This Week's Chinese Molybdenum Market Overview - July 5, 2024

- Details

- Category: Tungsten's News

- Published on Friday, 05 July 2024 14:44

This week, the domestic Chinese molybdenum market showed a trend of stability followed by a slight decline, with relatively few transactions. At the beginning of the week, due to the rise in international molybdenum prices and strong production cost support at the time, suppliers generally maintained firm prices.

However, nearing the weekend, the international molybdenum price's peak and subsequent fall, coupled with a continued decline in steel mill bidding prices, led to varying degrees of price reductions among holders. Recently, steel companies entering the market for ferromolybdenum tenders include Jiangsu Yonggang (30 tons), Hebei Iron and Steel (75 tons), and Xinxing Ductile Iron Pipes (30 tons), with tender prices ranging from 228,000 RMB/ton to 231,500 RMB/ton.

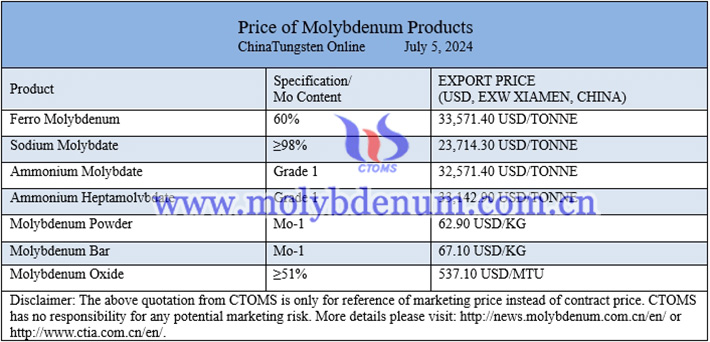

According to statistics from Chinatungsten Online, the current price of ferromolybdenum has decreased by approximately 5,000 RMB/ton from last week, a drop of 2.08%. The price of molybdenum concentrate has decreased by approximately 20 RMB/metric ton unit, a drop of 0.54%. The price of molybdenum oxide has decreased by approximately 20 RMB/metric ton unit, a drop of 0.53%. The price of sodium molybdate has decreased by approximately 2,000 RMB/ton, a drop of 1.19%. The price of ammonium heptamolybdate has decreased by approximately 2,000 RMB/ton, a drop of 0.85%. The price of molybdenum powder has decreased by approximately 5 RMB/kg, a drop of 1.12%.

On the news front, according to a survey by the Price Monitoring Center of the National Development and Reform Commission on major steel wholesale markets nationwide, the expected sales price index and purchase price index for the steel wholesale market in July are 37.3% and 44.4%, respectively, down by 24.1 and 16.7 percentage points from the previous month, both below the 50% threshold. This reflects a general market consensus that steel prices will run weak in July. The expected sales volume index and inventory volume index for the steel wholesale market in July are 48.1% and 57.6%, respectively, down by 2.4 percentage points and up by 5.2 percentage points from the previous month, straddling the 50% threshold. This indicates that the market expects steel demand to be weak to stable in July, with a slight increase in inventory, but with relatively limited changes.

Prices of molybdenum products on July 5, 2024

Picture of MoSi2 heating elements

![]()

Follow our WeChat to know the latest molybdenum price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com