Rare Earths in EVs: Problems, Solutions

- Details

- Category: Tungsten's News

- Published on Thursday, 04 November 2021 13:25

- Written by Caodan

- Hits: 659

Electric vehicles (EVs) mark the way to a greener future, but problems remain in the sourcing of some of these components or materials, such as rare earths. As the market for electric vehicles expands rapidly, so does the demand for components such as electric motors.

In 2021, demand for electric vehicle motors is expected to increase by 40% in the automotive market alone. Electric motors are literally driving electric vehicles, but many designs utilize kilogram-scale magnetic materials. These magnets rely heavily on rare earth materials such as neodymium and dysprosium, which are expensive, produce large amounts of waste, and have various mining concerns. Will electric vehicle manufacturers continue to rely so heavily on rare earth elements in the future?

The supply chain for rare earth is extremely constrained geographically. China accounts for the vast majority of global production, which has historically led to price volatility. Back in 2011, when China restricted the export of rare earths, the prices of neodymium and dysprosium increased by approximately 750% and 2000%, respectively. Due to environmental reforms in China, prices have remained fairly stable since then, except for a 1.5x increase in 2017. 2021 proved to be particularly volatile, with a 2.2x increase at the beginning of the year that has yet to stabilize.

In addition to the price issue, there are environmental concerns. Rare earth elements are extracted from ores, which can contain radioactive materials such as thorium, and the extraction of the rare earth needed usually uses large amounts of carcinogenic compounds such as ammonia, hydrochloric acid and sulfates. It is estimated that processing one ton of rare earths can produce as much as 2,000 tons of toxic waste. This must change in order for EVs to truly be a transition to green technology.

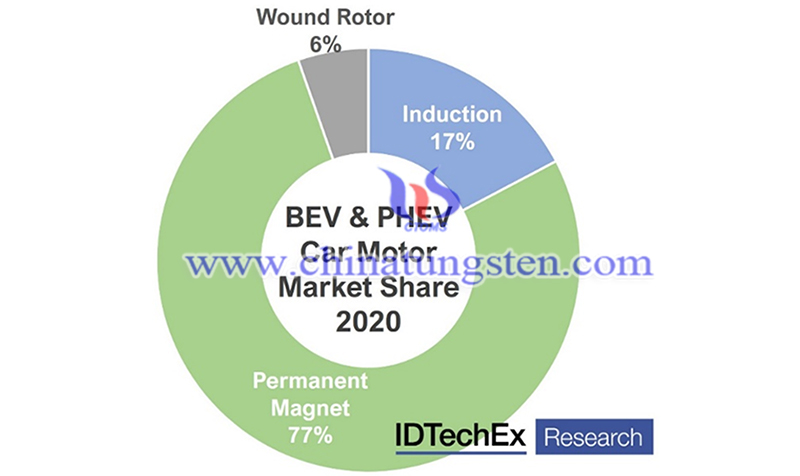

Electric drive motors come in many different designs, the most popular being permanent magnet machines, but some designs do not require permanent magnets (and therefore do not require rare earth). Induction motors use copper or aluminum cages in their rotors, a design that has historically been used by Tesla for its Model S and X.

Some companies have adopted a wound rotor configuration with copper windings on the rotor, such as Renault. Particularly in the heavy-duty or commercial vehicle segment, switched reluctance motors are being chosen, which have a silicon steel rotor and do not require magnets or copper on the rotor.

Typically, permanent magnet motors offer better power density and efficiency, so there are many companies that use them. In addition to eliminating magnets, some companies have made efforts to reduce the rare earth or at least heavy rare earth content in magnets. Original equipment manufacturers such as Honda and Nissan have reduced or eliminated the heavy rare earth content.

The U.S. has previously attempted to increase its participation in the rare earth supply chain, and now the Biden Administration has made it one of the priorities in its $2 trillion infrastructure proposal.MP Materials purchased a previously closed mine in California in 2017, vying to restore the rare earth supply chain in the U.S. with a focus on neodymium and praseodymium and a desire to be the lowest cost producer.MP Materials is planning to complete by 2025 their goal to be ready for a ramp-up in U.S. EVs production.

Lynas has received government funding to build a light rare earths processing plant in Texas and has another contract to build a heavy rare earth separation facility also in Texas. Despite these goals and investments, China has invested about twice as much as the U.S. in energy-related transformations over the past decade. The U.S. will certainly have a big task ahead of it in trying to compete with China, especially on the cost side, and we expect China to remain dominant, at least in the short term.

- Rare Earth Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com