High-Quality Low-Cost Single Tungsten Disulfide Realize a Large-Area Preparation II

- Details

- Category: Tungsten's News

- Published on Tuesday, 02 February 2016 17:39

- Hits: 662

| Tungsten Supplier: Chinatungsten Online www.chinatungsten.com | Tel.: 86 592 5129696; Fax: 86 592 5129797;Email:sales@chinatungsten.com |

| Tungsten News & Prices, 3G Version: http://3g.chinatungsten.com | Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn |

High-Quality Low-Cost Single Tungsten Disulfide Realize a Large-Area Preparation I

- Details

- Category: Tungsten's News

- Published on Tuesday, 02 February 2016 17:35

- Hits: 625

| Tungsten Supplier: Chinatungsten Online www.chinatungsten.com | Tel.: 86 592 5129696; Fax: 86 592 5129797;Email:sales@chinatungsten.com |

| Tungsten News & Prices, 3G Version: http://3g.chinatungsten.com | Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn |

Rare Earth Symposium will Be Held Soon, Attention on Rare Earth and Tungsten

- Details

- Category: Tungsten's News

- Published on Monday, 01 February 2016 18:11

- Hits: 1045

Last week, nine tin enterprises in the country decided cut back production of 17,000 tons in 2016, which take place about 12% of national yield. It’s expected that it doesn’t exclude the possibility of purchasing and storage business in the future, reduction of output and purchasing and storage tin supply and demand situation is expected to improve.

MIT Scientists have Developed an Improved Tungsten Wire Light Bulbs

- Details

- Category: Tungsten's News

- Published on Monday, 01 February 2016 16:04

- Hits: 741

| Tungsten Supplier: Chinatungsten Online www.chinatungsten.com | Tel.: 86 592 5129696; Fax: 86 592 5129797;Email:sales@chinatungsten.com |

| Tungsten News & Prices, 3G Version: http://3g.chinatungsten.com | Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn |

Tungsten Diselenide-Thin Flexible Solar Cells Material

- Details

- Category: Tungsten's News

- Published on Monday, 01 February 2016 16:00

- Hits: 567

| Tungsten Supplier: Chinatungsten Online www.chinatungsten.com | Tel.: 86 592 5129696; Fax: 86 592 5129797;Email:sales@chinatungsten.com |

| Tungsten News & Prices, 3G Version: http://3g.chinatungsten.com | Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn |

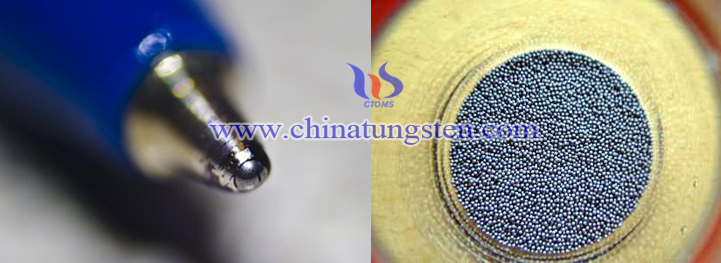

“Embarrass” of Tungsten Carbide Ball for Pen Using

- Details

- Category: Tungsten's News

- Published on Tuesday, 26 January 2016 16:56

- Hits: 745

It is reported that China has become the largest country of pen manufacture. However, in the back of a string of prides, such as 3,000 the enterprises, 200,000 employees, 40 billions of annual output, it still has the lack of core technology and highly depends on the bead import. Some related experts consider that the nib and the ink are the major parts of the pen, and the nib can be specifically divided in to the bead and the ball seat. At the present, tungsten carbide (WC) ball is the most widely used in the world, which China can not only meets the domestic needs, but also can be exported plenty. In addition, tungsten carbide ball for pen using can be specifically divided into WC-based cemented carbide, WC-TiC-based cemented carbide, Tic-based cemented carbide, Cr3C2-based cemented carbide and so on. WC-based cemented carbide is the most widely using for pen, although different basis of ball has different advantages and properties. Therefore, according to different ink and the material of nib, we should choose the proper ball and it can improve the quality of production.

While the production of the ball seat, either the equipments or the materials are mastered by Switzerland, Japan and other countries. “The small nib by traditional process requires more than 20 procedures, which should be manufactured separately”, Chen said, the honorary president of China Writing Instrument Association. So domestic pen manufacturers start to use the integrative production facility of other countries, and it has high demand on the raw materials, which domestic stainless steel wire is not suitable. Besides, the pen also has 5 grooves of ink flowing, which the precision should reach one of a thousand of millimeters and any deviation of the angle, the pressure, the bead, the nib and the ink grooves will have an effect on the fluency and the service life of the pen. Therefore, China allocated nearly 60 million to support the relevant research institutions, enterprises for the manufacture center of the ink, stainless steel wire tip, machining equipment to carry out scientific and technological research. However, acceptance of new technology and equipment business also requires a process, in order to remove this “embarrass”, we should find some way to increase the promotion of new technologies.

tungsten carbide ball

| Tungsten Carbide Supplier: Chinatungsten Online tungsten-carbide.com.cn | Tel.: 86 592 5129696; Fax: 86 592 5129797;Email:sales@chinatungsten.com |

| Tungsten News&Tungsten Prices, 3G Version: http://3g.chinatungsten.com | Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn |

Diselenium Tungsten for Manufacturing Ultrathin Flexible Solar Cell

- Details

- Category: Tungsten's News

- Published on Thursday, 21 January 2016 17:46

- Hits: 877

The researchers in Austria Vienna University of Technology first developed a diode made of diselenium tungsten (WSe2) which can be used in the ultrathin flexible solar cell, according to the experiment.

Mostly, the standard solar cell which is rather bulky and inflexible made of Silicon; although organic materials can apply in photoelectricity, it has quite fast degree of degradation. While graphene is considered to be one of the prospects for the development of electronic materials, it is not suitable in making solar cells. That is why the team of Vienna University of technology began looking for other similar materials which is arranged in ultrathin and with better electronic properties.

WSe2 is similar to grapheme, and its main structure composed of one upper and lower layers of selenium atoms connected to the middle layer of tungsten atoms. About 95% of the light can pass through this thin layer, and 1/10 of the remaining 5% light will be absorbed by the material, and converted into electricity with quite high internal efficiency. If multiple thin layers are stacked on each other, a large part of the incident light can used effectively and may bring beneficial side effect at the same time.

Imagine that, the solar cell stack on your glass curtain, part of the light pass through the building and bringing available power, don’t you think your future life would be brighter?

| APT Supplier: Chinatungsten Online ammonium-paratungstate.com | Tel.: 86 592 5129696; Fax: 86 592 5129797;Email:sales@chinatungsten.com |

| Tungsten News&Tungsten Prices, 3G Version: http://3g.chinatungsten.com | Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn |

MIIT Issued Announcement of Criterions for Tungsten Industry (2016 No.1)

- Details

- Category: Tungsten's News

- Published on Wednesday, 20 January 2016 11:53

- Hits: 720

According to the certain laws and industry policies of China, criterions for tungsten industry is pronounced with the aim to strength tungsten industry management, to reduce low level and similar constructions, to standardize the existing operation order, to improve the usage ability of resource and energy conservation and to promote the development of transforming and upgrading.

Tungsten Industry Development Situation

- Details

- Category: Tungsten's News

- Published on Thursday, 14 January 2016 19:20

- Hits: 787

| Tungsten Supplier: Chinatungsten Online www.chinatungsten.com | Tel.: 86 592 5129696; Fax: 86 592 5129797;Email:sales@chinatungsten.com |

| Tungsten News & Prices, 3G Version: http://3g.chinatungsten.com | Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn |

Tungsten Concentrate Import and Export Decrease, Tungsten Carbide Increase

- Details

- Category: Tungsten's News

- Published on Thursday, 14 January 2016 19:16

- Hits: 1524

According to the data show that in 2005 to 2014 China import and export volume of tungsten concentrate in general shows a downward trend, and carbide exports have seen a growing trend (specific data as shown below).

sales@chinatungsten.com

sales@chinatungsten.com