Chinese Molybdenum Market - July 19, 2024

- Details

- Category: Tungsten's News

- Published on Friday, 19 July 2024 16:40

This week, the domestic Chinese molybdenum market has remained stable overall. Key characteristics include traders having a general lack of enthusiasm for market operations, mainstream product prices staying relatively stable, and very few new orders being placed.

In the molybdenum concentrate market, although market activity has decreased compared to earlier periods, strong support from production costs and limited spot supply have kept suppliers' quotations firm. In the ferromolybdenum market, intermediate smelting enterprises face the risk of cost-profit inversion, mainly due to the high price suppression from steel enterprises and the difficulty of finding low-cost sources. Recently, companies such as Shougang Jingtang, Angang Steel, China First Heavy Industries, and Fushun Special Steel have all initiated a new round of ferromolybdenum bidding activities. In the molybdenum chemicals and products market, there is a strong wait-and-see atmosphere, with product prices mainly influenced by supply and demand relationships.

On the news front, information from the World Stainless Steel Association shows that in the first three months of 2024, global crude stainless steel production increased by 5.5% year-on-year to 14.585 million tons, a decrease of approximately 1.3% from the previous quarter. Among the regions, Europe saw a year-on-year decrease of 4.8% but a quarter-on-quarter increase of 3.7% to 1.558 million tons. The United States experienced a year-on-year increase of 6.5% and a quarter-on-quarter increase of 15.8% to 509,000 tons. Mainland China's production grew by 2.1% year-on-year but fell by 4.5% quarter-on-quarter to 8.595 million tons.

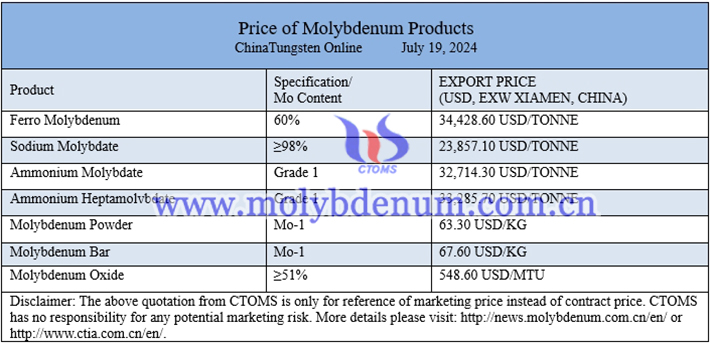

Prices of molybdenum products on July 19, 2024

Picture of molybdenum electrode

Follow our WeChat to know the latest molybdenum price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com