First Week After Chinese New Year: Strong Performance in the Chinese Rare Earth Market

- Details

- Category: Tungsten's News

- Published on Saturday, 08 February 2025 16:49

In the first week after the Chinese New Year, Chinese rare earth market showed strong overall performance, with many mainstream products continuing their pre-holiday upward trend. This was primarily driven by increased inquiries from downstream users, strong production cost support, slow growth in spot supply, and positive market expectations.

However, in the short term, traders should remain cautious, as demand from magnetic material manufacturers remains relatively weak, and overall transaction volumes are still low. In the long term, with the continued development of industries such as robotics, new energy vehicles, smart home appliances, and wind power generation, the demand for rare earth functional materials is expected to increase, which may further boost the rare earth market.

Price Changes & Market Trends

According to data from Chinatungsten Online, current price movements compared to pre-holiday levels are as follows:

Praseodymium-Neodymium Oxide: ↑ 9,000 RMB/ton (+2.16%)

Praseodymium-Neodymium Metal: ↑ 10,000 RMB/ton (+1.95%)

Terbium Oxide: ↑ 40 RMB/kg (+0.67%)

Dysprosium Oxide: ↑ 30,000 RMB/ton (+1.80%)

55N Neodymium-Iron-Boron Blanks: ↑ 3 RMB/kg (+1.48%)

Neodymium-Iron-Boron Scrap (PrNd Content): ↑ 16 RMB/kg (+3.67%)

These figures indicate significant price increases in both rare earth raw materials and their functional materials this week.

Market Updates & Industry Insights

Jingci Magnetic Materials (金力永磁) has projected its 2024 net profit to be between 270.57 million to 326.94 million RMB, reflecting a 42% to 52% year-on-year decline. The adjusted net profit (excluding non-recurring items) is expected to be 160.57 million to 216.94 million RMB, down 56% to 67% year-on-year. The decline in profits is attributed to significantly lower rare earth raw material prices and intensified industry competition.

According to Chinatungsten Intelligence, rare earth prices experienced a notable decline throughout 2024:

Praseodymium Oxide: ↓ 9.57%

Neodymium Oxide: ↓ 10.99%

Praseodymium-Neodymium Oxide: ↓ 11.11%

Praseodymium-Neodymium Metal: ↓ 8.89%

Terbium Oxide: ↓ 26.45%

Dysprosium Oxide: ↓ 36.86%

Dysprosium-Iron Alloy: ↓ 35.71%

Despite short-term price increases, the long-term price trend in 2024 has been predominantly downward due to weakened demand and market competition. Moving forward, market dynamics will largely depend on supply chain stability and demand growth in key industries.

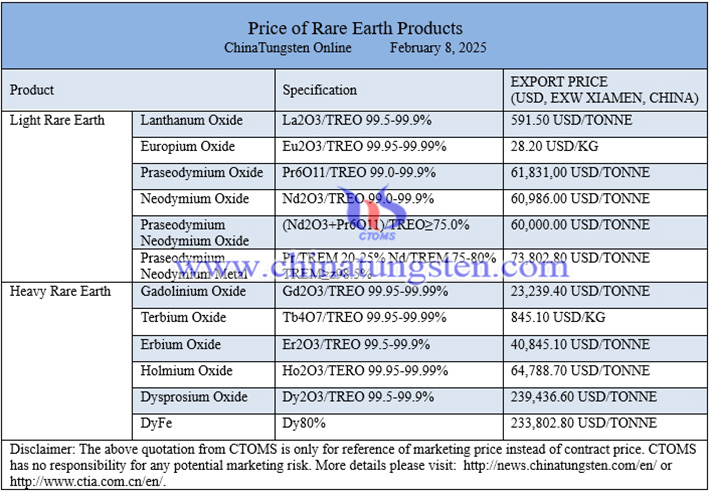

Prices of rare earth products on February 8, 2025

Picture of neodymium oxide

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com