Europe Trying to Decrease Utilization of Rare Earth Magnets

- Details

- Category: Tungsten's News

- Published on Tuesday, 16 November 2021 21:43

According to a report by IDTechEx, efforts are underway in Europe to reduce the use of rare earth magnets materials, especially heavy rare earths. The EU's strategy is aimed at protecting its EV industry from price volatility driven by other countries, as China currently dominates the supply of rare earths.

In 2011, the prices of neodymium and dysprosium rose by about 750% and 2000%, respectively, due to restrictions on exports of rare earths. But according to IDTechEx, despite European efforts, production of PMs will not stop completely, given their superior efficiency and power density. In fact, in 2020, 77% of the electric vehicle market uses PM motors.

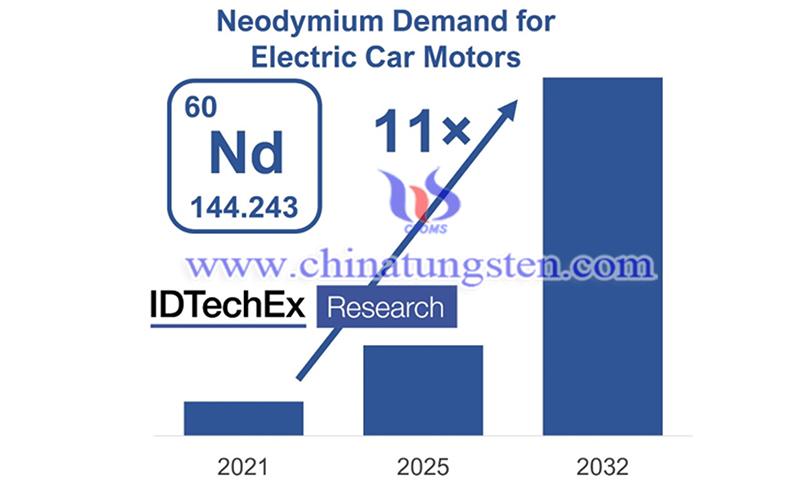

In this context, IDTechEx reports that demand for neodymium in battery electric vehicles is expected to reach 11 times higher in 2032 than in 2021. Other automakers such as BMW are also switching to wound rotor designs, in this case, the fifth-generation drive system that will power their next generation of electric vehicles, including the iX3, i4 and other cars.

Wound rotor configurations use copper windings on the rotor, while induction motors, like those historically used by Tesla for its Model S and X, use copper or aluminum cages on the rotor. However, Tesla has been one of the companies that have persevered, starting their Model 3 with a permanent magnet motor while keeping the induction motor on the front axle. Audi's new Q4 e-tron for 2021 takes a similar approach.

"While we have seen some divergence in the European market, price volatility is not as much of a concern as China largely controls rare earth supply and they are unlikely to move away from permanent magnet machines. Since China is one of the largest markets for electric vehicles, this means that rare earth magnets motors are here to stay."

The price of praseodymium oxide or NdPr (two of the 17 rare earth elements used in NdFeB magnets) soared to $115,000 per ton last Thursday, the highest price since November 2011, after the price of neodymium and dysprosium rose 2.2 times at the beginning of the year, according to Shanghai Steelhome E-Commerce.

"In addition to the price issue, there are environmental concerns," the IDTechEx report reads. "Rare earths are extracted from ores, which can contain radioactive materials such as thorium, and the extraction of the required rare earths typically uses large amounts of carcinogenic compounds such as ammonia, hydrochloric acid and sulfates."

"It is estimated that processing one ton of rare earths can generate up to 2,000 tons of toxic waste. This must change for electric vehicles to truly be a transition to green technology."

- Rare Earth Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com