China Supplies Most of Tungsten, Rare Earths and Other critical minerals to US in 2021

- Details

- Category: Tungsten's News

- Published on Saturday, 19 February 2022 18:44

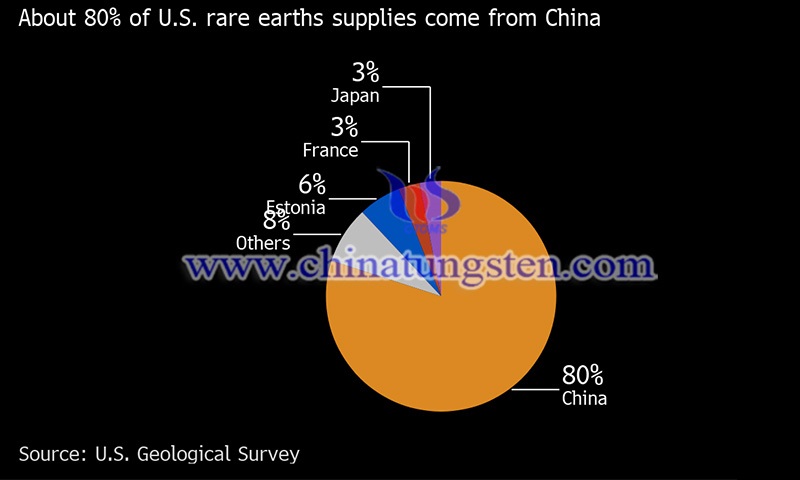

China accounts for the largest share of the US imports of critical minerals such as tungsten and rare earths in 2021. According to the U.S. Geological Survey (USGS), the major source countries for U.S. imports of mineral commodities, or net import dependence of more than 50 percent, are China, 25 mineral commodities; Canada, 16 mineral commodities; Germany, 11 mineral commodities; South Africa, 10 mineral commodities; and Brazil and Mexico, 9 mineral commodities each.

The USGS says imports of 47 non-fuel mineral commodities account for more than half of U.S. apparent consumption in 2021, with the U.S. relying on 100 percent net imports for 17 of those commodities.

Of the 35 mineral or mineral material groups published in the Federal Register on May 18, 2018 (83 FR 23295), the United States has a net import dependence of 100 percent on 14 minerals and a net import dependence of more than 50 percent of consumption for another 15 critical mineral commodities.

In 2021, China supplied the following mineral commodities to the United States: rare earth compounds and metals (including lanthanides), graphite, gallium, indium, tantalum, yttrium, bismuth, antimony, germanium, iodine, tungsten, magnesium compounds, industrial diamonds, barite, and others.

As for domestic production, the estimated total value of U.S. non-fuel minerals is $90.4 billion in 2021, up 12% from a revised $80.7 billion in 2020. The estimated value of metal production increased by 23 percent to $33.8 billion. The USGS added that the increase in the value of metal production was fueled by higher copper prices, which are projected to be about $4.20 per pound in 2021, a record high.

The major contributors to the total value of ore products in 2021 were copper, 35%; gold, 31%; iron ore, 13%; and zinc, 7%. mining, quarrying, and oil and gas extraction in Canada declined in November 2021.

The total value of industrial mineral production in the U.S. is $56.6 billion, up 6% from 2020. Of this amount, $29.2 billion is for construction aggregate production (sand and gravel for construction and crushed stone).

Crushed rock is the leading nonfuel mineral commodity in 2021, with a value of more than $19.3 billion, or 21 percent of the total of the US nonfuel mineral value. Increased consumption of non-fuel mineral commodities in commercial construction, steel production, automotive, and transportation. The authors of the report said, "This is thanks to the economic reboot under the global COVID-19 outbreak."

The USGS noted that for the metals sector, tungsten, rare earths, copper, iron ore, steel, and zinc sectors were particularly affected by increased demand from the manufacturing sector. For the industrial minerals sector, the largest increases in production were in cement, crushed stone, sand and gravel, and soda ash, commodities that are closely tied to the performance of the construction industry.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com