Molybdenum Demand on Rise

- Details

- Category: Tungsten's News

- Published on Thursday, 04 November 2021 13:28

Molybdenum demand is on rising. As commodity prices have soared in global markets over the past 12 months, with lithium, gold, and iron ore taking center stage, one material has been quietly and steadily increasing in value: molybdenum.

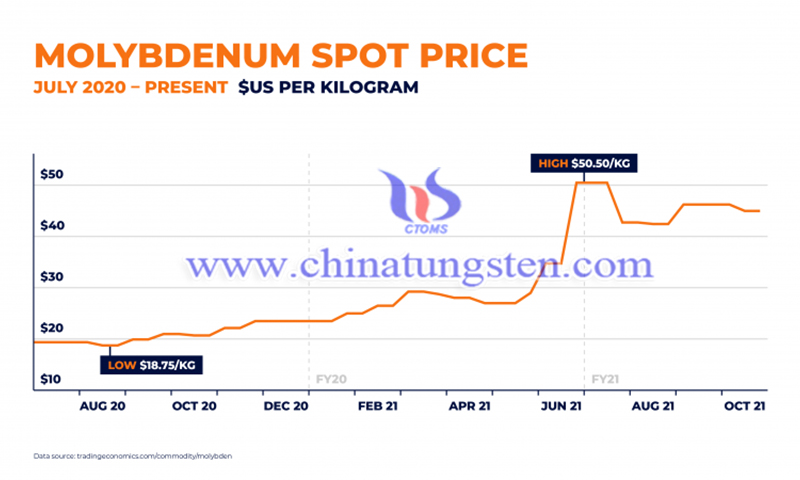

Often referred to simply as "Mo", moly is not well known or widely traded, but its spot price has risen from under US$20 per kilogram in July 2020 to around US$45 per kilogram in October 2021.

Interestingly, Mo is rarely mined on its own. Instead, the metal is often produced as a by-product of other mining operations such as copper, tungsten, and iron ore. It is the close relationship between moly and steel that has caused the price of Mo to soar.

Molybdenum itself is rarely used. At the human level, large quantities of metal can be toxic. However, molybdenum is needed as a cofactor to absorb various enzymes. On an industrial level, molybdenum can withstand extremely high temperatures without softening and has strong corrosion-resistant properties. This property means that molybdenum can be used to make important alloys, for example, by adding it to steel to increase strength, hardness, corrosion resistance, and electrical conductivity.

As a result, molybdenum steel alloys have important uses in industry and construction and are used in a wide range of products such as engines, air conditioners, and drill bits. The metal's strength also allows it to play a vital role in military equipment and defense products. Molybdenum demand is rising within the years.

There are three main reasons for the recent rise in molybdenum prices: firstly, China has been buying large quantities of the metal over the past 12 months; secondly, researchers have started to look at molybdenum as a core element in future lithium-based batteries and electric vehicles; and thirdly, rising geopolitical tensions are putting pressure on countries around the world to invest more in the defense sector, where Mo has important applications.

Of course, this does not include the dampening of Mo prices as a result of the oversupply of the material in 2020. When the pandemic struck and blockades were imposed around the world, the construction and steelmaking industries were largely put on hold.

In a report for 2021, international commodity market researcher Roskill found that around two-thirds of Mo production takes place in the form of by-products. This means that the supply of the metal is not dependent on demand from the Mo market. As a result, despite low demand for Mo, its supply has remained stable and its price has fallen.

Roskill reports that while steel and stainless steel production, together with renewed drilling activity in the oil sector, are partly responsible for the recent rise in Mo prices.

Speaking of carbon neutrality, Mo is also being touted by some researchers as the future of the lithium battery industry. Researchers at the University of Texas found in 2018 that lithium-sulfur batteries have potential advantages over lithium-ion batteries in the electric vehicle industry, including increased energy storage, cheaper production, and safer use.

However, the technology to produce stable lithium-sulfur batteries does not yet exist. Mo has enhanced properties and may offer a potential solution. Mo already has important applications in almost all forms of energy creation, including new-age solar panels and hydrogen power plants.

| Molybdenum Supplier: Chinatungsten Online www.molybdenum.com.cn | Tel.: 86 592 5129696; Fax: 86 592 5129797;Email:sales@chinatungsten.com |

| Tungsten News & Prices, 3G Version: http://3g.chinatungsten.com | Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn |

sales@chinatungsten.com

sales@chinatungsten.com