Western Questioned China's Rare Earth Rectify Groundless

- Details

- Category: Rare Earth News

- Published on Friday, 08 March 2013 17:41

- Written by jiang

- Hits: 2591

During the two meetings, the member of the National Committee of the Chinese People's Political Consultative Conference, Li Yizhong, Minister of Industry and rare earth is a valuable and scarce mineral resources in the national economy, the defense industry, the state-of-the-art scientific purposes, it is not self-evident. The consolidation of the rare earth industry in China, for resources and environmental protection, some Western countries objection is entirely without justification.

Li Yizhong pointed out that, "eighteen large raised four modernizations simultaneous development, urbanization is on everyone's lips, and the focus of attention. Simply benign interaction with eighteen big words, industrialization and urbanization. Starting industrialization head speaking industrialized prerequisite for urbanization to urbanization create the conditions, laid the foundation. "

Li Yizhong, said rare earth is a valuable, scarce a mineral resources in the national economy, the defense industry, the state-of-the-art scientific purposes, it is not self-evident. China now accounts for about 23% of the world's large reserves, but provides 90 percent of the rare earth, "Comrade Xiaoping once said a word, the Middle East has oil, China has rare earth. Could have been our strengths, but due to various reason, this industry is a lot of confusion, to dig Luancai mining on private. "

Li Yizhong stressed, "We propose the reorganization of the rare earth industry, resource protection, environmental protection, which we should do, does not make sense for some of the objections of the Western countries. Rectify the development of rare earth industry is both a traditional, but also a strategic emerging industries. "

Rare Earth Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Results of Glenover PEA on Rare Earth Project

- Details

- Category: Rare Earth News

- Published on Friday, 08 March 2013 17:29

- Written by Yuri

- Hits: 2648

Galileo, the emerging African Rare Earth exploration and development company, is pleased to announce the results of a Preliminary Economic Assessment (“PEA”) of its Glenover Rare Earth Project (“Glenover Project or the Project”) in South Africa.

Economic Highlights:

Net Present Value (“NPV”) of US$ 512 million using a rare earth oxide (REO) basket price 2 of US$60.79 per kg of 99% REO and a discount rate of 8%. (NPVs at different rates are set out below e.g. NPV of US$783 million at a discount rate of 5%).

Internal Rate of Return (“IRR”) of 34.5 % for the Project.

REO production of 167,100 t (tonnes) in mixed high-grade REO chemical product over 24-year life of mine (LOM) on current resource estimate.

Ore production rate from 2.7 Mt stockpiles at 400,000 t per year 1 to 7.

Open-pit-mine ore production from 7.1 Mt at 400,000 t per year from year 8.

Waste to ore mine stripping ratio of 2.1 to 1 from year 8.

Initial capital investment US$233M, including a contingency of US$34M but excluding $57M for deferred and sustaining capital.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Slight Fluctuations Rare Earth Prices This Week

- Details

- Category: Rare Earth News

- Published on Friday, 08 March 2013 16:02

- Written by jiang

- Hits: 2718

Rare earth prices slight fluctuations this week, mainly light, lanthanum, cerium, yttrium oxide market transaction price down. Praseodymium, neodymium, gadolinium alloys and oxides of market prices remained strong.

The gradual increase in the supply of foreign markets, has also been the resumption of production in the domestic Big Three, small and medium-sized enterprises have been looking for goods shipped in the traditional sales season in March, the market gradually active signs. Deserted February, March, manufacturers and trade slightly busy. No matter the market inquiry how lively, the industry is more than reflect, the market traded just slightly better than February, "high season" yet arrived. As far as we know, the rare earth hold stocks and more depending on the purchases and sales of inventory and the market price of some products, such as the current market oxide, praseodymium, neodymium, gadolinium oxide recent inquiries and procurement increased, the price steady bullish. Of neodymium oxide, erbium, yttrium Inquiries less cargo operators who offer slightly downstream. This week the lanthanum cerium class oxides turnover in general, the transaction price is lower than in February. Oxide, europium, terbium market turnover less stable, offer basic.

Alloy market such as praseodymium, neodymium, gadolinium-ferrous market tax price of basic remain unchanged, and individual cargo operators to raise its offer, and also not too out of the mainstream of the market price, the gadolinium iron prices slightly upstream excluding tax, dysprosium iron prices this week basically stable.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Rare Earth Recycling Technologies Applied in Nickel-hydrogen Battery

- Details

- Category: Rare Earth News

- Published on Friday, 08 March 2013 17:18

- Written by Yuri

- Hits: 1604

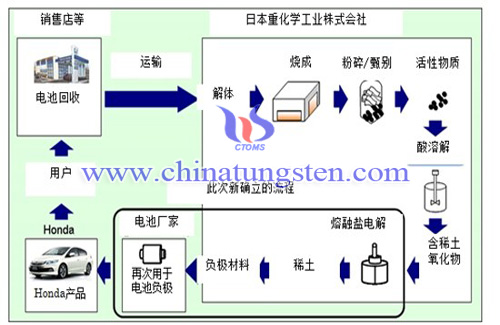

Recently, Honda took the lead in the global establishment of recycling mechanism of the nickel-hydrogen battery in hybrid vehicles, which means they applied the rare earth they extracted from the the nickel-hydrogen battery of hybrid vehicles as nickel-hydrogen battery materials to practice. In this way, they realized the first cycle of rare earth resources in the world.

Previously, Honda has extracted rare earth oxides from the waste nickel-hydrogen batteries in the factories of Heavy Chemical Industry Corp. in Japan. This time, they did further electrolysis on these oxides and successfully extracted rare earth metals which can be used directly as the material for the anode of nickel-hydrogen battery. Adopting that measure, we can refine out rare earths with its purity up to 90%. The rare earths extracted are the same as those taken from the mines, but the recovery rate of the former rare earth can reach 80% or more.

At the very beginning of March, Heavy Chemical Industry Corp. has already provided Japanese battery factory with this kind of rare earth as materials for anodes of nickel-hydrogen batteries. The rare earth used by this batch of materials came from the nickel-hydrogen batteries of 386 new Honda hybrid vehicles, which can not be used after suffered from the great earthquake in the eastern Japan. From now on, as long as the used nickel-hydrogen batteries are accumulated to a certain amount, Honda will put them all into the same recycling way.

In spite of the nickel-hydrogen batteries, Honda will spare no effort to extract rare earth from all kinds of used materials so as to promote the recycling of rare resources. Later, at the same time as Honda trying his best to develop hybrid cars, he will constantly improve reusing them, recycling mechanism and reduce the pressure of environment of the mobile society.

Honda's nickel-hydrogen battery recycling mechanism:

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Beneficiation Success Enhances Ngualla Rare Earth Project Economics

- Details

- Category: Rare Earth News

- Published on Friday, 08 March 2013 16:01

- Written by Yuri

- Hits: 2755

Peak Resources Limited reported further improvements to beneficiation processes for the Ngualla Rare Earth Project in Tanzania. The ability to concentrate mineralisation at an early stage prior to acid leach recovery will have a significant and positive impact on costs and support Peak’s target to be a low cost producer.

The optimisation of the beneficiation process effectively reduces the mass of feed to be treated by the acid leach recovery process by 43% compared to the scoping study assumptions. This will lead to significantly lower capital and operating costs for the operation.

The latest test work shows that conventional magnetic separation and flotation techniques reduce the mass of the feed mineralisation by 78% through the rejection of relatively unmineralised barite and iron oxides.

Reducing the amount of material processed at the acid leach recovery stage has a significant impact on operating costs by reducing sulphuric acid consumption – the major constituent of reagent costs. The scoping study completed in early December 2012 estimated that the acid plant and acid leach recovery circuit make up 53% of total operating costs.

The reduction in volume treated will also reduce capital costs as a smaller plant will be required for the same amount of product. The acid leach recovery circuit and the acid plant together constitute 27% of total project capital costs as estimated in the scoping study.

The beneficiation process increases the grade of the feed over 3 fold from 5.3% REO* to 16.9% REO for this composite sample.

The cost reductions will be quantified in a revision of the scoping study and economic assessment to be completed in Q2 2013. The revised study will also use a new optimised mine schedule based on the new Mineral Resource estimate and model that is on schedule for completion by the end of March 2013.

Peak Resources Managing Director Richard Beazley said “Ngualla continues to improve with each milestone. We are already in the lower quartile in terms of operating costs, and also have one of the lowest capital costs of any rare earth project. This new test work will allow us to reduce costs even further and supports our assertion that Ngualla is the most commercially attractive rare earth project around.”

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com