New Opportunities for China's Tungsten Cemented Carbide Industry amidst the US-China Tariff Dispute

- Details

- Category: Tungsten's News

- Published on Friday, 11 April 2025 16:17

With the continuous evolution of China-US trade relations, key metal mineral products have become an important area of contention between the two sides. The United States has imposed tariffs of up to 125% on Chinese goods, but key minerals and energy products such as tungsten and rare earths are included in the exemption list. However, as a countermeasure, China has implemented export controls on tungsten, molybdenum, and some medium and heavy rare earth-related items on February 4 and April 4, 2025, respectively. This policy asymmetry has brought significant development opportunities for China's tungsten cemented carbide industry, especially in the fields of high-end cutting tools and machine tools, where restrictions on American companies have provided Chinese companies with the space to seize the market.

1. US High-End Cutting Tools Hindered, Chinese Companies Welcome Market Opportunities

The US high-end cutting tools and machine tool industry relies on tungsten cemented carbide products processed from key metals such as tungsten. Companies like Kennametal, Haas Automation, and Hardinge hold important positions in global manufacturing. However, China's implementation of dual-use item controls on tungsten products and strict controls on rare earth products exported to the US have significantly increased the difficulty for American companies to obtain raw materials. More critically, based on Trump's "reciprocal tariff" and China's counter-tariff measures, US high-end cutting tools face high tariff barriers when trying to enter the Chinese market, which not only weakens their price competitiveness but also limits their market penetration capability.

In contrast, Chinese tungsten cemented carbide companies, represented by Xiamen Tungsten's Jinlu Alloy, are seizing the opportunity to capture the high-end cutting tool market with their abundant tungsten resources, deep technical accumulation, and vast domestic market. China is the world's largest tungsten producer, with a complete industrial chain and continuously improving technological level. Against the backdrop of hindered US high-end cutting tools, Chinese companies are expected to accelerate filling the market gap, especially achieving breakthroughs in high-end fields such as aerospace and automotive manufacturing. This will not only enhance the global competitiveness of China's tungsten cemented carbide industry but also promote its advancement towards high-end products.

2. China's Reverse Control Benefits the Tungsten Industry, Enhancing the Value Chain

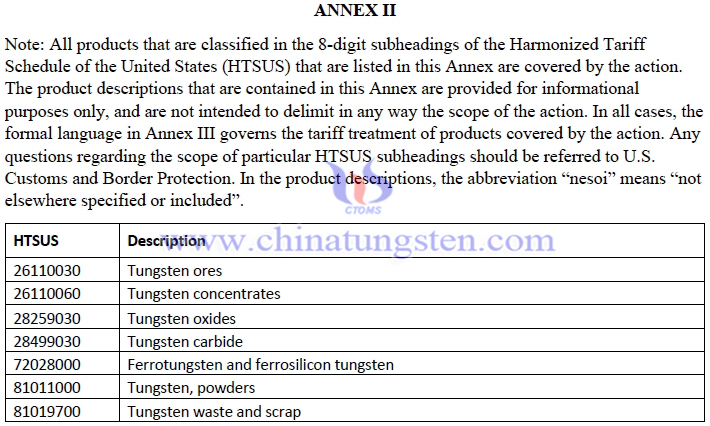

Although the US has imposed high tariffs on Chinese goods, key raw materials such as tungsten ore, tungsten concentrate, tungsten oxide, and tungsten carbide are included in the exemption list, indicating that the US has not cut off the import channel for Chinese tungsten raw materials. However, China has adopted a proactive defense strategy by implementing reverse controls on tungsten, molybdenum, and rare earth-related items. This control does not completely prohibit exports but increases the cost and uncertainty for the US to obtain these resources through policy adjustments. This strategy not only ensures domestic resource security but also brings dual benefits to tungsten raw material companies and deep processing enterprises.

For the domestic tungsten industry, reverse control stabilizes resource supply and promotes the overall enhancement of the tungsten value chain. According to Chinatungsten Online, tungsten powder, tungsten scrap, and other items are on the tariff exemption list, which retains export flexibility for Chinese companies while keeping more value domestically through control measures. As a strategic resource, tungsten's value is becoming increasingly prominent in global supply chain adjustments, and Chinese companies are expected to take this opportunity to transform from raw material suppliers to high-end product manufacturers.

3. US Supply Chain Adjustment Unlikely to Shake China's Advantage in the Short Term

Facing China's export controls, the US is attempting to replace the supply chain and find alternative sources for tungsten and rare earths. However, this process is unlikely to pose a significant threat to China's industry in the short term. The mining and processing of tungsten and rare earths require long-term technical accumulation and infrastructure support, and the production capacity of the US and other countries (such as Australia and Canada) cannot quickly replace China. For example, although the US has increased investment in rare earth development in recent years, its tungsten industry chain still relies heavily on imports and cannot achieve self-sufficiency in the short term.

China's position in the global tungsten market is not only the result of resource endowment but also the crystallization of years of industrial integration and technological progress. The US needs time, capital, and technological breakthroughs to replace the supply chain, while Chinese companies can use this window period to further consolidate their advantages. Whether in resource reserves or processing capabilities, China's tungsten cemented carbide industry will maintain its competitive dominance in the short term, buying valuable time for technological upgrades and market expansion.

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com