Rare Earths for Tariffs

- Details

- Category: Rare Earth News

- Published on Wednesday, 29 October 2025 11:21

- Hits: 2

According to Reuters, on October 26, 2025, the United States and China reached a "very important framework agreement" in Kuala Lumpur, Malaysia, aimed at easing bilateral trade frictions. The agreement will avoid the US imposing 100% tariffs on Chinese goods and postpone China's controls on rare earth exports.

Rare Earth Market - October 28, 2025

- Details

- Category: Rare Earth News

- Published on Tuesday, 28 October 2025 19:11

- Hits: 17

Rare earth market update on October 28, 2025

The domestic rare earth market overall showed a slight improvement, primarily reflected in most product prices halting their decline and rebounding, heightened enthusiasm among traders to enter the market, and increased transaction volumes.

Rare Earth Market - October 27, 2025

- Details

- Category: Rare Earth News

- Published on Monday, 27 October 2025 14:38

- Hits: 107

Rare earth market update on October 27, 2025

The domestic rare earth market presented a general downward trend on Monday, primarily attributed to weak downstream demand, insufficient supplier confidence in maintaining prices, and heightened concerns among industry players about future prospects.

Rare Earth Market - October 24, 2025

- Details

- Category: Rare Earth News

- Published on Friday, 24 October 2025 18:23

- Hits: 12

Rare earth market update on October 24, 2025

This week, domestic rare earth prices overall continued the downward trend from last week, though the decline has narrowed compared to the previous week.

Molybdenum Prices - October 23, 2025

- Details

- Category: Rare Earth News

- Published on Thursday, 23 October 2025 19:14

- Hits: 0

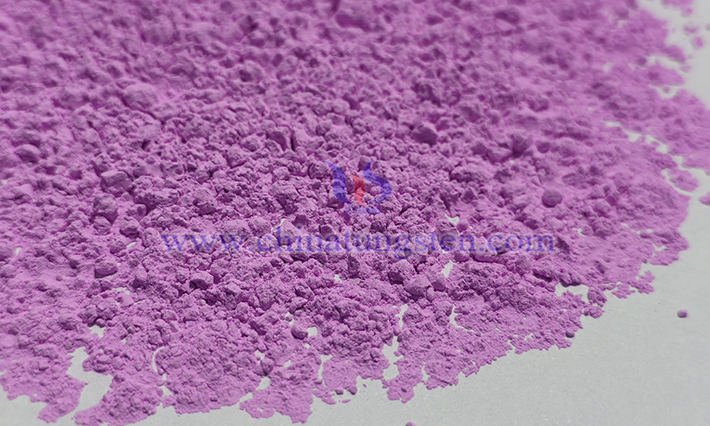

Molybdenum market update on October 23, 2025

Domestic molybdenum prices overall continue to slide, with prices of molybdenum concentrate, ferromolybdenum, and ammonium heptamolybdate decreasing by approximately RMB 50 per ton-unit, RMB 2,000 per ton, and RMB 1,000 per ton, respectively. Against this backdrop, the enthusiasm of downstream users for inquiries and procurement has not significantly increased, resulting in persistently slow order growth.

Rare Earth Market - October 23, 2025

- Details

- Category: Rare Earth News

- Published on Thursday, 23 October 2025 19:10

- Hits: 5

Rare earth market update on October 23, 2025

The domestic rare earth market overall maintains stable operation, with a mix of bullish and bearish factors leading traders to focus on rigid transactions, resulting in moderate market activity and temporarily stable product prices.

Rare Earth Market - October 22, 2025

- Details

- Category: Rare Earth News

- Published on Wednesday, 22 October 2025 16:39

- Hits: 62

Rare earth market update on October 22, 2025

The domestic rare earth market has generally shown a trend of stabilizing after a decline, mainly attributed to the enhanced profit awareness of suppliers and the increased enthusiasm of downstream users for bargain hunting.

Rare Earth Market - October 21, 2025

- Details

- Category: Rare Earth News

- Published on Tuesday, 21 October 2025 11:35

- Hits: 83

Rare earth market update on October 21, 2025

The domestic rare earth market continues to exhibit a bearish downward trend, primarily due to reduced market demand and a high willingness among suppliers to lower prices for shipments.

Rare Earth Market - October 20, 2025

- Details

- Category: Rare Earth News

- Published on Monday, 20 October 2025 15:37

- Hits: 68

Rare earth market update on October 20, 2025

On Monday, the domestic rare earth market overall continued the weak pattern from last week. Affected by numerous uncertain factors, the prices of mainstream light rare earth products continued to decline, while the prices of medium and heavy rare earth products maintained a sideways consolidation trend.

JLMAG's Net Profit Is Expected to Increase by 179% in the First Three Quarters of 2025

- Details

- Category: Rare Earth News

- Published on Monday, 20 October 2025 14:28

- Hits: 58

In the first three quarters of 2025, JL Mag Rare-Earth Co., Ltd. (JLMAG)is expected to achieve net profit attributable to shareholders of the parent company (NPASP) of RMB 505.00 million to RMB 550.00 million, increased by 157% to 179% year-on-year; non-recurring profit and loss-adjusted net profit of RMB 415.00 million to RMB 460.00 million, increased by 365% to 415% year-on-year. For the third quarter, the company is expected to realize NPASP of RMB 200.047 million to RMB 245.047 million, increased by 159% to 217% year-on-year; and non-recurring profit and loss-adjusted net profit of RMB 180.9875 million to RMB 225.9875 million, increased by 228% to 309% year-on-year.

sales@chinatungsten.com

sales@chinatungsten.com