsten's purchase price for APT in the first half of April 2024 was $302.7/mtu, an increase of $4.0/mtu from the second half of March.

(2) Tungsten material and alloy companies have raised product prices.

Due to the continuous rise in the prices of raw materials such as tungsten concentrate, production costs have significantly increased. Downstream tungsten product companies, including tungsten rods, tungsten wires, cemented carbide, and tungsten alloys, have successively raised their product quotations.

(3) PMI returned to the expansion zone since September last year.

In March, China's Manufacturing Purchasing Managers' Index (PMI) was 50.8%, an increase of 1.7 percentage points from the previous month, indicating a rebound in manufacturing confidence.

(4) Record high scale of goods trade import and export.

From January to February 2024, China's total import and export value reached $930.86 billion, an increase of 5.5% compared to the same period last year. Among them, exports were $528.01 billion, an increase of 7.1%; imports were $402.85 billion, an increase of 3.5%; the trade surplus was $125.16 billion, an increase of 20.5%. In terms of RMB, China's total import and export value reached 66.1 trillion yuan, a year-on-year increase of 8.7%, setting a new record for the same period in history.

(5) Gold prices hit new highs.

Expectations of a US interest rate cut, escalating geopolitical tensions, and increased gold reserves by central banks worldwide have continuously driven gold prices to new highs. The London gold price rose by approximately 13.2% in 2023, and the Shanghai gold price rose by 17.3%. In March 2024, the London gold price rose by 9.28%, achieving its best monthly performance since July 2020. On April 1st, the highest price of the Shanghai Gold 2406 contract reached 535.16 yuan/gram, an increase of over 11% from March 1st. The international spot gold price once broke through $2260/ounce, with an intraday increase of 1%; New York Mercantile Exchange gold futures rose to $2278/ounce, with an intraday increase of 1.78%, both reaching historical highs. The prices of multiple gold brands in China are approaching the 700 yuan/gram mark.

(6) Copper prices may surpass $10,000 in the future.

Similarly, copper, a metal with both financial and commodity attributes, is expected to continue rising in price due to tight supply and strong demand in China, as well as global economic and political tensions. ANZ Bank predicts that copper prices will surpass $9,000 in the short term and exceed $10,000 in the next 12 months, with a refined copper deficit of 400,000 tons. ING expects copper prices to reach $9,000 by the end of the year, with refined copper deficits exceeding 1 million tons in 2025 and 2026. BMO Capital Markets estimates that copper prices will rise to over $9,000 in the long term. Capital Economics predicts that copper prices will reach $9,250 by the end of 2024. Goldman Sachs believes that there will be a supply deficit of 250,000 tons in the second quarter and 450,000 tons in the second half of the year, leading to a copper price of $10,000 by the end of the year.

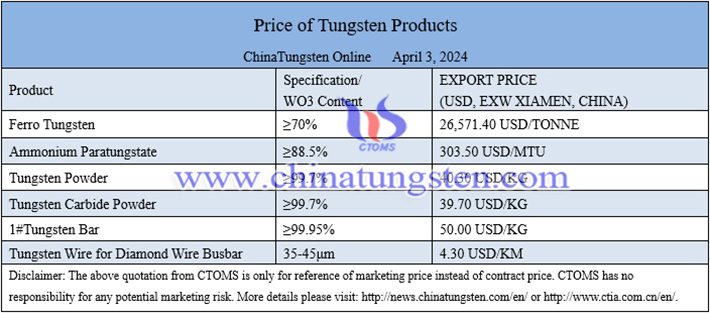

Prices of tungsten products on April 3, 2024

Picture of APT

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com