Chinese Molybdenum Market - December 27, 2024

- Details

- Category: Tungsten's News

- Published on Friday, 27 December 2024 15:13

The Chinese molybdenum market remained relatively stable in the week ended on Friday, December 27, 2024. With molybdenum mining enterprises showing low willingness to cut prices and downstream users maintaining their price-suppression attitudes, trading activity was moderate, and product prices fluctuated within a reasonable range.

This week, transaction prices for molybdenum concentrate, ferromolybdenum, and molybdenum oxide were approximately 3,600 RMB/metric ton unit, 233,000 RMB/ton, and 3,700 RMB/metric ton unit, respectively.

Positive Factors:

Production Reductions: The increased difficulty of production and stricter environmental regulations have led to reduced output among some molybdenum manufacturers, supporting stronger offers from stockholders.

Exchange Rates: The high USD-to-RMB exchange rate, around 7.30, has limited the import volume of molybdenum products into China.

Downstream Restocking: In preparation for normal production during the New Year and Spring Festival holidays, downstream users, such as steel enterprises, have been actively purchasing molybdenum products at lower prices.

Negative Factors:

Low Steel Mill Offers: Steel companies have been offering lower prices for ferromolybdenum, which has made it difficult for prices of ferromolybdenum and other molybdenum products to rise.

End-of-Year Liquidation: As the year-end approaches, some suppliers are eager to liquidate inventory and adopt a volume-driven pricing strategy, putting downward pressure on prices.

Industry News:

According to the China Iron and Steel Association (CISA), the production of key steel enterprises showed a slight year-on-year increase in November 2024:

Medium and thick plate mills produced 5.81 million tons, up 0.4% year-on-year.

Hot rolling mills produced 15.79 million tons, up 1.3% year-on-year.

Cold rolling mills produced 6.49 million tons, down 3.4% year-on-year.

Daily production levels for November were as follows:

Medium and thick plate mills: 194,000 tons/day, down 2.3% month-on-month, up 0.4% year-on-year.

Hot rolling mills: 526,000 tons/day, up 2.1% month-on-month, up 1.3% year-on-year.

Cold rolling mills: 216,000 tons/day, down 2.0% month-on-month, down 3.4% year-on-year.

The market remains attentive to the balance of supply and demand, as well as to macroeconomic and policy developments affecting the steel and molybdenum sectors.

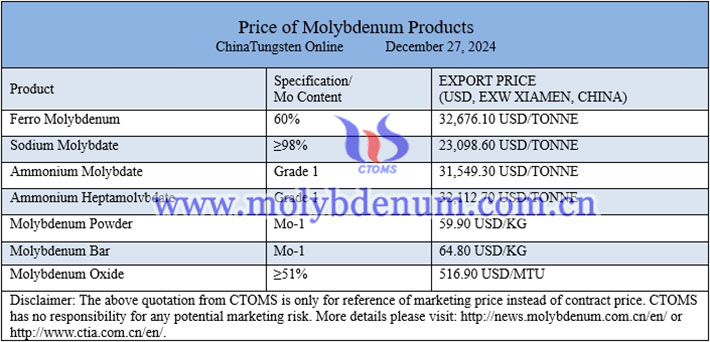

Prices of molybdenum products on December 27, 2024

Picture of MoSi2 heating elements

![]()

Follow our WeChat to know the latest molybdenum price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com