Tungsten Price Stable with Caution, Cobalt Market Heat Fades

- Details

- Category: Tungsten's News

- Published on Thursday, 20 March 2025 17:46

Analysis of latest tungsten market from Chinatungsten Online

The domestic tungsten price currently shows a predominantly stable trend, with recent essential demand gradually entering the market, creating a certain level of activity.

However, the overall market remains in a tug-of-war between buyers and sellers, with clear competition between supply and demand. Due to insufficient conditions for a fundamental market recovery, participants generally adopt a cautious approach, with a strong wait-and-see sentiment prevailing.

It is worth noting that overseas tungsten raw material suppliers are hoping for a price increase to enhance the profitability of projects lacking cost competitiveness.

The price of 65% wolframite concentrate remains steady at $19,718.3/ton, with tight supply providing support for the market. However, weak demand has dampened buying enthusiasm, resulting in limited market liquidity.

Ammonium paratungstate (APT) is priced at $331.0/mtu, with poor profit margins. Industry insiders are closely watching the trends in the next round of long-term procurement prices from tungsten companies.

Tungsten powder is priced at $43.9/kg, and tungsten carbide powder at $43.2/kg. Due to unclear expectations for domestic demand recovery and the lack of visible effects from relevant policy implementations, purchasing activity in the cemented carbide sector remains low. The market is primarily driven by on-demand shipments, with prices temporarily stable and a heavy wait-and-see mood.

The price of 70% ferro tungsten is reported at $30,422.5/ton, influenced by the stalemate in the tungsten raw material market. Trading activity is moderate, with rigid demand supporting price stability, while the market awaits directional news to provide guidance.

The price of tungsten waste and scrap remains stable, but market confidence among traders shows clear divergence, with sentiment fluctuating between upward probing and downward pressure. Tight supply in the primary market benefits the recycling industry, though insufficient domestic demand limits transaction activity.

The cobalt market has seen a decline in momentum, as demand has underperformed expectations, and some traders have chosen to cash in profits after a price surge. Currently, there is significant disagreement among industry players regarding the price range and sustainability of the market trend influenced by the export ban from the Democratic Republic of Congo. Cobalt powder prices remain steady at $39.4/kg.

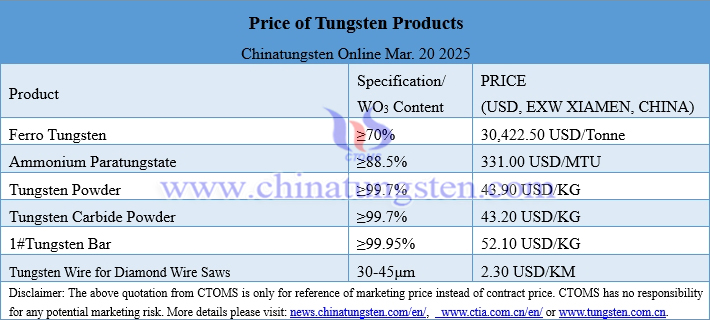

Prices of tungsten products on March 20, 2025

Picture of tungsten alloy shielding tank

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com