Xiamen Tungsten, GEM to Strengthen CAM Precursor Deal

- Details

- Category: Tungsten's News

- Published on Thursday, 28 October 2021 22:11

Xiamen Tungsten Co., Ltd. (XTC) New Energy Materials (Xiamen), China's largest manufacturer of cathode active material (CAM) for lithium-ion batteries, has signed a supply agreement with Jingmen GEM, a wholly owned subsidiary of Green Eco Manufacturing (GEM), a major cathode active material precursor producer, to strengthen cooperation in the supply of cathode active material precursors.

XTC New Energy will purchase 5,000-15,000 tons/year of cobalt tetroxide and 15,000-35,000 tons/year of nickel, cobalt, manganese and lithium precursors from Jingmen Green Eco Manufacturing Company until the end of 2023. Prior to the announcement of this transaction, the two companies had established a long-term cooperative relationship in the supply of CAM precursors.

XTC New Energy was listed on the Technology Innovation Board of the Shanghai Stock Exchange on August 5 and raised 1.5 billion yuan (232 million US dollars) to provide for the construction of an NCM facility with an annual output of 20,000 tons in Xiamen, Fujian Province, southeast China. Capital, which will increase the company's NCM production capacity from 30,000 tons/year to 50,000 tons/year.

The company's predecessor was the battery materials department of Xiamen Tungsten Industry, which began research and development of cathode materials for lithium-ion batteries in 2004. XTC New Energy Materials Co., Ltd. was registered and established in December 2016. Since then, it has operated independently and became a subsidiary of XTC. It researches, develops, produces and sells lithium cobalt oxide (LCO) and NCM as its main products. Ion battery cathode material.

XTC New Energy reported that in 2020, LCO production will be 33,750 tons, and NCM production will be 16,113 tons, accounting for 42.8% and 7.5% of total domestic production. From January to June, its LCO and NCM sales increased by 71.7% and 126.1% year-on-year, respectively.

It has cooperative relationships with major battery companies at home and abroad, including ATL, Samsung SDI, Murata, LGC, New Voda, Zhuhai Guanyu and BYD. XTC New Energy products are used in downstream mid-to-high-end computers, communications and consumer electronics products. It also has long-term cooperative relationships with power lithium battery manufacturers such as Panasonic, BYD, CATL, Avic lithium, EVE Energy and Gotion High-tech.

It signed a strategic framework agreement with CNGR Advanced Material, China's largest CAM precursor producer, on September 14 to purchase 20,000-25,000 tons/year of cobalt tetroxide and 15,000-35,000 tons/year of NCM precursors until the end of 2023.

XTC New Energy plans to build a lithium iron phosphate (LFP) and NCM production complex in Ya'an City, Sichuan Province, southwest China, to keep up with the fast-growing lithium-ion and electric vehicle (EV) industries.

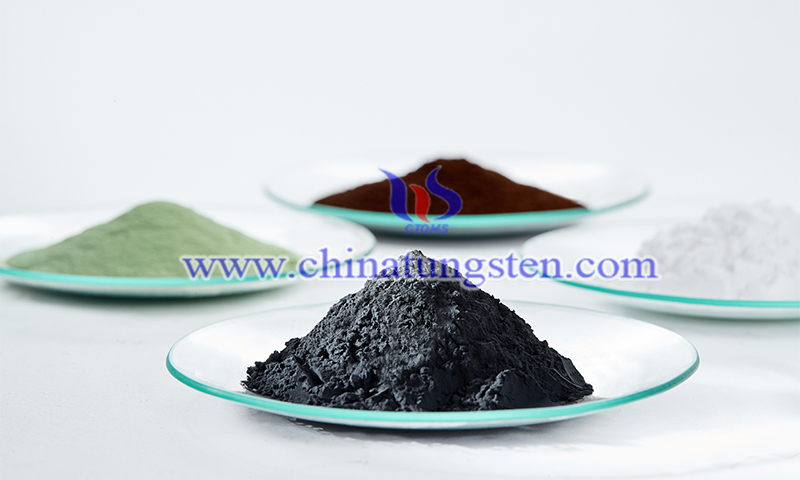

GEM has an industrial chain from cobalt salts to lithium ion cathode materials, as well as metal cobalt and powder. The company's main products include NCM ternary precursors, cobalt tetroxide, cobalt powder and metal cobalt. The production capacity of cobalt tetroxide is 16,000 tons/year and the metal cobalt is 3,000 tons/year. It also produces NCM and lithium cobalt oxide. In addition, as it is optimistic about the future development prospects of LFP and LFP precursor products, Green Eco Manufacturing is preparing to add these products to its product portfolio.

From January to June, Green Eco Manufacturing's NCM precursor shipments increased by 190% over the same period last year, exceeding 42,000 tons, of which 15,000 tons were sold to overseas markets, an increase of 110% year-on-year. Due to strong demand from downstream industries, the company is expected to sell 90,000 to 100,000 tons of NCM precursors this year. It is expected that by the end of this year, it will also expand the production capacity of NCM precursors to 200,000 tons/year. Its goal is to further increase its production and sales to 400,000 tons per year by 2025 to meet the needs of the ever-expanding electric vehicle market.

From January to June, its shipments of cobalt tetroxide totaled nearly 8,500 tons, an increase of 41.7 percentage points year-on-year, of which lithium cobalt oxide and NCM totaled 4,900 tons. The company sold 2227 tons of cobalt powder, an increase of 65% over the same period.

The company announced a plan in June to build a new cobalt and nickel salt production facility in Jingmen City, Hubei Province, central China, with a cobalt sulfate capacity of 33,000 tons/year, a cobalt chloride capacity of 33,000 tons/year, and a nickel sulfate capacity. 33,000 tons/year.

Green Eco Manufacturing signed a preliminary agreement in October to extend the supply of lithium battery ternary precursors to South Korean battery cathode material manufacturer Ecopro BM, and supply 650,000 tons of high nickel NCM/NCA ternary precursors during 2024-26. Previously, Green Eco Manufacturing reached an agreement in April to supply materials to Ecopro BM from 2021-23.

GEM mainly purchases raw materials from Swiss trading and mining company Glencore through long-term contracts. It cooperates with NCM precursor and NCM manufacturer Brunp and domestic steel producer Tsingshan to invest in a high-pressure acid leaching project in Indonesia to produce mixed nickel and cobalt hydroxide precipitates. The project is planned to be launched in the first quarter of next year, with an output of 50,000 tons/year of nickel metal equivalent and 5,000 tons/year of cobalt metal equivalent. GEM also recycles cobalt/nickel/lithium waste as raw materials.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com