Rare Earth Market - June 12, 2025

- Details

- Category: Rare Earth News

- Published on Thursday, 12 June 2025 14:56

Rare earth market update on June 12, 2025

The domestic rare earth market is maintaining a generally weak trend, with mainstream product prices declining to varying degrees.

Praseodymium-neodymium oxide, gadolinium oxide, and dysprosium oxide prices have decreased by approximately 3,000 yuan/ton, 1,000 yuan/ton, and 20,000 yuan/ton, respectively. Under these conditions, downstream demand has not shown significant growth, primarily due to limited working capital among buyers and the lack of a strong short-term expectation for a sharp rise in rare earth raw material prices. However, supported by production costs, suppliers have limited room for price concessions.

Currently, industry players are closely watching the outcome of the rare earth technology export negotiations at the first U.S.-China economic and trade consultation mechanism meeting. Reports indicate that the two sides have reached a preliminary agreement framework in principle. The U.S. claims that the trade framework and implementation plan agreed upon with China should address restrictions on rare earths and magnetic materials. Rare earth materials, known as the “vitamins” of modern industry, consist of 17 elements critical to new energy, electronics, and medical fields. Among these, rare earth permanent magnets, with their high magnetic energy product and coercivity, serve as core supports for cutting-edge technology, used in electric vehicle motors in the new energy sector and robotic joint motors in advanced manufacturing. According to CTIA GROUP LTD, between 2020 and 2023, the U.S. showed significant dependence on China for rare earth compound and metal imports, with China accounting for 70% of the U.S.’s total supply.

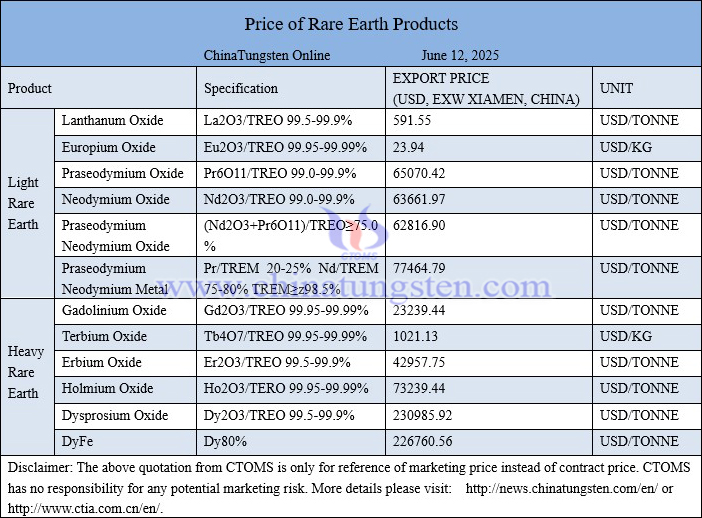

Price of rare earth products on June 12, 2025

Neodymium oxide picture

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com