Tungsten Products Price Trend China,2021

- Details

- Category: Tungsten's News

- Published on Tuesday, 08 February 2022 10:48

Tungsten is an irreplaceable and non-renewable strategic metal resource in the field of national economy and modern national defense. It is the metal element with the highest melting point. Because of its excellent characteristics such as high melting point, high specific gravity, high hardness, strength and toughness and corrosion resistance, it is widely used in aerospace, shipbuilding industry, automobile manufacturing, electrical engineering, electronic information, chemical and petroleum, mining, iron and steel metallurgy, CNC machine tools, national defense and military and other important fields.

China is the largest tungsten resource country, producer, supplier and consumer in the world. More than 80% of the global tungsten industrial consumption comes from China every year.

According to the data of China's Ministry of natural resources, by the end of 2020, the identified resource reserves of tungsten mines in China were 2,224,900 tons (WO3 content), a decrease of 4.5% compared with the end of 2015. Tungsten resources are distributed in 24 provinces and regions, including Jiangxi 1,157,000 tons, Hunan 554,300 tons, Henan 232,000 tons, Fujian 93,400 tons, Gansu 47,600 tons, Xinjiang 45,500 tons, Yunnan 40,200 tons, Inner Mongolia 22,700 tons, Guangdong 12,900 tons, Guangxi 11,800 tons, Zhejiang 5,200 tons, Hubei 22,000 tons and Qinghai 100 tons.

According to the mineral product summary 2021 data of the United States Geological Survey (USGS), by the end of 2020, the world's tungsten resource reserves were 3.4 million tons, of which China's tungsten reserves were 1.9 million tons, accounting for nearly 56%; Russia has 400,000 tons of tungsten reserves, ranking second; Followed by Vietnam (95,000 tons), Spain (54,000 tons), North Korea (29,000 tons), Mongolia (29,000 tons), Australia (10,000 tons) and Portugal (3,100 tons).

In 2020, the world's Tungsten output will be 84,000 tons, of which China's Tungsten output will be 69,000 tons, accounting for more than 82%; Vietnam's Tungsten output is 4,300 tons, ranking second; Followed by Russia (2,200 tons), Mongolia (1,900 tons), Bolivia (1,400 tons), Rwanda (1,000 tons), Australia (890 tons), Spain (800 tons), Portugal (680 tons) and North Korea (500 tons).

For more tungsten market analysis & news, please visit www.ctia.com.cn

More about tungsten products & its applications, please visit www.tungsten.com.cn

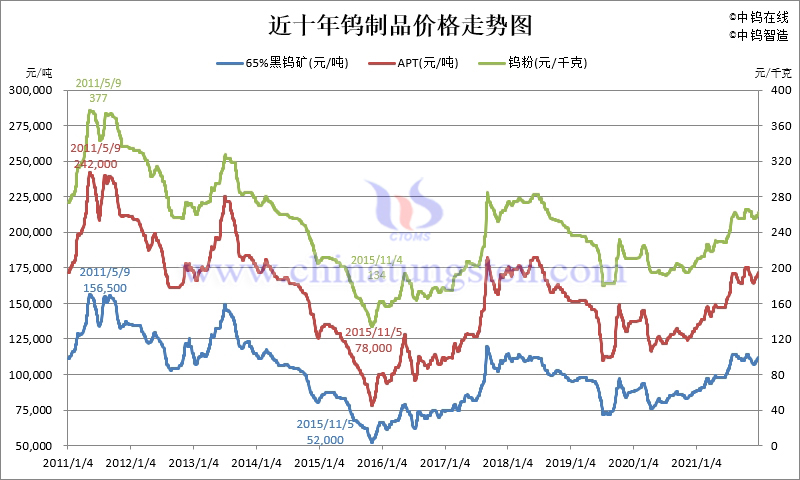

I. Price Trend of Tungsten in Recent Ten Years

From 2011 to 2021, the price of tungsten products in China experienced four peaks and three troughs. The overall market feature is that the price of tungsten products is obviously affected by both market and non market factors, as well as the demand of domestic and international markets; The market price of tungsten products has not fluctuated much in the past decade, the price trend fluctuates less and the market is becoming more and more rational.

A. After the 2008 financial crisis, the world economy recovered rapidly. The supply constraints of the tungsten market, strong demand, rising costs and the resonance of the bull market of bulk commodities stimulated the price of tungsten concentrate to soar from the low of RMB59,000 Yuan/MT in 2009 to RMB156,500 Yuan/MT in May 2011 (some offers reached RMB158,000 Yuan/MT). This value is the highest price of tungsten concentrate in history.

Related reading: What is the highest price of tungsten concentrate in history?

B. After the bull market, the fear of high market sentiment and inventory clearing operation led to the negative decline of ore price to RMB103,000 Yuan/MT (August 2012).

C. Large scale hoarding by institutions and leading enterprises stimulated the price of tungsten concentrate to reach a high of RMB147,000 Yuan/MT in July 2013.

D. In November 2015, the price of tungsten concentrate hit the lowest point of RMB52,000 Yuan/MT in ten years, mainly due to market panic caused by the cashing crisis of Pan Asian Nonferrous Metals Exchange, unsalable tungsten products, upside down smelters and a large-scale decline in the operating rate of tungsten enterprises. (Related reading: What is the historical lowest price of tungsten concentrate?)

E. China's environmental protection inspectors became stricter, the scarcity and cost of strategic minerals increased, and the ore price rose to RMB120,000 Yuan/MT (September 2017).

F. Tension between China and the United States, Pan Asian inventory concerns and the decline in terminal demand for automobiles, the price of tungsten concentrate fell to RMB72,000 Yuan/MT (August 2019). On September 17, Luoyang molybdenum industry purchased 28,000 tons of apt at a price of RMB115,338 Yuan/MT, encouraging the market to recover.

G. Since the beginning of this year, China's strong economic recovery after the epidemic has driven market consumption. During the year, the price of tungsten products generally showed an upward trend, and the ore price reached the peak of RMB114,000 Yuan/MT in August.

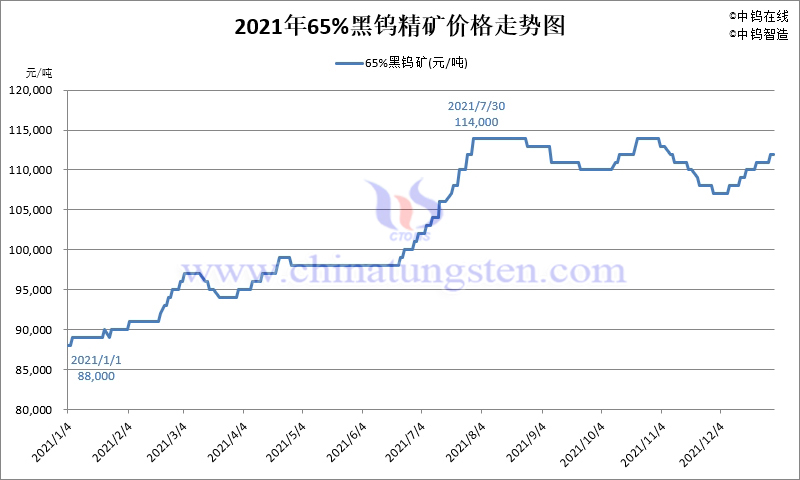

II. Price Trend of Tungsten Concentrate in 2021

In 2021, the average price of 65% wolframite concentrate was RMB103,100 Yuan/MT, up about 21.9% from RMB84,600 Yuan/MT in 2020.

In 2021, the average price of 65% Scheelite Concentrate was RMB101,100 Yuan/MT, up about 22.4% from RMB82,600 Yuan/MT in 2020.

At the beginning of 2021, the price of 65% wolframite concentrate was RMB88,000 Yuan/MT (the lowest value in the year), an increase of about 29.5% compared with the highest value of RMB114,000 Yuan/MT in the year; Compared with RMB112,000 Yuan/MT at the end of the year, the increase was about 27.3%.

In the first quarter of 2021, the average price of 65% wolframite concentrate was RMB92,300 Yuan/MT, up 8.3% month on month and 2.9% year-on-year (the average price in the first quarter of 2020 was RMB89,700 Yuan/MT); The average price in the second quarter was RMB97,900 Yuan/MT, up 6.1% month on month and 23.3% year-on-year (the average price in the second quarter of 2020 was RMB79,400 Yuan/MT); The average price in the third quarter was RMB110,600 Yuan/MT, up 13.0% month on month and 30.9% year-on-year (the average price in the third quarter of 2020 was RMB84,500 Yuan/MT); The average price in the fourth quarter was RMB110,600 Yuan/MT, which was basically the same month on month, with a year-on-year increase of 29.9% (the average price in the fourth quarter of 2020 was RMB85,200 Yuan/MT).

The overall price trend of tungsten concentrate is consistent with China's economic recovery after the epidemic. It rose rapidly in the first half of the year, slowed down gradually after the third quarter and fell back in the fourth quarter. Tungsten concentrate prices peaked twice during the year. The rise in July was mainly due to the soaring commodity prices in the second quarter caused by frequent global inflation and extreme events, and the lag of tungsten market; October was due to the rise in market production costs caused by the global energy shortage.

According to the data of China Tungsten Association, in 2021, China's tungsten concentrate production capacity was 176,000 tons, a year-on-year increase of 1.73%, and the estimated output was about 138,800 tons, a year-on-year increase of 0.14%.

III. Price Trend of Ammonium Paratungstate (APT) in 2021

IV. Price Trend of Tungsten Powder & Tungsten Carbide Powder in 2021

V. Price Trend of Ferro Tungsten (FeW70) in 2021

VI. Price Trend of Tungsten Bars in 2021

VII. Price trend and main factors of metal cobalt powder (CO) in 2021

IIX. Price Trend of Tungsten by Ganzhou Tungsten Association, 2020 to 2021

IX. Long-Term Order Price Trend of Tungsten Zhangyuan Tungsten 2020 to 2021

X. Long-Term Order Price of W-Concentrate of Jiangxi Tungsten, 2020 to 2021

XI. Long-Term Order Price of APT of Xiamen Tungsten 2020 to 2021

XII. Long-Term Order Price of Tungsten Xianglu Tungsten 2020 to 2021

XIII. Forecast of the Price of Tungsten Products in 2022

Read/download the full report:

'Tungsten Products Price Trend China,2021'

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com