China Ammonium Paratungstate Prices Tend to Decline in Early June 2024

- Details

- Category: Tungsten's News

- Published on Tuesday, 04 June 2024 17:45

Analysis of latest tungsten market from Chinatungsten Online

On Monday, China tungsten prices continued to stagnate weakly as the central environmental inspection came to a close.

The market saw an increase in profit-taking, leading to overall pressure on the market sentiment. Amidst the ongoing tug-of-war between costs and demand, businesses adjusted their quotations cautiously, waiting for the new round of guidance prices from institutions and tungsten enterprises at the beginning of the month. Currently, there are expectations of a slight correction.

The tungsten concentrate market continues to dominate the direction of the industry chain. Recently, there have been more profit-takings from low-grade resources, while prices for high-grade resources have stabilized around $22,000.0/ton. Market expectations for the supply chain remain relatively tight.

Ammonium paratungstate (APT) prices partly slipped below $371.3/mtu, with smelters maintaining relatively low production levels. The market continues to see a tug-of-war between costs, demand, and profits, with significant hedging pressure still present. The central environmental inspection team will be in place until June 9th, and market players are waiting to see any changes in trading strategies afterward.

The adaptability of the alloy market to changes in tungsten raw material prices is slow. Recently, there has been a more cautious atmosphere in purchasing, with poor market liquidity. The price center for tungsten powder remains stagnant around $48,571.4/ton, while tungsten carbide powder is consolidating around $47,857.1/ton.

There are differences in opinions in the ferro tungsten market, influenced by factors such as strong raw material costs, steel mills adopting a wait-and-see approach, and external environmental fluctuations. This has led to stalemates in negotiations, with market transactions mainly for consolidation. The reference price for 70% ferro tungsten has been adjusted to around $32,571.4/ton.

Activity in the scrap tungsten market has relatively decreased recently, mainly due to the loosening of tungsten raw material prices and the slowing pace of restocking in the alloy market. The range of quotations from holders has widened, and overall trading sentiment is cautious.

In terms of news, on May 31st, the National Bureau of Statistics Service Industry Survey Center and the China Federation of Logistics and Purchasing released data showing that in May, the Purchasing Managers' Index (PMI) for China's manufacturing sector was 49.5%, a decrease of 0.9 percentage points from the previous month. This is mainly due to factors such as the relatively high base formed by the rapid growth of the manufacturing industry in the previous period and insufficient effective demand, leading to a slight decline in the overall manufacturing industry prosperity level.

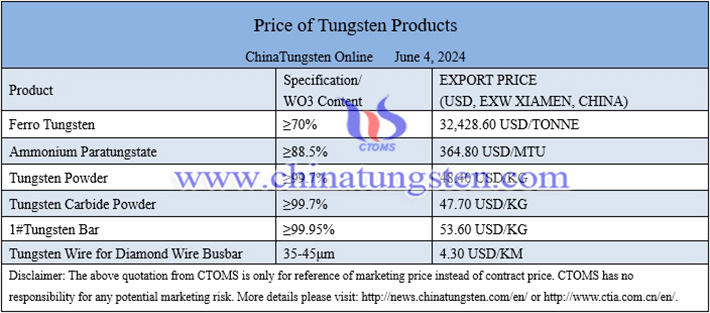

Prices of tungsten products on June 4, 2024

Picture of ammounium matatungstate

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com