Chinese Rare Earth Market - January 3, 2025

- Details

- Category: Tungsten's News

- Published on Monday, 06 January 2025 11:31

This week, the Chinese rare earth market has shown mixed trends, with limited transaction volumes overall.

Supply-Side Overview:

According to industry sources, Myanmar's rare earth mineral imports have returned to normal, potentially increasing China’s imports of heavy rare earth products.

Some rare earth manufacturers have reduced production or entered maintenance mode due to factors such as low rare earth prices, high energy costs, and cold weather.

Demand-Side Overview:

In the short term, downstream consumers remain cautious, leading to market demand falling short of expectations.

Price Movements:

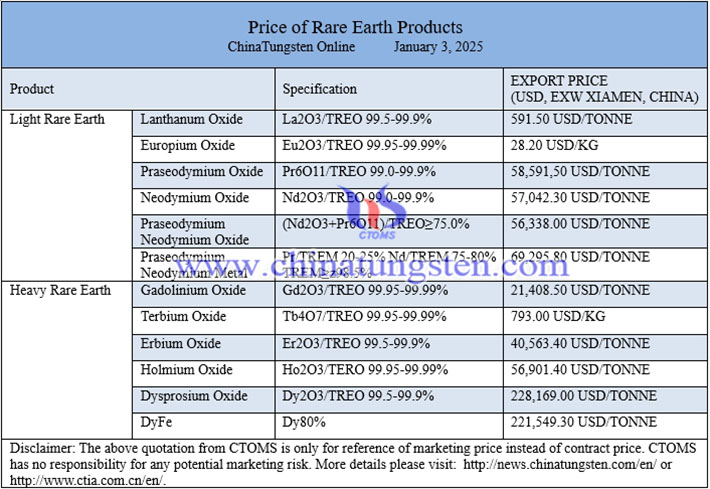

According to Chinatungsten Online, recent rare earth product price changes include:

Praseodymium-neodymium oxide: Down by approximately 1,000 RMB/ton (-0.25%) compared to last week.

Praseodymium-neodymium metal: Down by approximately 2,000 RMB/ton (-0.61%).

Terbium oxide: Up by approximately 40 RMB/kg (+0.72%).

Dysprosium oxide: Up by approximately 20,000 RMB/ton (+1.25%).

55N NdFeB blanks and NdFeB scrap praseodymium-neodymium prices: Remained unchanged compared to last week.

These trends indicate a slight decrease in praseodymium-neodymium prices and a modest increase in dysprosium and terbium prices this week.

Industry News:

Recently, Northern Rare Earth announced its intention to invest 153 million RMB of its own funds in partnership with its associate company, Fujian Jinlong Rare Earth Co., Ltd., to jointly establish Beifang Jinlong (Baotou) Rare Earth Co., Ltd. The new company will serve as the main entity for constructing a 5,000-ton rare earth oxide separation production line project.

Prices of rare earth products on January 3, 2025

Picture of neodymium oxide

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com