Molybdenum Market Update - February 12, 2025

- Details

- Category: Tungsten's News

- Published on Wednesday, 12 February 2025 19:28

Molybdenum market update on February 12, 2025

The domestic molybdenum market has shown a generally stable but slightly weak trend, primarily reflected in the strong wait-and-see sentiment among traders and a slight decline in the prices of some molybdenum products.

Today, the prices of molybdenum concentrate, ferromolybdenum, and ammonium tetramolybdate have stabilized at approximately RMB 3,570 per ton-degree, RMB 230,000 per ton, and RMB 224,000 per ton, respectively.

From a positive perspective, two factors stand out: first, many steel enterprises remain willing to enter the market for inquiries and purchases, such as China First Heavy Industries, Dongfang Special Steel, and Baosteel; second, most suppliers are currently focused on fulfilling previous orders and are in no rush to sell. On the negative side, two factors are at play: first, the difficulty in raising steel prices has led steel enterprises to strongly pressure ferromolybdenum prices, resulting in a decline in the selling prices of molybdenum raw materials; second, the continuous decline in international molybdenum prices has hindered the recovery of the domestic molybdenum market.

Data from the China Iron and Steel Association (CISA) shows that in late January 2025, the steel inventory of key steel enterprises reached 15.35 million tons, an increase of 18.7% compared to the previous ten days, 24.1% higher than at the beginning of the year, 24.1% higher than the same period last month, 25.8% higher than the same period last year, but 6.9% lower than the same period two years ago. By region, steel inventories increased by 140,000 tons in Northeast China, 690,000 tons in North China, 870,000 tons in East China, 140,000 tons in Northwest China, 150,000 tons in Southwest China, and 430,000 tons in Central-South China.

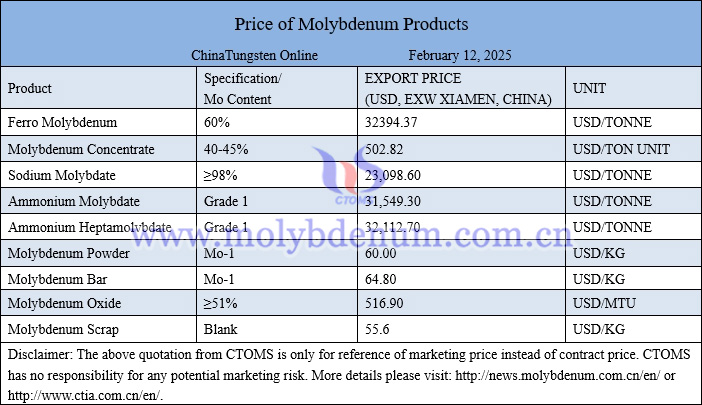

Prices of molybdenum products on February 12, 2025

Molybdenum electrode picture

Follow our WeChat to know the latest tungsten price, information and market analysis.

| Molybdenum Supplier: Chinatungsten Online www.molybdenum.com.cn | Tel.: 86 592 5129595/5129696 Email:sales@chinatungsten.com |

| Tungsten News & Prices: Chinatungsten Online news.chinatungsten.com | Molybdenum News & Molybdenum Price: news.molybdenum.com.cn |

sales@chinatungsten.com

sales@chinatungsten.com