W Resources Shares up as it Reports "Significant" Régua Resource Upgrade

- Details

- Category: Tungsten's News

- Published on Monday, 16 November 2015 14:55

- Written by xinyi

- Hits: 741

W Resources shares pushed higher as it unveiled a significant increase in resources at the Régua project in northern Portugal.

W Resources (LON:WRES) shares pushed higher as it unveiled a "significant" increase in resources at the Régua project in northern Portugal.

Notably, the higher confidence indicated resources now stand at 3.76 million tonnes at 0.304% tungsten trioxide - a 76% increase on the previous figure of 2.14 million tonnes at 0.367% WO3 from three years ago.

The total resource tonnage increased by 22% to 5.46 million tonnes at a grade of 0.28% tungsten, up from 4.46 million tonnes.

The group's chairman Michael Masterman told investors: "The drilling campaign at Régua exceeded our initial expectations and we are delighted that the work to date has resulted in this significant increase in the indicated resources at Régua.

"The results to date provide us with a strong basis for the next phase of mine planning as we move the project nearer to production.

"The next step is now to complete the mine planning and reserve estimation process, which is targeted for the first quarter 2016.

"Metallurgical work has progressed well over the last quarter with good metal recoveries. A full update on the metallurgical programme and results will be provided in the next two months."

The latest resource is based on thick, high grade sections of tungsten at or near surface.

In August this year, the firm said it was considering a shallow open pit mine design in a first phase with the second phase to be a larger scale high grade underground operation.

W Resources shares added 3.17% in early deals to 0.65p

| Tungsten Supplier: Chinatungsten Online www.chinatungsten.com | Tel.: 86 592 5129696; Fax: 86 592 5129797;Email:sales@chinatungsten.com |

| Tungsten News & Prices, 3G Version: http://3g.chinatungsten.com | Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn |

Commodity Index of Ammonium Paratungstate is 34.26 on November 12

- Details

- Category: Tungsten's News

- Published on Friday, 13 November 2015 15:59

- Written by xinyi

- Hits: 635

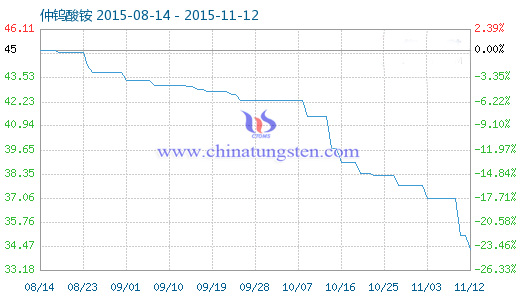

Commodity Index of Ammonium Paratungstate is 34.26 on November 12, 0.78 lower than yesterday, which make a historical new low record in cycle, compared with the highest point of 100.00 points on September 1, 2011 decreased by 65.74%.

|

Date |

08-14 |

08-23 |

09-01 |

09-10 |

09-19 |

09-28 |

10-07 |

10-16 |

10-25 |

11-03 |

11-12 |

|

Commodity Index |

45.04 |

44.89 |

43.40 |

43.15 |

42.81 |

42.30 |

42.30 |

38.98 |

38.30 |

37.02 |

34.26 |

| Tungsten Supplier: Chinatungsten Online www.chinatungsten.com | Tel.: 86 592 5129696; Fax: 86 592 5129797;Email:sales@chinatungsten.com |

| Tungsten News & Prices, 3G Version: http://3g.chinatungsten.com | Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn |

Tungsten Supply

- Details

- Category: Tungsten's News

- Published on Friday, 13 November 2015 09:13

- Written by xinyi

- Hits: 1257

The Tungsten Lifecycle Chart

- Details

- Category: Tungsten's News

- Published on Friday, 13 November 2015 14:14

- Written by xinyi

- Hits: 852

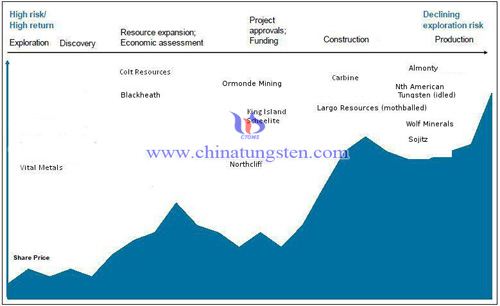

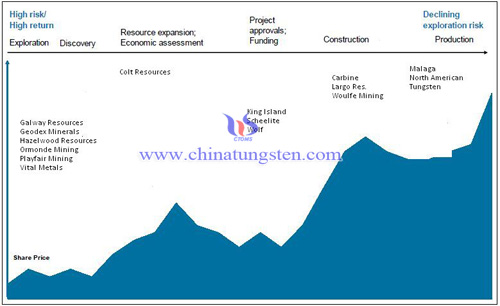

Our all-purpose Lifecycle chart serves particularly well, in the case of Tungsten, to show the state of progress of the various players vis-à-vis each other on the exploration-production continuum (not that some players, irrespective of which metal, imagine themselves production-bound).

This chart raises the interesting question of how to deal with juniors. During the years of the Supercycle any junior in a given metal could be seen as a potential player. As it wended its way through the Resource/PEA/PFS/BFS continuum there was always an assumption that financing would be forthcoming by hook or by crook for a worthy project. That is now not the case. So do we position a no-hope junior on the Lifecycle Chart at all or just cast them into the outer darkness?

The second issue relates to “naming names” because it is not particularly a company that it somewhere on the timeline but rather individual projects. A good example is Almonty, which has a producing mine in Spain, a near producing mine in Australia and a more distant prospect in South Korea. The stricken North American Tungsten has a producing mine in the Yukon and a project that is way at the other end of the lifecycle and likely to stay there because of its owner's travails.

Looking back at the Lifecycle Chart (below) we published in 2011, the companies at the very right were Malaga and North American Tungsten, now both in administration or bankruptcy, and Malaga's property is in the hands of new owners.

Geodex sold its project to Northcliff. Largo mothballed its Brazilian mine almost as soon as it got into operation. Woulfe was bought by Almonty and the “other” Wolf has advanced mightily. King Island Scheelite had a management and project reconfiguration (for the better) but that has put it no further ahead of where it was. Colt has oscillated around trying to decide if it will be a Tungsten project or a gold venture. Almonty did not even figure on our radar screen!

| Tungsten Supplier: Chinatungsten Online www.chinatungsten.com | Tel.: 86 592 5129696; Fax: 86 592 5129797;Email:sales@chinatungsten.com |

| Tungsten News & Prices, 3G Version: http://3g.chinatungsten.com | Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn |

Wolf Minerals focused on full production at Hemerdon

- Details

- Category: Tungsten's News

- Published on Thursday, 12 November 2015 10:16

- Written by xinyi

- Hits: 733

Tungsten Oxide, Tungsten Powder Manufacturer & Supplier: Chinatungsten Online - www.tungsten-powder.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten & Molybdenum Information Bank: http://i.chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Molybdenum News & Molybdenum Price: http://news.molybdenum.com.cn

More Articles...

- Northland Capital Partners View on the City Mariana Resources, W Resources, Altona Energy and Alexander Mining

- GULFPORT, Mississippi — A Pennsylvania company is buying a Gulfport facility to expand.

- China Sodium Tungstate Industry 2015 Market Report

- Ormonde Mining on Track for First Tungsten by End 2016

sales@chinatungsten.com

sales@chinatungsten.com