Analysis of Current Trends and Challenges in the Tungsten Market

- Details

- Category: Tungsten's News

- Published on Tuesday, 21 May 2024 17:09

Analysis of latest tungsten market from Chinatungsten Online

China tungsten product prices continued to rise and the market atmosphere tended to be complex in the week ended on Friday, May 17, 2024. Tungsten ore suppliers have no trouble selling their stocks and only need to maintain their cash flow, as overall production capacity is also limited under environmental controls.

Middle traders and smelters are cautious in purchasing and accepting orders, eager to gain higher profits in the current market with soaring raw material prices, but also concerned about buying at high levels and being harvested by the market. Alloy and its downstream customers are similarly hesitant to accept high prices, leading to recent inactivity in inquiries. The tungsten market continues to be in a state of persistent volume shortage and price increases. Over the weekend, the atmosphere of sideways observation increased, with attention focused on the performance of several representative tungsten companies' long-term contract prices for the second half of the month.

According to statistics from Chinatungsten Online, as of May 16, 2024, the price of 65% black tungsten concentrate reached $22,285.7/ton, with a year-on-year increase of 26.8%, approaching the historical high point that tungsten ore holders have been looking up to. The price of ammonium paratungstate (APT) reached $371.3/mtu, with a year-on-year increase of 26.4%. The profit margin of production and processing is still severely squeezed by the high price of tungsten concentrate raw materials. The price of tungsten powder was $49,285.7/ton, with a year-on-year increase of 26.4%. Currently, some downstream customers find it difficult to find sources even at $50,000.0/ton. The price of tungsten carbide powder was $48,285.7/ton, with a year-on-year increase of 26.1%. The pressure on alloy users' costs is slowly being absorbed, with efforts being made to reduce raw material inventory, process existing products, and cool down raw material procurement. The price of 70% ferro tungsten was $32,857.1/ton, and the weakening market consumption atmosphere followed the price increase.

With the decrease in the grade of tungsten ore, the technical input costs of smelters are increasing. Coupled with the impact of environmental costs, theoretically, the price of APT should be higher than it is currently. The intermediate value of important quality control and supply adjustment valves in the entire industry chain should be recognized by the market, and the ratio with tungsten ore prices should be higher. However, reality is contrary to desires. Using the tungsten ore price of $22,285.7/ton as a reference, the current APT price is $371.3/ton, while the APT price corresponding to the same price of tungsten concentrate in 2011 was $34,285.7/ton. Over the past decade, the difference in the ratio of one thousand yuan per ton is a cruel reality of the continuous compression of the profit margin of tungsten smelting products. It may also be an important issue for leading enterprises in the APT smelting end to seriously consider the matching relationship between production capacity, output, quality, product category, and market demand in the industry chain.

According to Chinatungsten Online, the main reason for the significant increase of over 30% in tungsten prices in a short period of time in this round is the tension in the tungsten supply chain. In addition to the impact of the decrease in ore grade and environmental safety control, the continuous expansion of APT and tungsten powder production capacity has led to a large consumption of raw material tungsten ore, which is the fundamental reason for the increasingly tight tungsten resources. While the demand for tungsten materials, cemented carbide, tungsten alloys, and other downstream tungsten products continues to expand, it cannot fully digest this expanded production capacity, or the orders consumed have limited profit supplements for smelters. Smelters continue to absorb production, and the upstream resources on the industrial chain are becoming increasingly tight. The tight supply and high demand have created a seller's market, resulting in an awkward situation for the middlemen. The prices of tungsten smelting products are relatively under pressure compared to the profit margins of enterprises.

Chinatungsten Online believes that after tungsten product prices have continued to rise for a period of time, the long-term problem of low profits in the intermediate smelting link may be alleviated to some extent. Previously, the profit margin of the tungsten market was small, with most of it concentrated in the ore end and the deep processing field of cemented carbide and downstream. As the cost of raw materials continues to rise, small and medium-sized enterprises, especially low-end enterprises that do not meet environmental regulatory requirements, will face production cuts or closures. The overall increase in the profit margin of the tungsten industry chain driven by the strong tungsten ore price will promote the tungsten industry chain's supply and demand pattern and profit distribution to reach a new balance point. At this point, rational pricing and production and operation strategies of enterprises are crucial.

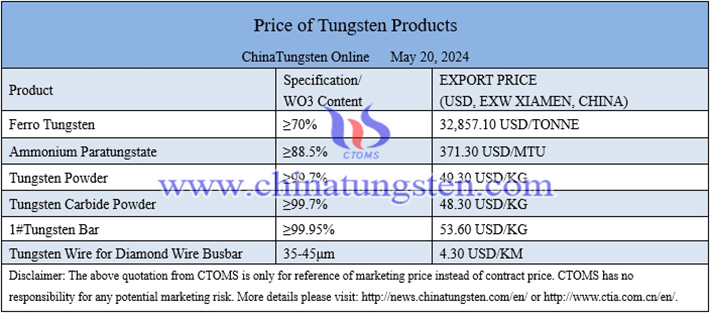

Prices of tungsten products on May 20, 2024

Picture of gold plated tungsten wire

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com