Tungsten Weekly: Small Prices Rise, Supply-Demand Deadlock

- Details

- Category: Tungsten's News

- Published on Friday, 28 March 2025 14:49

Analysis of latest tungsten market from Chinatungsten Online

This week, tungsten prices showed a slight upward trend, with ongoing and intensifying competition between the upstream and downstream segments of the industrial chain.

The market's bullish and bearish momentum displayed characteristics of a phased transition. The contradiction between tungsten's strategic resource attributes and short-term economic cycles continued to persist, and under the tug-of-war between supply and demand, the recovery trajectory of the tungsten industry remains to be observed.

The price of 65% black tungsten concentrate rose above $19,929.6/ton, reflecting a standoff in the market characterized by "miners holding firm on prices while end-users remain on the sidelines." Rigid supply-side constraints bolstered market confidence, but downstream procurement momentum remained limited, with spot circulation in the market continuing to be tight.

Ammonium paratungstate (APT) prices edged toward $332.6/ton in some areas, driven by cost support, the depletion of previously low-priced inventories, and rigid demand orders. However, the severe mismatch between supply and demand persists, undermining market stability, with participants generally adopting a cautious wait-and-see approach.

Tungsten powder was priced at $44.1/kg, while tungsten carbide powder stood at $43.4/kg. Cobalt powder prices surged by 70% to $ $39.4/kg due to export policy changes in the Democratic Republic of Congo, indirectly prompting price adjustments for some cobalt-containing cutting tool products. Nevertheless, the downstream consumer market's ability to absorb these increases remains weak, and cemented carbide companies continue to adopt a need-based procurement strategy for tungsten and cobalt raw materials.

The price of 70% ferrotungsten stabilized around $30,422.5/ton. Amid macroeconomic uncertainties intertwined with expectations for strategic resources, the market fundamentals remained deadlocked, and trading activity was moderate.

The scrap tungsten market showed signs of a structural recovery, with offers slightly increasing during the week. However, the overall recycling system continues to be constrained by the pace of downstream demand recovery, with supply and demand still in contention and liquidity limited.

On the macroeconomic front, according to data from the National Bureau of Statistics, industrial profits of enterprises above a designated scale declined slightly by 0.3% year-on-year from January to February, indicating that the momentum for real economy recovery still needs strengthening. As a key strategic resource in the industrial sector, tungsten's demand is closely tied to industrial prosperity. The 11.7% profit growth in the automotive manufacturing sector and the explosive 125.5% profit surge in smart equipment during January-February highlight new trends in industrial upgrading. Tungsten-based cemented carbide, a critical material for high-end cutting tools and wear-resistant components, stands to directly benefit from the expanding demand in end-use sectors such as new energy vehicles and industrial robots.

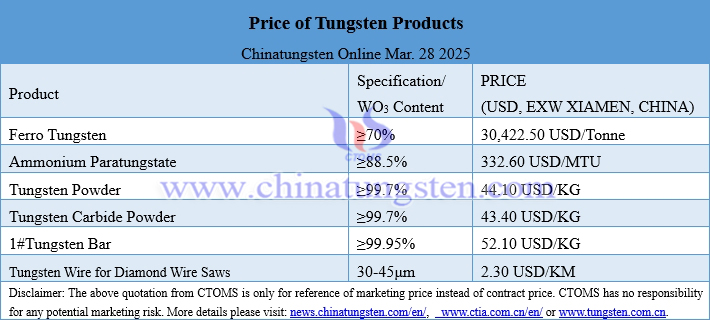

Prices of tungsten products on March 28, 2025

Picture of ammonium metatungstate

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com