Chinese Molybdenum Prices - November 18, 2024

- Details

- Category: Tungsten's News

- Published on Tuesday, 19 November 2024 09:48

At the start of the week, Chinese molybdenum prices fluctuated within a narrow range. This was primarily due to the strong sentiment among molybdenum mining enterprises to hold onto inventory and support prices, contrasted with a decline in both volume and prices from steel procurement.

Currently, molybdenum concentrate and ferromolybdenum are quoted at approximately 3,720 yuan/metric ton unit and 241,000 yuan/ton, respectively. Under these conditions, market transaction volumes remain low, and confidence among industry participants in the market outlook appears somewhat subdued.

Notably, although many steel companies are still willing to tender for ferromolybdenum, the combination of lower bid prices from steel mills and limited bargaining room in the molybdenum concentrate market has led to significant cost-revenue inversion risks for intermediate smelting enterprises.

News Update

According to data from the China Iron and Steel Association (CISA), in early November 2024, the steel inventory of key monitored enterprises stood at 13.66 million tons, a slight increase of 0.1% compared to the previous 10-day period, up 10.5% from the beginning of the year, and a decrease of 7.3% month-on-month. Year-on-year, inventories fell by 7.0% compared to the same period last year and by 18.3% compared to two years ago.

Regional Breakdown:

Northeast China: Steel inventory decreased by 50,000 tons; North China: Steel inventory decreased by 160,000 tons; Southwest China: Steel inventory decreased by 30,000 tons; East China: Steel inventory increased by 140,000 tons; Northwest China: Steel inventory increased by 20,000 tons; Central-South China: Steel inventory increased by 100,000 tons.

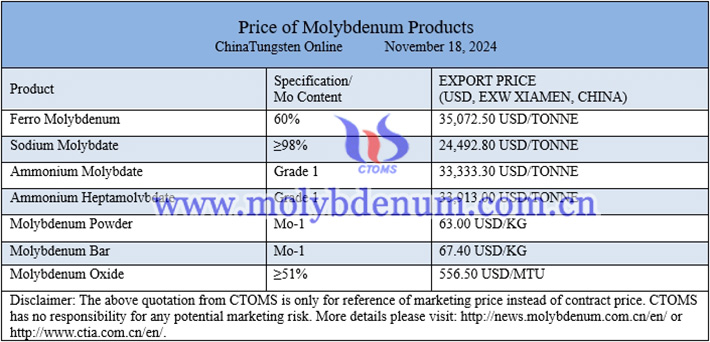

Prices of molybdenum products on November 18, 2024

Picture of TZC piercing plug

Follow our WeChat to know the latest molybdenum price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com