Molybdenum Market Update - February 21, 2025

- Details

- Category: Tungsten's News

- Published on Friday, 21 February 2025 15:12

Molybdenum market update on February 21, 2025

This week, the domestic molybdenum market remained subdued.

Influenced by factors such as fluctuating international molybdenum prices, steady downstream demand, persistent price pressure from steel companies, weakening production cost support, and increasing market supply, traders adopted a cautious wait-and-see approach. As a result, product prices showed minimal fluctuations. Ferromolybdenum prices experienced a slight decline of 0.43%, while prices for other molybdenum products remained relatively stable.

According to China Tungsten Online, the Chinese molybdenum market has been range-bound for two to three consecutive months. This stagnation is not due to weaker-than-expected downstream demand but rather stems from intense price negotiations between buyers and sellers, with neither side willing to concede on margins. Recent ferromolybdenum bidders included Zhongtian Steel, China First Heavy Industries, Jiangsu Shagang, Nanjing Steel, and Guangdong Shaoguan Iron & Steel.

According to data from the United States Geological Bureau, by the end of 2024, the global molybdenum reserves will be about 15,000 kilotons, the same as last year; among them, China's molybdenum reserves are the highest, at 5,900 kilotons, accounting for 39.33% of the global total reserves. In 2024, the global molybdenum production is expected to be approximately 260,000 tons, up 4.84% year-on-year; among them, China has the highest molybdenum production of 110,000 tons, up 14.58% year-on-year, accounting for 42.31% of the global total production.

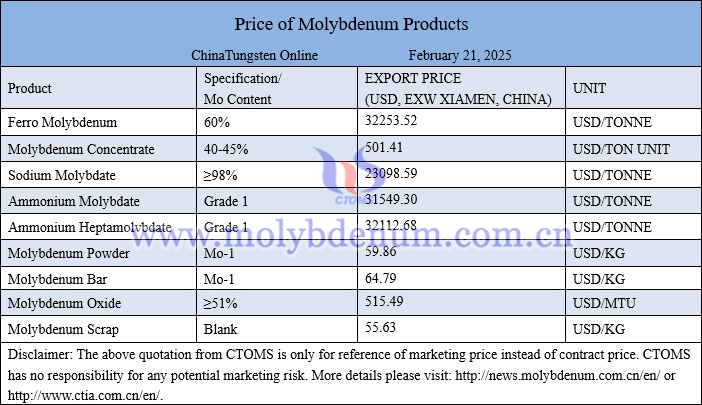

Prices of molybdenum products on February 21, 2025

Silicon molybdenum rod picture

![]()

Follow our WeChat to know the latest tungsten price, information and market analysis.

| Molybdenum Supplier: Chinatungsten Online www.molybdenum.com.cn | Tel.: 86 592 5129595/5129696 Email:sales@chinatungsten.com |

| Tungsten News & Prices: Chinatungsten Online news.chinatungsten.com | Molybdenum News & Molybdenum Price: news.molybdenum.com.cn |

sales@chinatungsten.com

sales@chinatungsten.com