China’s APT Prices Have Weakened with Few Bulk Orders in the Second half of July 2024

- Details

- Category: Tungsten's News

- Published on Wednesday, 24 July 2024 17:39

Analysis of latest tungsten market from Chinatungsten Online

China tungsten prices continued to show a weak trend, primarily due to the stalemate in market supply and demand, as well as the reduction in long-term contract prices by large tungsten enterprises, significantly affecting market sentiment. Although there is some cost support from the intention of miners to stabilize prices, the overall market is still under pressure, and transaction activity remains low.

The price of 65% black tungsten concentrate remains stagnant at around $18,571.4/ton. Miners' intentions to stabilize prices have not received a positive response, with market consumption proceeding on a need-only basis and real transactions being sparse.

APT prices have weakened to around $314.8/mtu. Market negotiation sentiment remains cautious and under pressure, with few bulk orders. There is limited new information outside the long-term contracts for the second half of the month, and trade sentiment remains to be restored.

Tungsten powder prices are holding at around $43,428.6/ton, while some carbide tungsten powder prices are testing below $42,857.1/ton. Market consumption sentiment remains low, and overall cost support is limited, with the market continuing to be weak and stable.

The price of 70% ferro-tungsten is consolidating around $29,571.4/ton. There is a divergence in market confidence, with neither high nor low prices prevailing, leading to a rather cold trade atmosphere.

The price of scrap tungsten bars remains flat at around $28,1/kg. The recycling industry sentiment is generally subdued, with consumer engagement being less than ideal, and the overall market is under pressure and awaiting further developments.

Prices of tungsten products on July 23, 2024

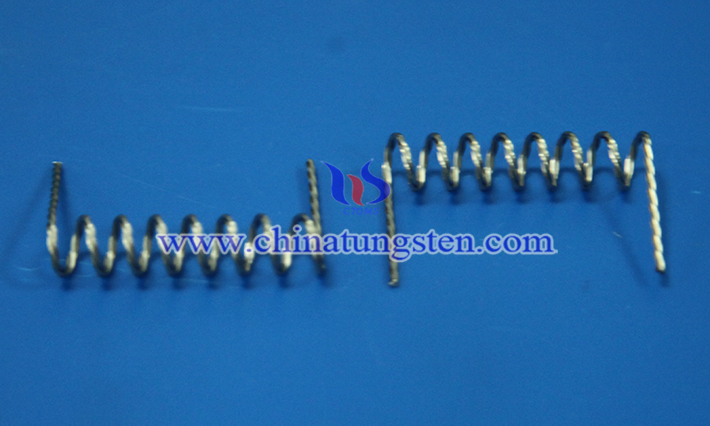

Picture of tungsten filament

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com