APT Price Hits New All-Time High - October 28, 2025

- Details

- Category: Tungsten's News

- Published on Tuesday, 28 October 2025 17:29

Analysis of Latest Tungsten Market from Chinatungsten Online

The tungsten market remains strong. Upstream raw materials are experiencing tight supply, while midstream smelting products are reaching new highs driven by cost pressures.

Powder products have seen limited price increases due to poor demand. Downstream tungsten product manufacturers, such as cemented carbide, continue to implement a production-as-needed strategy. The overall tungsten market is experiencing a slow transaction pace, with profits skewed towards the raw materials sector and significant pressure on the processing sector.

Tungsten concentrate prices have returned to historical highs, primarily driven by tight supply. On the one hand, annual mining targets have yet to be announced, and the release of new domestic and international mine capacity is currently limited. On the other hand, strong bullish sentiment among holders is a reluctance to sell, exacerbating the tight supply and firm prices in the market.

The price of 65% wolframite concentrate was reported at RMB 288,000/ton, a 101.4% increase from the beginning of the year.

The price of 65% scheelite concentrate was reported at RMB 287,000/ton, a 102.1% increase from the beginning of the year.

The price of ammonium paratungstate (APT) hit a new record, driven by both supply and demand in the industry and costs. Traders have been relatively optimistic recently, with a strong market sentiment, but trading volume has shrunk.

Domestic APT prices are reported at RMB 425,000/ton, up 101.4% from the beginning of the year.

European APT prices are reported at USD 610-685/mtu (RMB 384,000-431,000/ton), up 96.2% from the beginning of the year.

Tungsten powder prices have passively followed the increase, but market consumer sentiment is weak, and downstream users are generally purchasing on demand, limiting the extent of price increases.

Tungsten powder prices are reported at RMB 635/kg, up 101% from the beginning of the year.

Tungsten carbide powder prices are reported at RMB 620/kg, up 99.4% from the beginning of the year.

Cobalt market prices are in a period of high volatility. The impact of supply policy changes in major producing countries is gradually being digested by the market, and industry demand resistance has once again become a focus, causing some arbitrage to retreat from high levels.

Cobalt powder prices are reported at RMB 500/kg, up 194.1% from the beginning of the year.

Ferrotungsten prices are gradually rising, supported by high tungsten ore prices. The consumer market has not seen significant fluctuations, with cautious trading based on demand.

70 ferrotungsten prices are reported at RMB 395,000/ton, up 83.7% from the beginning of the year.

European ferrotungsten prices are reported at USD 87-90.75/kg W (RMB 433,000-452,000/ton), up 102% from the beginning of the year.

Tungsten waste and scrap prices are rising alongside tungsten raw material prices, but market participants are experiencing some divergence in sentiment. Both sellers' enthusiasm for accepting orders and buyers' willingness to accept goods have waned, leading to a decrease in overall risk appetite and caution in quick-entry and quick-exit strategies.

Tungsten scrap bar prices are reported at RMB 438/kg, up 99.1% from the beginning of the year.

Tungsten scrap drill bit prices are reported at RMB 420/kg, up 84.2% from the beginning of the year.

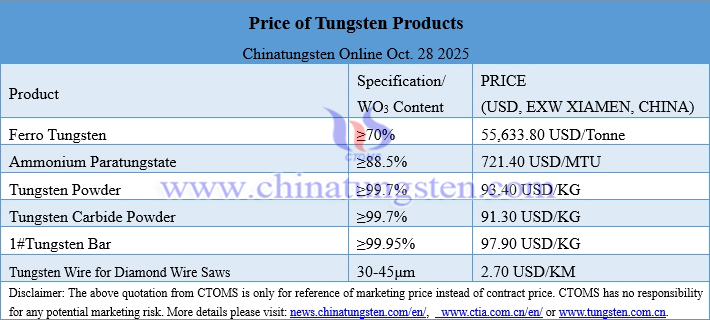

Prices of Tungsten Products on October 28, 2025

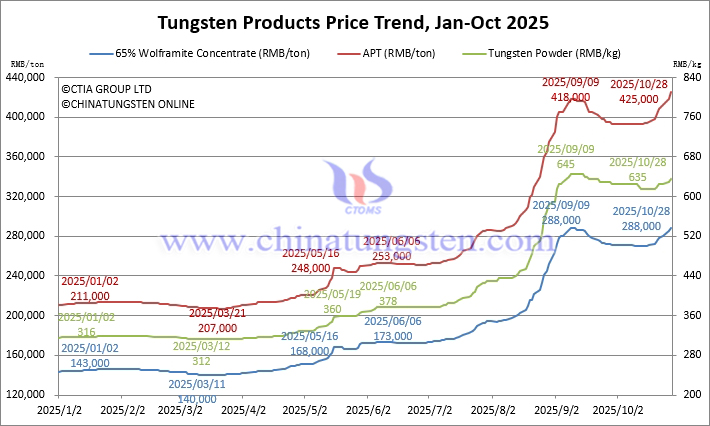

Tungsten Price Trend from January to October 28, 2025

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com