70,000 Tons of China's Tungsten Output in 2019, Over 80% of World's Total

- Details

- Category: Tungsten's News

- Published on Tuesday, 31 March 2020 21:03

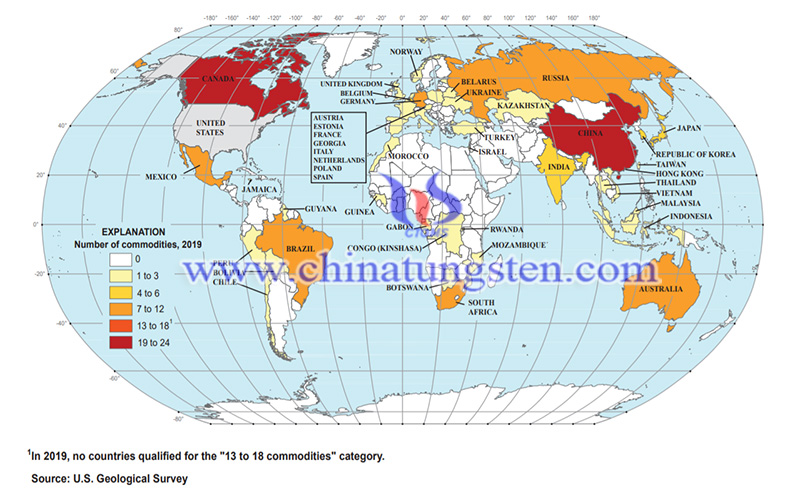

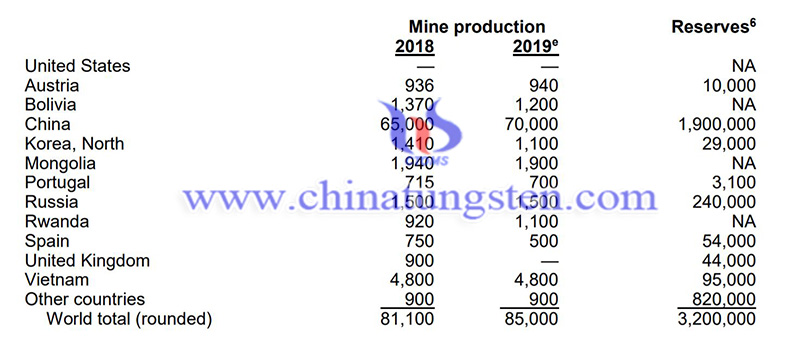

Per the mineral product summary 2020 data of U.S Geological Survey (USGS), the world's tungsten reserves were 3.2 million tons as of the end of 2019, of which the reserves in China were 1.9 million tons, which was the world's largest resource country; Russia, 240,000 tons, ranks second; followed by Vietnam, 95,000 tons; Spain, 54,000 tons; the United Kingdom, 44,000 tons; North Korea, 29,000 tons; Australia, 10,000 tons; and Portugal, 3100 tons.

The world's tungsten output was 85,000 tons in 2019, of which China's output was 70,000 tons, accounting for 82.35%, as well as was the world's largest producer; followed by Vietnam, 4,800 tons; Mongolia, 1900 tons; Russia, 1500 tons; Bolivia, 1200 tons; North Korea,1100 tons; Rwanda,1100 tons; Australia, 740 tons; Portugal, 700 tons; Spain, 500 tons.

Since 2015, there has been no known domestic commercial production of tungsten concentrates in the United States. About six companies use chemical processes to convert the concentrates, ammonium paratungstate (APT), its oxide, and (or) scrap into metal powder, carbide powder, and (or) its chemicals. Nearly 60% of the metal is used for cutting and wear-resistant applications, primarily used in construction, metalworking, mining, and oil-gas drilling industries. The remaining was used to make various alloys and specialty steels; electrodes, filaments, wires, and other components for electrical, electronics, heating, lighting, and welding, as well as chemicals for various applications. The estimated value of apparent consumption in 2019 was approximately $700 million.

2015 to 2018 U.S. ores and concentrates, intermediate and primary products, wrought and unwrought, and tungsten contained in waste and scrap, mainly imported from China, 31%; Bolivia, 10%; Germany, 9%; Spain, 6%; and others, 44%.

The world supply of the metal was dominated by Chinese production and export. The Chinese government has regulated the industry by limiting the number of mining and export licenses, implementing a quota system for concentrate production, and imposing restrictions on mining and processing. It was expected that the output of tungsten concentrates outside the country in 2019 would be lower than in 2018, partly because the owner closed the only mine in the UK after the owner entered voluntary administration at the end of 2018. Scrap continued to be an important source of raw materials for the industry worldwide.

China was the world's largest consumer of tungsten. Analysts predicted that the global demand of the metal last year to be lower than in 2018, mainly due to consumer destocking and reduced consumption due to slowing global economic growth. In September 2019, APT stocks equivalent to 3 months of production in the country were sold from the Fanya Metal Exchange to a leading Chinese mining and processing company of the metal. This relieved some of the uncertainty that had been hanging over the global market since the exchange’s collapse in 2015. For most of the last year, the prices of the concentrates and the downstream materials in China and Europe showed a downward trend; prices increased following the Fanya sale.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com